We’re in unsettled market times. January saw sharp drops that brought a sudden end to last year’s bullish trends, while February has seen increased volatility that makes it difficult to predict what’s coming next.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Investors need some signal to make sense of volatile trading. There are simply too many currents and counter-currents for the average retail investor to chart a clear path. This is where the TipRanks Smart Score comes in.

Using a series of algorithms, the Smart Score gathers and collates the latest data on thousands of publicly traded stocks, and rates them according to 8 separate factors. Taking all 8 together, the Smart Score creates a single-digit rating for each stock, a score on a scale of 1 to 10, so that investors can tell at a glance how it may fall out.

A select few stocks will pick up the ‘Perfect 10’ score, the highest rating from the Smart Score. Are these the right ones for your portfolio? According to the algorithms, they check all the boxes for gains in the weeks ahead; we’ve pulled up details on three of them to find out what makes them tick. Here they are, along with commentary from the Street’s analysts.

Energy Transfer LP (ET)

We’ll start with Energy Transfer, an oil and gas midstream company. This is an essential component of an essential industry; midstream companies move the product from the wellhead to the storage farms, refineries, transfer terminals, and import-export facilities that in turn send fuels to the customers. Energy Transfer, a $30 billion company, is one of North America’s largest midstream players, and its network of natural gas and crude oil pipelines, storage tanks, and processing facilities, centered on Texas-Oklahoma-Arkansas-Louisiana, connects the Gulf region with the Great Lakes, Appalachia, and North Dakota.

Earlier this month, ET released its financial results for Q4 2021. Top-line revenue hit $18.66 billion, an 86% increase year-over-year. EPS, at 29 cents, was up 52%, and the company’s distributable cash flow increased from $1.36 billion at the end of 4Q20 to $1.6 billion, a gain of 17%.

Unsurprisingly, ET also boosted its dividend for Q4, raising it 15% to 17.5 cents per common share. This annualizes to 70 cents per share, and marks the first time the company has raised the dividend since slashing it back at the height of the corona panic in the summer of 2020. The raised dividend gives a yield of well over 6%, or more than triple the average dividend found among S&P-listed companies.

Turning to the Smart Score, we find that ET earns its Perfect 10 with strong results in all 8 factors. Of special note are the insider activity, which shows strong purchases in the last 3 months; hedge activity, which increased by 2.4 million shares last quarter; and news sentiment, which is 100% positive.

Evercore analyst Todd Firestone is bullish on ET, and thinks shares are undervalued. He writes, “ET units still trade at a significant discount to peers even after the YTD move and is a ~$14-$15/unit valuation trading in line with partnership peers (~9-10x) and a ~3-4x discount if compared to c-corps. We think the discount to what are clearly lower quality peers in terms of asset breadth, earnings power, and now balance sheet, gets increasingly difficult to defend with at least some measure of margin expansion likely.”

These comments support an Outperform (Buy) rating, and a $14 price target suggests room for 43% share growth in the year ahead. (To watch Firestone’s track record, click here.)

In addition to a perfect Smart Score, ET also gets a unanimous Strong Buy consensus rating, based on 8 recent positive reviews. The stock is selling for $9.76 and its average target of $13.88 implies a 42% one-year upside. (See Energy Transfer’s stock analysis at TipRanks.)

Sweetgreen, Inc. (SG)

Let’s now move on to something different. Sweetgreen is a fast food chain specializing in healthy food, offering customers salads and bowl meals made from fresh ingredients, locally sourced from sustainable farms, and prepared to order. The company is merging fast food with fast tech, allowing customers to order by app for both pick-up and dine-in.

Sweetgreen took advantage of last year’s rising stock market to raise new capital through an IPO. The company’s entry to the stock market took place in November, with the SG ticker making its debut on November 18. The stock opened at $52 per share, well above the range initially expected, and was trading for $49 on its first day’s close. The initial sale of 13 million shares raised approximately $364 million, and for a short time, Sweetgreen’s market cap exceeded $5 billion. The stock, however, hasn’t been immune to the market volatility, and has since shed 37% of its value.

This new stock shows that a perfect Smart Score doesn’t need to strike gold on every factor. Fundamentals and technical are neutral here, and the hedge funds haven’t taken much notice of the stock yet – but company insiders bought over $2.9 million worth of stock in the wake of the IPO, a clear sign of confidence, and the news sentiment has been 100% positive around the company.

Oppenheimer’s Brian Bittner, who holds a 5-star rating from TipRanks, believes that this is a stock investors should watch closely – he describes it as a ‘generational growth story,’ writing of Sweetgreen, “We believe SG represents a unique opportunity to own a generational growth story at the intersection of powerful shifts in consumer trends. Our deep-dive analysis validates a clear path to 1,000+ units over the next decade (vs. 140 today), enabling a >20% unit growth CAGR. With attractive new unit economics and strengthening same-storesales, we forecast a robust inflection in profitability metrics as the business scales.”

These comments are backed up by an Outperform (Buy) rating, and a $41 price target implying a potential one-year gain of 68%. (To watch Bittner’s track record, click here.)

In its short time on the markets, Sweetgreen has picked up 7 reviews, and they are all positive, for a unanimous Strong Buy consensus rating. The average price target of $40.33 and the share price of $24.44 combine to give an upside potential of 65% for the coming year. (See Sweetgreen’s stock analysis at TipRanks.)

Zurn Water Solutions (ZWS)

Lastly, we have Zurn Water Solutions. This Milwaukee based company offers customers worldwide solutions to the major issues around our water systems: quality, safety, flow control, and conservation. The company’s products, which include pressure reduction and backflow prevention, fire protection systems, commercial plumbing components, and drainage and flow systems, are designed to enhance the sustainability of our water resources.

Zurn has had a busy February so far. The company has announced this month that it will be combining with Elkay Manufacturing, a competing company in the sustainable water solutions niche, in an all-stock transaction. Zurn will own approximately 71% of the combined company, which will change its name to Zurn Elkay Water Solutions. The acquisition is expected to close in 3Q22.

Also this month, Zurn released its 4Q21 and full-year results. The company showed $232 million in net sales for the quarter, up from $188 million in the year-ago period. For the full year, Zurn had $911 million in sales, a gain of 22% from 2020. Adjusted EPS for the full year grew from 50 cents to 77 cents, a gain of 54%.

The perfect Smart Score on this stock is based on strong trends in 6 of the 8 factors. Hedge activity and stock fundamentals are neutral – but insiders have been buying shares, and the PR is good, as shown by the 100% bullish sentiment from both news reports and financial bloggers.

Baird analyst Mircea Dobre sees the Elkay merger as the main factor for consideration here. The 5-star analyst writes, “Elkay provides the M&A catalyst we have been looking for. In our view, Elkay is a home run for ZWS in terms of strategic fit and valuation/synergy potential. The deal structure (all stock) signals sellers’ confidence in future synergies while further boosting ZWS M&A firepower. The shares have potential for reaching $60 over the next three years (sooner with further M&A).”

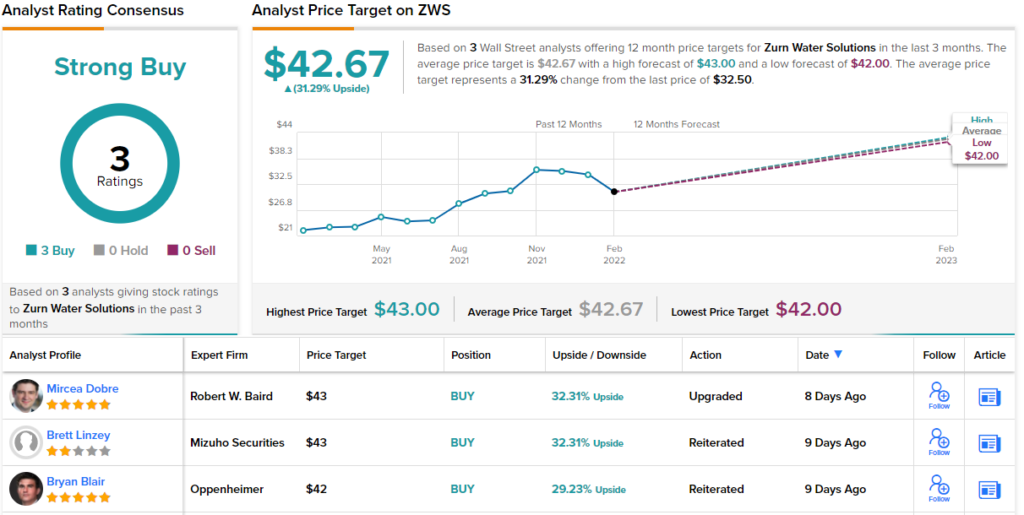

Dobre has an Outperform (Buy) rating on the shares, along with a $43 price target that indicates potential for 32% upside by this year’s end. (To watch Dobre’s track record, click here.)

This water-technology stock gets a unanimous Strong Buy from Wall Street, with 3 recent positive reviews. The stock is selling for $32.5 and its $42.67 average price target suggests a 31% upside form that level. (See Zurn’s stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.