There are two sides to every coin. This holds particularly true for penny stocks, or tickers that trade for less than $5 per share. These stocks are among the most divisive names on Wall Street, either enticing investors with their high return potential or driving them away. But why?

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

When we say high return potential, we aren’t exaggerating. The bargain price points allow investors to snap up more shares than possible when investing in other more well-known names. What’s more, even what feels like trivial share price appreciation can translate to massive percentage gains.

That said, there’s a legitimate reason some investors are wary when it comes to penny stocks. The risk involved with these plays scares off the faint-hearted as real problems like weak fundamentals or overwhelming headwinds could be masked by the low share prices.

So, how are investors supposed to determine which names have what it takes to make a comeback? Follow the pros.

Using the TipRanks database, we were able to pinpoint two penny stocks that boast ‘Strong Buy’ consensus ratings from the analyst community. Not to mention massive upside potential is on the table. We’re talking about up to 750% here.

Vigil Neuroscience (VIGL)

We’ll start with Vigil Neuroscience, a biotech firm working on the development of new therapeutic agents for the treatment of neurodegenerative diseases. The company is taking a novel approach, focused on microglia, cells resident in the central nervous system and acting in the defense and repair of neurons. The company’s goal is to create a line of drug candidates capable of targeting genetically defined patient sub-populations, to demonstrate efficacy before expanding the patient base.

Vigil’s programs are currently designed to target TREM2 activation, through both large and small molecule compounds. The firm’s leading drug candidate, iluzanebart (also known as VGL101), is currently undergoing a Phase 2 clinical trial in the treatment of ALSP, or Adult-onset leukoencephalopathy with axonal spheroids and pigmented glia. Iluzanebart is a fully human monoclonal antibody and TREM2 agonist.

ALSP, the initial disease target, is a severe, degenerative neurological disease with a high unmet medical need; enrollment in the Phase 2 IGNITE trial of iluzanebart has been completed, and interim data, released in April, showed promise based on the first 6 patients after 6 months of treatment. The next data readout for IGNITE, currently scheduled for 3Q24, remains on track.

Complementing iluzanebart is Vigil’s second asset, VGL-3927, an oral small molecule TREM2 agonist undergoing a Phase 1 clinical trial for Alzheimer’s Disease. Interim healthy volunteer data from this trial is expected to be reported in the upcoming weeks.

The high potential of iluzanebart has caught the attention of Wedbush analyst Laura Chico, who writes of this program, “IGNITE readout creates critical catalyst for VIGL… We do think the prior interim IGNITE readout in six patients provided early signals of iluzanebart activity. A longer of duration of treatment (e.g. 12 months vs. 6 months) could be helpful to better tease out trends on imaging and biomarkers. Given the rapid progression typically observed in ALSP patients, demonstrating any signs of disease stabilization would be a success…”

Chico notes the stock’s potential for gains, stating, “We see attractive risk/reward ahead of the IGNITE readout while cash (~$2/share) offers some downside protection and positive data can help shares work higher towards our $22 target.”

Chico’s $22 price target suggests a robustly high 752% upside on the one-year horizon. With such potential, it’s no surprise that Chico rates VIGL shares as Outperform (i.e., Buy). (To watch Chico’s track record, click here)

While highly bullish, the Wedbush view is hardly an outlier. VIGL stock has 6 unanimously positive analyst reviews, for a Strong Buy consensus rating, and the $18.33 average price target indicates a 630% one-year upside from the current share price of $2.51. (See VIGL stock forecast)

scPharmaceuticals (SCPH)

The second penny stock we’re looking at is SCPharmaceuticals, a biopharma company that has achieved the end goal of every research-oriented company: putting an approved product on the market. SCPharmaceuticals is focused on treatments for heart failure, which is the chronic inability of the heart to effectively pump blood. This condition leads to a cascade of other systemic failures throughout the body, including congestion or the build-up of fluids. It’s a potentially lucrative field for biotech, as heart failure affects well over 6.5 million adults in the US and is a factor in more than 85,000 deaths every year.

At the heart of SCPharmaceuticals’ portfolio lies Furoscix, a subcutaneous medication that gained FDA approval in October 2022 and was introduced to the market in early 2023. Furoscix, a proprietary formulation of furosemide, specifically targets congestion stemming from fluid retention associated with Class II and Class III chronic heart failure. It offers the convenience of outpatient treatment.

The company’s efforts at commercialization for Furoscix have been successful, and revenues have risen sharply since 1Q23. SCPharmaceuticals is moving to expand the label for Furoscix, and has enrolled patients in a pharmacokinetic (PK) study to support a higher-dose injector. The PK study is intended to support a supplemental NDA (sNDA) by the end of this year. The company already has an sNDA under review by the FDA, with a PDUFA date this coming August, to expand the use of Furoscix to patients with Class IV chronic heart failure.

Earlier this year, the healthcare sector faced a disruption due to the Change Healthcare cyberattack, which had ripple effects across several major health insurance providers, resulting in a payment backlog. SCPharmaceuticals, too, felt the impact, experiencing a 10% reduction in its top-line revenue. However, despite this setback, the company reported $6.1 million in 1Q24 revenue, marking a 190% increase year-over-year.

These factors, and more, form the basis for a positive outlook on SCPH by Craig-Hallum analyst Chase Knickerbocker.

“We continue to believe that 2024 will be a very eventful and very positive year for SCPH. First, we expect to hear updates on progress with large Medicare payers as mentioned. Second is the label expansion into class IV HF, for which the PDUFA date is set for August. Third, the initiation of the pivotal PK study for the autoinjector (extends exclusivity to 2039) that was recently announced, allowing for a submission of the sNDA by year-end if the trial is successful. Fourth, the sNDA for CKD (expands TAM from $6B to $8B) that was filed in early May. With the Change Healthcare interruption resolved, we continue to see a lot of ways for investors to win in SCPH shares, especially at current levels, and think the company is positioned to potentially exceed expectations through the year,” Knickerbocker opined.

To this end, Knickerbocker rates SCPH shares as a Buy, setting a $16 price target, which implies potential gains of ~398% in the year ahead. (To watch Knickerbocker’s track record, click here)

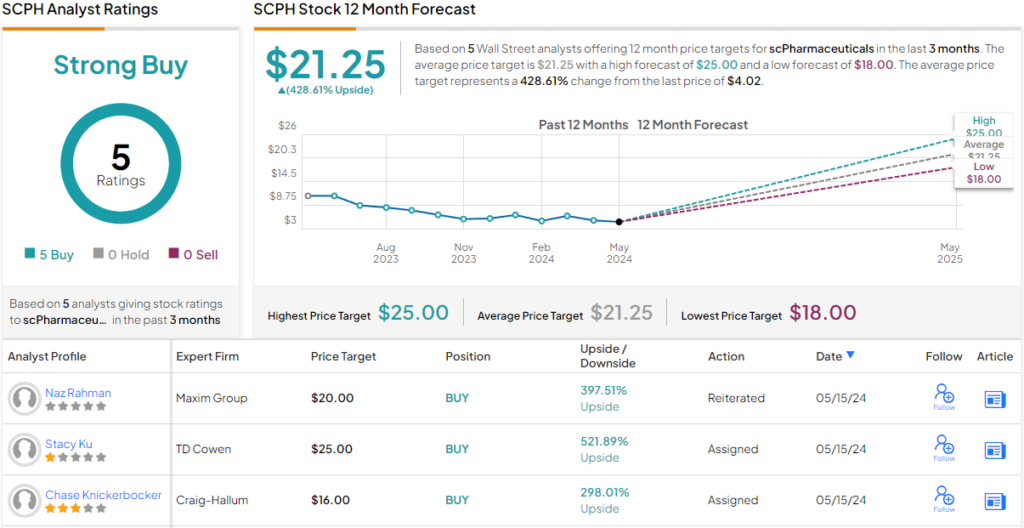

The overall view of SCPharmaceuticals is even more bullish than that. The stock’s Strong Buy consensus rating is unanimous, based on 5 positive analyst reviews, and the $21.25 average price target suggests a 428% upside from the current share price of $4.02. (See SCPH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.