Consumer price inflation in the UK has already crossed the 10% mark. To add to investors’ concerns, Goldman Sachs recently warned that if rising gas prices are not controlled, UK inflation could reach 22% in 2023. Even if energy costs are contained, analysts still expect inflation to hit around 14% in January.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Taking this into account, we have shortlisted financial services company Legal and General (GB:LGEN) and beverage giant Diageo (GB:DGE). These companies are well-placed to perform and beat inflation, and the icing on the cake is that they are also good dividend payers.

Let’s see what’s working for these stocks.

Legal and General Stock

Legal and General is a financial services company providing insurance, pensions and retirement, and asset management services in the UK.

The company has an advantage from the rising interest rates in the economy, which supports its solvency II coverage ratio, which was 212% in its first-half results for 2022. This ratio helps the company to return more capital to its shareholders and maintain a stable dividend growth. LGEN currently has a dividend yield of 7.38%.

J.P. Morgan recently upgraded its rating on LGEN from neutral to overweight.

JPM believes the pension risk transfer (PRT) market has huge growth potential in the insurance sector. It said, “It is the best-placed company, in our view, to capture the PRT opportunity for growth in illiquid assets through its unique ‘L&G Capital’ unit.”

JPM further added, “L&G has dominated the PRT market for more than 20 years and offers the most innovative products with a strong franchise as an asset manager for defined benefit (DB) schemes.”

According to TipRanks, the LGEN average target price is 319.5 with a Moderate Buy rating. The target price is 25.5% higher than the current price level.

Diageo Stock

Diageo is a global alcoholic beverage company with over 200 brands under its umbrella, including Johnnie Walker, Smirnoff, Baileys, Guinness, and more.

Diageo remains a company with strong pricing power, which comes in handy during inflationary times. The company enjoys the benefit of amazing brands and a loyal customer base. Moreover, it has a diverse range of premium as well as non-premium brands, which gives it flexibility in price points.

Last month, the company reported its annual results for 2022, with strong sales performance in all regions. The group’s net sales of £15.4 billion were increased by 21.4%, and operating profit grew by 18.2% to £4.4 billion.

The strong numbers were driven by organic sales growth, a recovery in consumer demand, and market share gain.

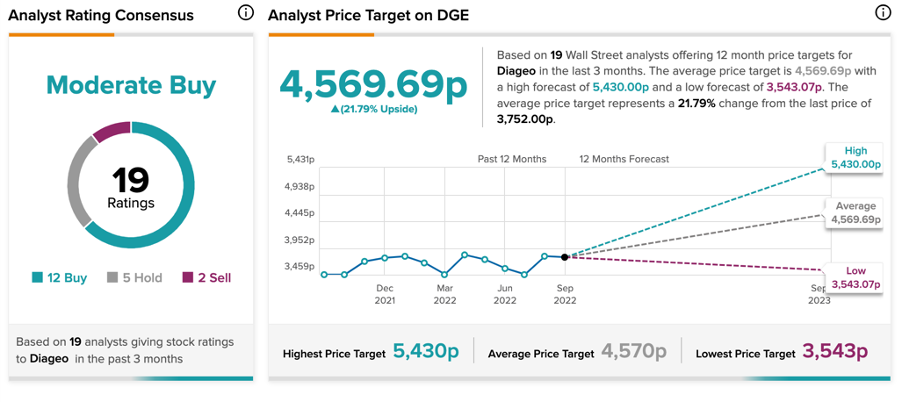

According to TipRanks’ analyst consensus, Diageo stock has a Moderate Buy rating with wide coverage from 19 analysts. It includes 12 Buy, five Hold, and two Sell recommendations.

The DGE target price is 4,569p, which has an upside potential of 21.8% from the current price level.

Conclusion

Investors are currently looking for stocks that can cope with the rising costs and still generate stable returns. These two stocks check all of the boxes and could be a great investment.