Professional services companies FRP Advisory Group (GB:FRP) and Begbies Traynor (GB:BEG) are currently enjoying huge growth in their revenues – and could be a great investment.

Here, we have used the TipRanks Stock Comparison tool to pick out two stocks from the professional services industry. With the help of this tool, we can list various stocks in any sector and analyse them based on various parameters.

Let’s see the stocks in detail.

FRP Advisory Group

FRP Advisory provides consulting services for M&A, debt restructuring, disputes, and many more. The company offers services to companies as well as individuals, with the main focus on small and medium businesses.

The demand for financial advice has grown tremendously in the last few years. With a looming recession and economic uncertainties, the demand is here to stay.

The company has grown with rising demand, and that has been reflected in its share prices as well. FRP’s stock has grown by around 43% in the last year and 117% in the last three years.

The company has already reported its full-year results for 2022 with a 21% growth in its revenues to £95.2 million, mainly supported by growth in some larger projects and acquisitions.

But company faced some pressure from rising costs, which drove the profit down to £15.1 million from £16.6 million last year.

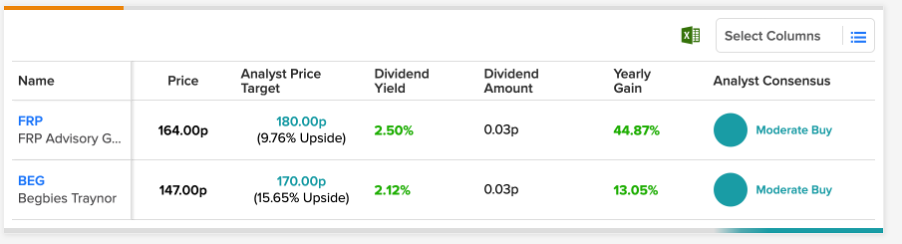

The stock is good for passive income as well with a dividend yield of 2.5%, above the sector average of 0.5%. In its last results, FRP announced the final dividend of 1.9p which made the total dividends of 4.3p per share in 2022.

Talking about the outlook, the company has a solid pipeline, which will help it hit its medium-term goals. It is really optimistic about the restructuring segment, where there is an expected increase in demand.

Is FRP Advisory’s stock a buy?

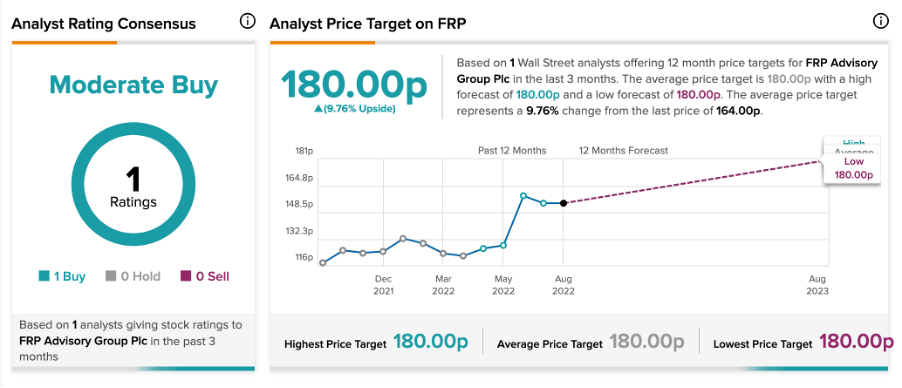

According to TipRanks’ analyst rating consensus, FRP Advisory Group stock has a Moderate Buy rating based on one Buy rating from James Bayliss from Berenberg Bank.

Recently, Berenberg Bank reissued its Buy rating on the stock with a target price of 180p.

The FRP Advisory price target is 180p, which is 9.7% higher than the current price level.

Begbies Traynor

Begbies Traynor is among the leading consulting companies providing services in finance, business recovery, property, investigations, etc.

Begbies Traynor’s business is also driven by the strong growth in insolvency business due to COVID-19.

Talking about the full-year results, the company saw a jump of 31% in its revenue to £110 million because of an increase in its service offerings. The company’s operating margins remain strong at 16.9%, which resulted in profit growth of 55%.

The company declared a 17% increase in its dividends to 3.5p per share, making it the fifth consecutive year of dividend growth. It has a dividend yield of 2.12% as compared to the sector average of 0.54%.

The company continues its acquisition strategy, sitting on a healthy balance sheet. In August, the company acquired Mantra Capital, a UK-based finance and insurance brokerage firm. The acquisition will complement its financial advisory segment and contribute to its earnings immediately.

What’s in for the BEG stock?

According to TipRanks’ analyst rating consensus, Begbies Traynor stock has a Moderate Buy rating, based on one Buy rating.

The BEG price target is 170p, with an upside potential of 15.6%. The high and low forecasts for the price are 170p.

Conclusion

Looking at the current volatility in the economy, the upward trend in the revenues for these companies will continue. Any fall in the share prices creates a more attractive opportunity to buy the stocks.