Western Union (WU) shares are down about 8% since the start of the year after struggling to withstand the headwinds that, due to serious underlying causes, have also swept credit services stocks. Macro headwinds are likely to weigh further on the stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, I would still Hold the stock and benefit from the dividend yield, which is well above the market average.

The company’s potential and leadership in the global credit services sector should provide a solid foundation for it to continue paying dividends despite the risk of an economic recession and lower financial prospects due to the suspension of services in Russia and Belarus.

What Does Western Union Do?

Western Union is a leader in cross-border, cross-currency money transactions (movements and payments) worldwide through a platform that enables cross-border money flows and through a global financial network.

The company states that its global networks consist of access to billions of bank accounts and millions of digital wallets and cards, in addition to a global network of retail locations.

Its technology serves consumers, businesses, banks, and governments around the world.

Q1-2022 Results: EPS Was Strong, Revenue Fell

In the first quarter of 2022, the Consumer Money Transfer segment lagged behind previous levels.

As this negative trend was combined with the suspension of services in Russia and Belarus, total revenue for the quarter fell 4% year-over-year to $1.15 billion, falling $10 million short of analysts’ median forecast.

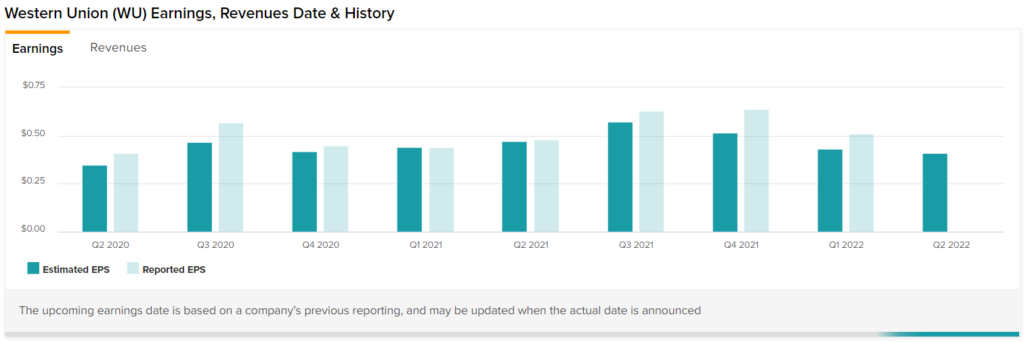

Revenues were down, but Western Union’s earnings per share (EPS) rose 16% year-over-year to $0.51, better than analysts’ average estimate of $0.43.

An improvement in its operating margin and the repurchase of outstanding shares led to a higher EPS, partly negating the application of a higher effective tax rate.

The operating margin improved 250 basis points to 21.8% of total revenues in the first quarter of 2022, up from 19.3% in the first quarter of 2021. The company allocated $150 million in share repurchases during the quarter.

The company said the higher operating margin resulted from the timing of investments, a better combination of product and channel, and favorable currency changes.

Western Union’s Fiscal 2022 Guidance Calls for a Decline

WU lowered its full-year 2022 financial outlook to reflect the suspension of operations in Russia and Belarus.

As of March 31, 2022, it expects a 9%-11% decline in GAAP revenue, compared to analysts’ estimated decline of 10.2% to $4.56 billion.

The company also expects adjusted EPS of $1.75 to $1.85 versus a consensus of $1.79 and compared to EPS of $2.19 in 2021.

The Balance Sheet is Decent but Has Its Flaws

In all fairness, Western Union’s financial position could be stronger, as its total financial exposure of $2.53 billion is about 1.95 times its total available cash and short-term investments.

Furthermore, an Altman Z-Score of 1.3 indicates an elevated possibility of bankruptcy within a few years. The financial indicator measures the probability that a company will go bankrupt.

A value less than or equal to 1.8 indicates a relatively high probability of bankruptcy, while a value equal to or greater than 3.0 indicates an extremely low risk of bankruptcy.

On the other hand, if the value fluctuates between 1.8 and 3, the company is in the “gray area,” with a moderate risk of bankruptcy.

However, the bankruptcy scenario will most likely not materialize, although the Altman Z-Score suggests the opposite. The prestige of the brand coupled with a leading position in the global industry will save the company from serious financial problems that could affect stability and threaten its future.

Additionally, Western Union is not the only company in the industry to perform poorly on the Altman Z-Score indicator, but there are many competitors that actually perform significantly worse.

Western Union trails only Credit Acceptance Corporation (CACC) and FirstCash Holdings Inc (FCFS), with these two competitors having Altman Z-Scores of 3.01 and 2.21, respectively. Over 500 U.S.-traded stocks are active in the credit services industry.

Wall Street’s Take on WU Stock

In the past three months, 10 Wall Street analysts have issued a 12-month price target for WU stock. Western Union has a Moderate Sell consensus rating based on zero Buys, four Holds, and six Sell ratings.

The average WU price target is $18.22, implying 10.6% upside potential.

The Valuation Seems Inexpensive

Shares are changing hands at $16.48 as of the writing of this article for a market cap of $6.4 billion, a price/earnings ratio of 6.9x, a price/book ratio of 18x, and a price/sales ratio of 1.3x.

The stock is currently trading approximately 7.5% above its 52-week low and approximately 30% below its 52-week high.

Also, its price is below the 50-day moving average price of $16.97 and the 200-day moving average price of $18.19. Shares are near 2014 levels, and, based on the indicators above, they do not seem expensive.

Current valuations generate a dividend yield that’s about 5.7%, almost 3.5 times the S&P 500 (SPX) index’s 1.68% yield, adding to the stock’s appeal.

That spread could become more favorable for Western Union shareholders should the ratio improve due to lower share prices and dividend increases. The company has been increasing its dividend for 13 years, with the most recent one processed in 2021.

Lower share prices are likely to materialize, as the market is expected to face headwinds for several more weeks, while a dividend hike this year looks a long way off due to lower EPS estimates and economic uncertainty.

Also, looking at its 14-day Relative Strength Index (RSI) can give an idea of how much the stock price could fall from current levels.

For those who are just starting out in the world of stocks and are probably unfamiliar with the indices available, here’s what they need to know about the 14-day RSI. The indicator ranges from 30 to 70. A reading of 30 means a stock is oversold, while a reading of 70 means a stock is overbought.

Western Union’s 14-day RSI of 47 suggests there is room for additional downside if the turmoil that has impacted the stock so far this year continues to weigh on price action.

The Federal Reserve’s rate hike to curb galloping inflation is the biggest headwind for Western Union stock. Tighter monetary policy creates a tangible risk of an economic recession as higher borrowing costs depress consumption and business activities, impacting Western Union’s business as well.

Conclusion – WU Will Face Challenges, but Its Dividend Won’t

With the current macroeconomic situation, the risk of a recession is real. Current inflation is not demand-triggered inflation, for which a tightening stance sounds like a disproportionate monetary policy that will almost certainly deteriorate the economy.

A recession will likely affect Western Union’s stock price, but not its dividend payout, which has been growing consistently over the years.