The run in hot FANGMA stocks (META, AMZN, NFLX, GOOGL, MSFT, AAPL), which can be measured by the Evolve FANGMA Index ETF Trust Units CAD Hedged ETF (TSE:TECH), has been very impressive. It certainly did not take long for sentiment to take a 180-degree turn, sending some FANGMA stocks to new heights just months after touching down with ominous depths.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Undoubtedly, it would have been nice to get in a few months ago. Though it seems like the surge is a forgone opportunity, analyst bullishness suggests that big tech’s recent run still has room to gain. I’m inclined to agree with the analyst community. FANGMA stocks have more room to run, and it’s not just thanks to the AI boom!

Therefore, let’s use TipRanks’ Comparison Tool to check in with three AI-savvy FANGMA names and see where analysts stand.

Amazon (NASDAQ:AMZN)

Amazon is an e-commerce and public cloud behemoth that hasn’t been nearly as hot as some of its big tech peers, some of which are sitting at or around new all-time highs. Going into the second half, I view Amazon stock as the FANGMA company with the most room to surge.

Undoubtedly, Amazon is the priciest of the group. However, I still believe that its disruptive capabilities will help it grow into its seemingly sky-high price-to-earnings multiple (it’s over 300 times trailing price-to-earnings and 71 times forward price-to-earnings). Sure, a lot of enthusiasm is already baked into the share price. Still, I view new highs as a realistic target for the original innovator, especially as interest rates look to peak. All considered, I remain bullish on AMZN stock.

The cloud and e-commerce segments aren’t soaring into the clouds as they used to, thanks partly to a hazy economic climate. Indeed, growth in both areas could rebound after a recession concludes. If no recession unfolds, Amazon’s road to recovery could continue at the current blistering pace.

Even if the coming expected recession is rocky and longer lasting, the company has some growth drivers brewing, and it’s these disruptive innovations that could help keep the good times (at least on a year-to-date basis) going for Amazon stock investors.

Year-to-date, the stock is up around 52%. With skin in the AI game via its Amazon Bedrock AI service (which offers customizable AI models for easy integration into applications) and a smartening Alexa (Amazon’s cloud-based voice service), I view Amazon as one of the AI companies that may not have as much AI hype built in at current levels. We’ve heard a lot about OpenAI and ChatGPT this year. Up ahead, I’d look for Amazon to step up to the plate with its AI innovations.

What is the Price Target for AMZN Stock?

Amazon’s a Strong Buy on Wall Street, with a whopping 37 Buys and just one Hold. The average AMZN stock price target of $137.62 implies upside potential of 7%.

Microsoft (NASDAQ:MSFT)

Microsoft stock recently hit a new high, just months after ChatGPT shined a bright light on the potential of generative AI and large language models. As ChatGPT gets stronger and more widely available across a slew of productivity applications, it seems like Microsoft is on a breakaway, leaving many of its rivals in the dust.

Microsoft’s rivals have been going heavy on AI innovation of late, and they can catch up. That said, it may prove difficult to dethrone Microsoft as it explores new possibilities with the power of AI. Even at today’s frothy valuations, I find it hard to be anything but bullish on the stock.

Shares of Microsoft are the most expensive they’ve been in quite a while. At 36.7 times trailing price-to-earnings, MSFT stock is on the high end of the historical valuation spectrum. Over the last five years, Microsoft has averaged a 33.4 times trailing price-to-earnings multiple. Undoubtedly, there’s a lot of AI expectations factored in. As Microsoft keeps rolling out new AI features across its ecosystem, earnings could get a nice jolt. The magnitude of this jolt, though, remains a question mark.

Executives see plenty of ways that Microsoft hits $10 billion (or more) in annual AI ARR (annual recurring revenue). Arguably, Microsoft could exceed such estimates, perhaps sooner than expected, if AI plays well with the company’s existing offerings.

After the hot run, several analysts have hiked their price targets, some by generous amounts. JPMorgan recently hiked its price target from $315 to $350.

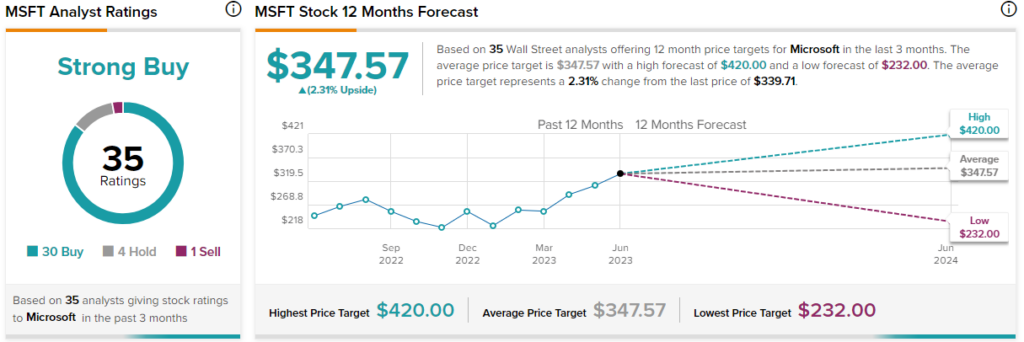

What is the Price Target for MSFT Stock?

Microsoft is still a Strong Buy on Wall Street, with 30 Buys, four Holds, and one Sell. Nonetheless, the average MSFT stock price target of $347.57 entails a small 2.3% gain from here.

Alphabet (NASDAQ:GOOGL)

I view Alphabet stock as a must-own for new investors looking to bet on AI. When it comes to AI innovation, it’s easier to bet on the products we’ve had a chance to interact with. Though Google has its Bard AI, a vast majority of the company’s AI innovations aren’t yet ready for consumers to play with. Arguably, Google’s AI innovations are too powerful (and risky) to be unleashed to the public right now. This could change once regulations come to be while guardrails improve.

For now, though, GOOGL stock certainly doesn’t seem like the “hottest” AI stock to own for investors. Still, give it a few years, and I’d look for Google to flex its AI muscles. Arguably, Google may have bigger AI muscles than some of its pricier peers. For this reason, I’m bullish on GOOGL stock and view it as relative value in a hot space.

Though GOOGL may be relatively cheap, given the AI talent (consumer-facing and behind-the-scenes) you’re getting, the stock still trades well above where it spent most of last year (it averaged a 17.54 times trailing price-to-earnings multiple in 2022). At 27.7 times trailing price-to-earnings, there’s some AI enthusiasm baked in. Nevertheless, my guess is that there’s not enough, given the monetizability of Google’s large language models.

What is the Price Target for GOOGL Stock?

Alphabet is a Strong Buy based on 28 Buys and three Holds assigned in the past three months. The average GOOGL stock price target of $131.48 implies 6.8% upside potential.

Conclusion

FANGMA stocks have a lot to gain from AI, and of the three AI-savvy stocks in this piece, analysts expect the most upside from Amazon stock.