We’re not far off a full month into 2024, and the conventional wisdom has settled on two possible paths for the economy this year. There’s the upbeat sentiment that we’ll see a continued economic recovery, and there’s the downbeat view that a recession is on the way. No matter what happens, smart stock picking can still bring profits for investors.

A recent note from UBS’s Curt Woodworth lays out the case for buying into packaging stocks now. Introducing his case, the 5-star analyst writes, “We are generally bullish on the packaging space as we expect positive volume leverage to become apparent over 2024. We believe most investors have underestimated the sizeable aggregate impact of destocking, SKU rationalization, and magnitude / duration impact from elasticity sticker shock in 2023 that resulted in volume pressures worse than seen during the Global Financial Crisis.”

Woodworth points out that there is always demand for product packaging – and also that a combination of higher volume sales and restocking needs in 2H24 are likely to provide support for the sector. He sees product pricing – that is, the cost of boxes, packing materials, and other related items – as a tailwind for packaging stocks this year. All in all, the UBS sector expert sees packaging stocks as the place to find profits.

So let’s follow this path. We’ve looked up the details on 3 packaging stocks Woodworth has picked out. For a fuller view of their prospects, we have also checked the TipRanks data to find out what the rest of Wall Street thinks. Here are the details, along with the UBS comments.

Pactiv Evergreen (PTVE)

The first stock we’ll look at, Pactiv Evergreen, is a mid-cap manufacturing firm with a $2.6 billion market cap, developing, producing, and distributing a wide range of packaging products for the food and beverage industry. The company markets its product lines to a varied set of target users, including educational and recreational companies and institutions, restaurants, supermarkets, and food & beverage processors.

Pactiv’s target market is huge, and the company employs over 14,000 people across 50+ manufacturing plants and more than 40 distribution centers. The company’s portfolio includes more than 14,000 unique products, ranging from plates and bowls to cutlery to meat and poultry trays, egg cartons, and resealable beverage containers. All in all, Pactiv has approximately 1,100 product lines.

In addition to its ready-made lines, Pactiv offers its customers the ability to custom-order packaging, accommodating odd shapes, unique designs, and customer-specific labeling requirements. The company’s engineers and designers will meet and collaborate with the customer to come up with the perfect package, and provide rapid prototype production through 3-D printing. Pactiv is also a leader in food packaging innovation, and in 2022 spent $33 million on R&D. The company also makes extensive use of recycled and sustainably sourced materials in its production activities.

This adds up to big business, although the top line did decline in the last reported quarter, 3Q23. The company reported a top line for 3Q of $1.379 billion, down 14% year-over-year – and some $10 million below the forecast. The bottom line did better – Pactiv’s Q3 non-GAAP earnings were 32 cents per share; this was up from 13 cents in 3Q22 and 20 cents in 2Q23, and beat the estimates by 12 cents per share.

For UBS’s Woodworth, this company presents return-minded investors with a sound long-term choice, and he says of the firm, “We view Pactiv as a compelling execution story in the packaging space as restructuring actions and improved productivity set the stage for more consistent earnings performance and better FCF conversion. PTVE has executed well in FY23 despite broad-based volume challenges due to strong net price attainment, cost down actions, and mix enhancement. PTVE has benefitted from share gains in Foodservice, and we expect modest organic volume growth in 2024 as destocking has abated and PTVE benefits from better operational performance and end of SKU rationalization.”

These comments back up Woodworth’s Buy rating on the stock, and his $19 price target implies a one-year gain of 30% for the shares. (To watch Woodworth’s track record, click here.)

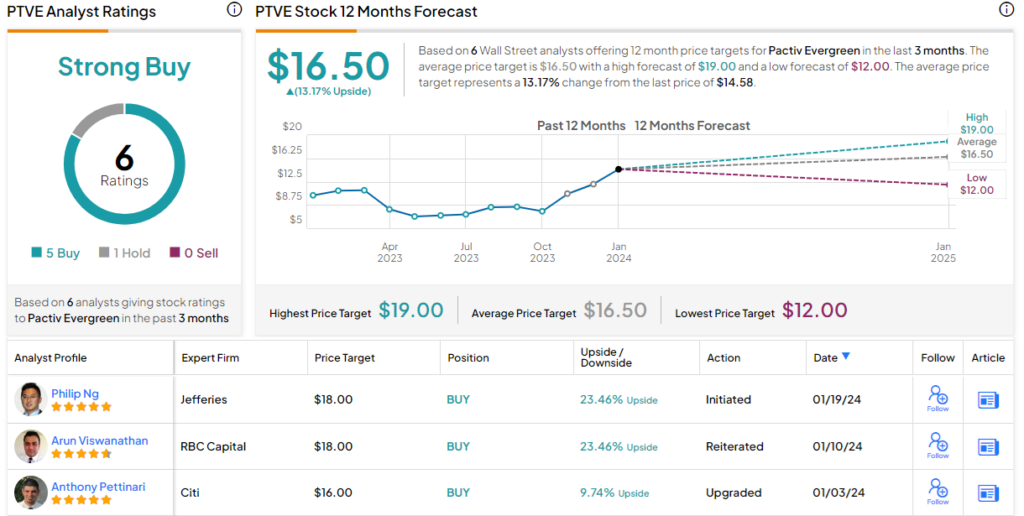

Wall Street generally is bullish here, as shown by the Strong Buy consensus rating based on 6 recent analyst reviews – 5 to Buy and 1 to Hold. The shares are priced at $14.58 and have an average target price of $16.50, suggesting an upside potential of 13% for the next 12 months. (See Pactiv Evergreen’s stock forecast.)

Berry Global Group (BERY)

Plastics are ubiquitous in today’s world, and the packaging sector is a major user, producer, and innovator of plastic materials. Berry Global Group, the second stock on our list, is a $7.7 billion firm that has been a leader in the field of plastic containers and packaging products since the 1960s. The company has more than 100,000 products on the market, produced by over 40,000 employees globally. Berry supports more than 18,000 customers, providing them with a wide range of plastic products.

These products include everything from spray bottles to tapes and adhesives. The company can manufacture plastic squeeze tubes of the sort frequently used for soaps, shampoos, and toothpaste; plastic trays and lids, of any shape; medical devices; jars and drinking cups; filters and filtration materials; films and laminates; applicators, bottles and vials, tubs and pots; plastic bags – think of the ever-present grocery bag; even plastic-fiber-based disposable attire. If a customer needs it, Berry can develop it in plastics.

This wide array of products is found in an equally wide array of market sectors. These can include heavy/industrial sectors, such as shipping and transportation or commercial and industrial supplies, to lighter segments such as personal hygiene, foodservice, and beauty products. The company also has customers in the building and construction industries, as well as agriculture and horticulture.

Maintaining such a broad-based business model has been good for Berry. The company brought in a total of $12.7 billion in net sales for its fiscal year 2023, which ended on September 30 last year. The company reported a free cash flow for the fiscal year of $926 million, and returned $728 million to shareholders during the year.

That said, in the last reported quarter, fiscal 4Q23, Berry’s quarterly revenue came to $3.1 billion, a figure that was down almost 10% y/y and came in $50 million below the forecast. Earnings presented better news for investors, coming in at $2.28 by non-GAAP measures – and beating the forecast by 14 cents per share.

Shares in BERY are up some 14% over the past 12 months but have trailed the S&P 500’s 20% gain. For analyst Woodworth, this stock is a solid value choice, with room for gains. He writes of the company, “We view Berry as undervalued: despite strategic shifts made over the past 2 years (capital allocation, Board & CEO changes, and strategic commercial pivots) the valuation multiple has de-rated on macro concerns & weakness in organic growth. We believe Berry is set for stronger growth in 2024/25 as a new product pipeline & more tactical commercial strategy should drive potential upside. We expect enhanced operating leverage will come with renewed focus on plant level optimization and positive net price, resulting in sharp acceleration in EPS growth in 2024-26.”

For Woodworth, this adds up to a Buy rating, and his price target on the stock, $89, indicates an upside potential of 33% on the one-year horizon.

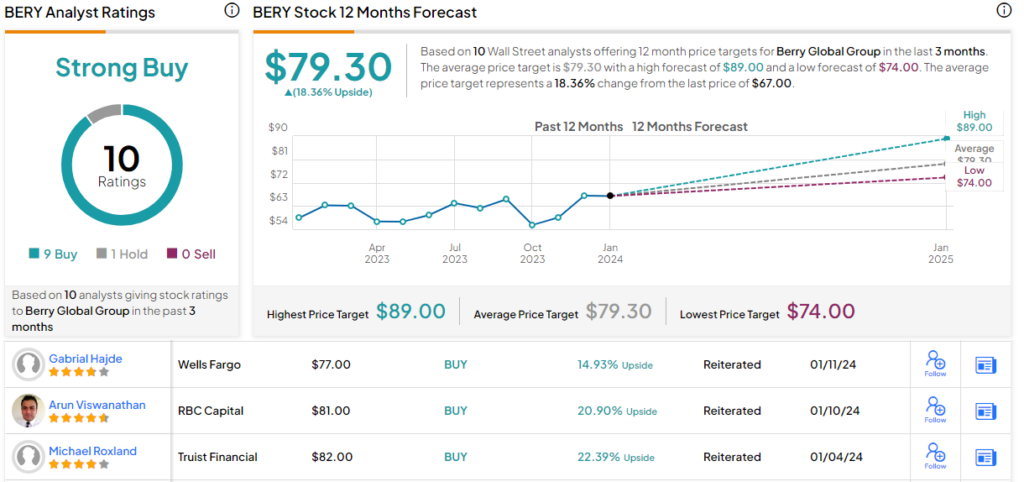

The 11 recent analyst reviews here break down 9 to 1 in favor of Buy over Hold, giving the stock its Strong Buy consensus rating. The stock’s $67 trading price and $79.30 average target price together suggest an 18% one-year upside potential. (See Berry Global’s stock forecast.)

O-I Glass (OI)

When you talk about packaging, you probably focus on plastics or cardboard – but glass bottles are also packages, and glass packaging materials are a major segment of the larger packaging business. O-I Glass, based in Ohio, has been involved in the glass container business since the early 1900s, and has grown to boast a global footprint, with customers and operations in North and South America, Europe, and the Asia-Pacific region.

O-I describes glass as the world’s ‘most sustainable packaging material,’ and the company has developed multiple lines of glass containers and bottles for use in the food and beverage sectors. The company markets glass bottles specially designed for wine, beer, and spirits, in all of the distinctive shapes we have come to expect. In addition, O-I produces and distributes containers and bottles for non-alcoholic beverages as well as food items.

The glass packaging niche may seem humble, but it is huge. O-I produced 41 billion glass containers in 2022, and the company employs over 24,000 people at 69 production plants in 19 countries. The financial side is impressive, too. O-I reported a total of $6.85 billion in sales for 2022, and is on track to exceed that figure when the 2023 results are announced on February 6.

In the meantime, we can look at the company’s last quarterly report, from 3Q23, to get a feel for where O-I stands now. The company’s top line in the quarter came to $1.74 billion. While this missed the forecast by $20 million, it was up 3% year-over-year. The bottom line non-GAAP earnings figure, reported at 80 cents per share, was up significantly from the 63 cents per share reported in the prior-year quarter – and it was 10 cents per share better than had been expected.

Analyst Woodworth, in his write-up for UBS, notes that O-I has been executing a turnaround plan – with success. He sees the company well-positioned for a bullish near-term, and writes, “We… believe glass fundamentals are not as bearish as recent volume trends would suggest owing to substantial destocking impacts and short cycle contract positioning. Contrary to market expectation for elasticity impacts, higher price point glass demand held up better than many other substrates across 2H22- early 2023 with stable growth in wine and spirits. OI’s elasticity impact on volumes and de-rating is unwarranted, in our view, as its EBITDA outlook remains supported by volume recovery and a less exaggerated pricing impact given aggressive industry action to rightsize capacity.”

Woodworth puts a Buy rating here, along with a $26 price target that indicates his confidence in a 73% upside potential heading out to the one-year time frame. (To watch Woodworth’s track record, click here.)

While Woodworth is highly bullish, the Street generally isn’t quite ready to go that far. That’s not to say that Wall Street doesn’t like this stock – the shares have a Moderate Buy consensus rating, based on 9 analyst reviews that include 6 Buys and 3 Holds. The shares are trading for $15 and their average price target, currently at $21.56, implies the stock will gain 44% over the next year. (See O-I Glass’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.