Banking giants NatWest (GB:NWG) and Standard Chartered (GB:STAN) have recently reported profits in their results, followed by good dividends for shareholders – and four-star analyst Ian Gordon is bullish on both these stocks.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Gordon is an equity analyst at Investec and is mainly focused on UK banks. At Investec, he covers both FTSE 100 banks and challenger banks. He is an economics graduate from Hull University. He joined Investec in 2012. Earlier in his career, he worked with Lloyds Bank for 17 years.

Gordon is a four-star rated analyst on TipRanks. He is ranked 1,692 out of 7,949 analysts and 2,897 out of 21,000 total experts on TipRanks. He has a success rate of 63%, with 25 out of 40 ratings being profitable.

He has an average return of 12.4% per rating. His most successful rating so far is Virgin Money UK (GB:VMUK) from October 2020 to October 2021. During this period, the stock generated a return of 165.3%.

NatWest Group

NatWest Group is a banking and insurance holding company based in the UK. The group operates retail, commercial, and private banking services, along with asset management services, and more.

The group posted its interim results for 2022 and delivered a robust performance. The total income of the bank was £6.2 billion for the first half of 2022, up from £5.1 Billion year-over-year. The bank posted £2.6 billion of operating profit before tax, which increased by £300 million from last year.

NatWest’s net interest income grew by 15% to £4.3 billion during the first half. This clearly showed the impact of the interest rate hike by the Bank of England.

The results cheered investors and the shares were up by around 8% on Friday. The stock is up by 27% in the last year.

The company declared a total dividend of 20.3p per share, consisting of a 3.5p interim dividend and a 16.8p special dividend. The interim dividend has increased by 17% from last year. NatWest’s dividend yield is 4.2%, higher than the sector average of 2.1%.

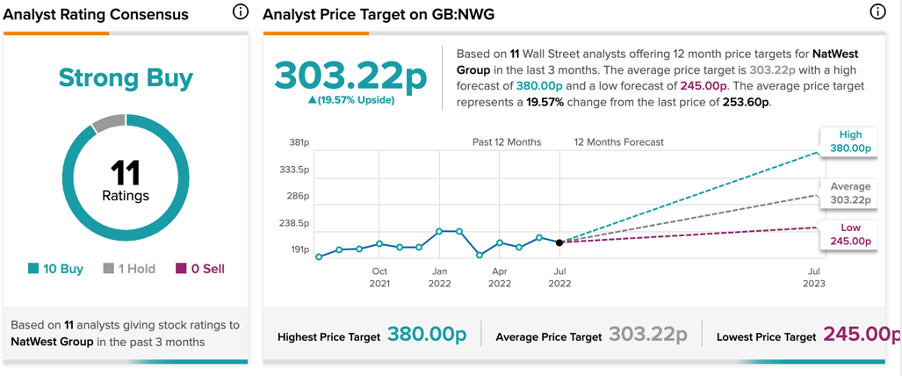

According to TipRanks’ analyst rating consensus, NatWest has a Strong Buy rating. It has ten Buy and one Hold ratings, with an average price target of 303.2p. The price is around 20% higher than the current price. The price has a high and a low forecast of 380p and 245p, respectively.

Gordon is bullish on the stock with a price target of 245p. Two months ago, he upgraded his rating on the stock from Hold to Buy.

He has a 100% success rate on the stock, with an average return of 46.8%.

Standard Chartered

Standard Chartered is a UK-based global bank dealing in a full range of services such as deposits, loans, credit cards, wealth management, and more.

STAN reported its interim results with its operating income at $8.2 Billion which increased by 8% from last year. The profits before tax increased by 5% from last year and were at £2.8 billion.

STAN also benefited from the Bank of England’s interest hike and reported a 12% growth in its net interest income.

The bank announced an interim dividend of 4 cents per share and a buyback worth $500 million. It aims to manage its capital efficiently and return around $5 billion to its shareholders over the next three years.

The bank believes the environment remains challenging in the western markets, with recession risks being higher in the US and Europe. It has a comparatively optimistic outlook in the eastern markets, like Asia, and will benefit from its diversified business operations.

According to TipRanks’ analyst rating consensus, Standard Chartered has a Moderate Buy rating. The bank has five Buy and three Hold ratings.

The average price target is 786.9p, which implies a 37.7% upside potential. The high and low forecasts for the stock is 899.1p and 678.8p, respectively.

Investec recently upgraded its rating from Hold to Buy on the bank. Gordon has a price target of 610p for the stock.

Conclusion

The economic outlook is challenging with a mounting fear of recession. However, these fundamentally strong banks are in a comfortable space right now as they are operating on higher margins.

Both the banking stocks have rewarded shareholders fairly and are set to deliver good results for FY 2022. This (along with backing from Ian Gordon) make them a good option for investors.