Just as things were looking up for the ride-sharing industry, the Omicron variant of COVID-19 emerged and threw mobility into a spiral, again. However, the panic from late-November has died down, and a continued recovery for ride-sharing companies is projected by analysts. Uber Technologies, Inc. (UBER) reported its quarterly earnings last week, and it is looking healthy and well-poised to continue scaling.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Publishing his view on the development is Brian Fitzgerald of Wells Fargo, who commended Uber for its multi-pronged and super-app business model. Enthusiastically noting that Uber’s “cross-platform flywheels are accelerating,” the analyst was pleased with the firm’s ride-sharing, delivery services, and freight segments, which have been performing strongly.

Fitzgerald bullishly rated the stock a Buy, although he lowered his price target to $68 from $78. This new target now represents a possible 12-month upside of 92.69%.

While the pandemic-induced drop off in user volume also translated into a prolonged driver supply for ride-sharing companies, Uber has since seen a robust and responsive comeback. For new drivers, onboarding processes have shortened, and retention levels are elevated for existing ones. After rectifying its supply/demand curve, UBER can continue penetrating into its global total addressable market.

Cross-dispatching and an increase in driver supply have benefitted both the company and users, lowering surge pricing and wait times across its markets.

Regarding Uber’s delivery services, Fitzgerald explained that domestic cost per trip leverage has remained strong, and attributed it to an increasingly dense network. For its delivery capabilities, Uber has acquired freight management firm Transplace, and has facilitated “an end-to-end logistics platform helping Shippers and Carriers with procure, load match, plan, execute and analyze.”

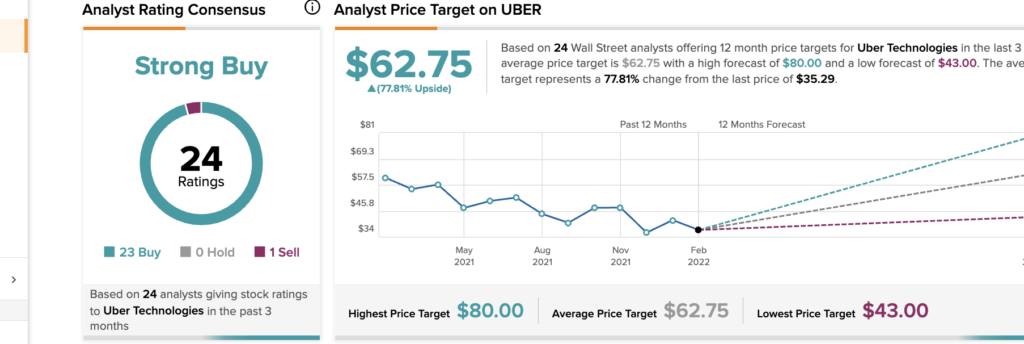

On TipRanks, UBER has an analyst rating consensus of Strong Buy, based on 23 Buy ratings and one Sell rating. The average Uber price target is $62.75, denoting a potential 12-month upside of 77.81%. UBER closed Friday trading at $35.29 per share.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure