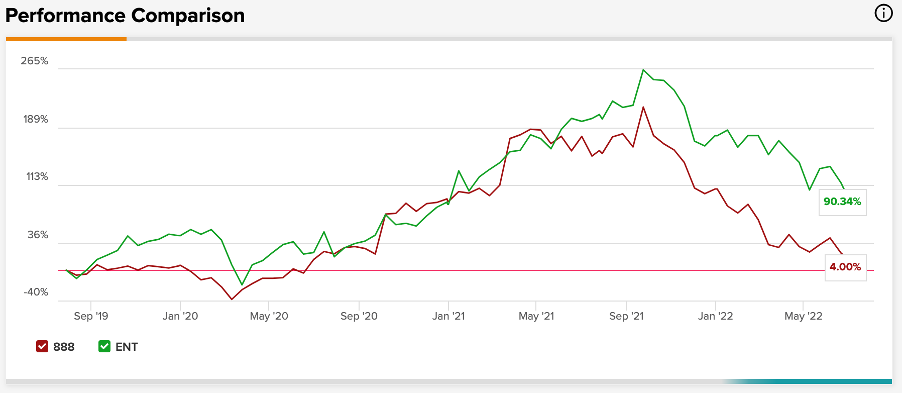

Stocks are down for two gaming companies, 888 Holdings (GB:888) and Entain (GB:ENT), after soaring during the pandemic. Both the companies’ UK businesses are also impacted by the government review of the 2005 UK Gambling Act, which could lead to tighter restrictions. Using the TipRanks stock comparison tool, we have compared these stocks to find out which one will be a better addition to a portfolio.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This tool helps investors compare up to seven stocks within the same or different sectors and make a well-informed decision.

The stock prices of 888 Holdings and Entain grew around 6 times their value during the pandemic.

Let’s see the stocks in detail.

Entain PLC – Better placed amid the uncertainties

Entain is one of the world’s largest gaming and betting companies with brands such as bwin, Coral, Ladbrokes, PartyPoker, PartyCasino, and Sportingbet under its umbrella.

In July, the company announced its trading updates for Q2 2022 and H1 2022. The company referred to its performance as ‘robust’ with ‘record levels of activity’.

The group’s net gaming revenue was up by 18% in H1 and 8% in Q2. The company’s customer base was up by 60% in Q2, as compared to the pre-COVID period. Entain’s online gaming revenue was down by 7% in both H1 and Q2.

Entain has updated its guidance for the full year’s online growth to flat. This is due to the uncertainty in the macro environment and rising inflation, which has reduced customer spending.

If we talk about the UK Gambling Act review, Entain is better placed as compared to 888 Holdings. Entain is known for its high standards when it comes to customer protection and fulfilling social responsibility. The company was recently awarded GamCare’s Advanced Safer Gambling Standard for the same.

It became the largest operator to earn this level of standard. It includes advanced level 3 for online activities and advanced level 2 for retail. This underlines the company’s approach toward safer gambling, which is the highest in the industry.

View from the city

According to TipRanks’ analyst rating consensus, Entain stock has a Strong Buy rating. The rating is based on nine Buy recommendations.

The average price target is 2,159.1p, with an upside potential of 89%. The high and low forecasts for the price are 2,700p and 1,800p, respectively.

Monique Pollard of Citigroup maintained her Buy rating on the stock in the last two weeks. She is extremely bullish about her target price, which is 135.8% higher than the current price. Her average profit on the stock is 48%.

888 holdings – A risky pick

Gibraltar-based 888 Holdings is a leading betting and gaming company with global operations. It owns gaming software such as 888casino, 888poker, 888Bingo, and 888sport.

The company’s last trading update in Q1 of 2022 showed that its businesses are stable and growing, other than those in the UK market. As the company earns the majority of revenue from the UK market, this is a concerning area.

The revenue growth for the UK business in Q1 2002 was flat at £60 million. The was highly impacted by safer gambling measures introduced by the UK government as part of the review of the 2005 Gambling Act. The review could impose some bans or restrictions on the companies to safeguard the customers. Overall, multiple factors could impact the revenue and profitability of the UK gaming market.

On the positive side, 888 has diversified its business globally. The stronger and more regulated markets such as the U.S., Romania, Italy, and Portugal have offset the dull performance of the UK market.

888 Holdings recently completed its acquisition of William Hill’s non-U.S. assets from Caesars Entertainment (Nasdaq: CZR). With the review expected to be out soon, the timing of this acquisition couldn’t be more wrong.

William Hill has 1,400 betting shops in the UK, which will be under the radar of this review.

View from the city

According to TipRanks’ analyst rating consensus, 888 stock has a Strong Buy rating based on four analyst ratings. It has three Buy and one Hold recommendation.

The average price target is 355p, which shows an impressive 143.6% of upside potential on the current price. The stock price has a high forecast of 470p and a low forecast of 230p.

Conclusion

The customer’s disposable income for non-essential items has declined, which will impact the revenue growth of these gaming companies. On top of that, the long-awaited review is expected soon, which will increase the regulatory pressures.

Based on these scenarios, Entain is better positioned to grow with minimal regulatory impact. This will help the stock prices recover in the long term.