The recent January jobs number showed a huge surprise to the upside. Wall Street had expected to see approximately 185,000 new non-farm payroll jobs – but the number came in at 335,000, beating that estimate by 150,000, or a whopping 81%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A hiring expansion of that size is sure to have ripple effects in the economy. Questions will be raised – are these new full-time jobs? Are these single workers holding multiple part-time jobs? Will wages keep up with inflation? But some questions will slide under the radar – How will HR departments deal with this rising tide?

Personnel management is a vital function for any business, and BTIG analyst Matt VanVliet has taken up the issue. In his recent coverage of HR stocks, VanVliet says, “Easy to use and accurate payroll is the bare minimum, but the modern enterprise must now efficiently recruit and onboard employees in a highly competitive, tight labor market, provide training and solid benefits to ensure retention, and have better visibility into staffing, scheduling, and employee experience to effectively manage the business.”

“This is creating elevated demand for cloud-based HCM solutions, with the segment expected to grow ~12.5% per annum in the US through 2026 to $33.1bn in annual spend, according to Gartner. This leaves an opportunity for many of the names in our coverage to grow into and expand their average revenue per employee as these companies become more creative in their attempts to solve the everyday needs and headaches of HR,” VanVliet added.

Against this backdrop, the BTIG analyst sees some sound opportunity brewing in 2 HR stocks in particular. Let’s check in with VanVliet’s comments on them, and use the TipRanks platform to look up the overall Wall Street take on each as well.

Paylocity (PCTY)

We’ll start with Paylocity, a company founded in 1997 and still working out of its original home state of Illinois. The firm caters primarily to small- and medium-sized businesses, and offers cloud-based software packages to meet a full range of HR service needs, including payroll, time and workflow management, regulatory compliance, talent searching and recruiting, and benefits management. Paylocity has found widespread acceptance, and boasts a client base across a wide range of industries, from manufacturing and technology to religious and nonprofit organizations to healthcare and financial services.

Like many business software companies, Paylocity operates through the subscription-based software-as-a-service model. The company makes its solutions available through its HCM (human capital management) systems; enterprise customers can adjust the packages to meet their own particular needs, backed up by Paylocity’s on-demand support services and its ability to custom-design software package pricing to meet its customers’ demands.

Paylocity released its latest set of earnings data last week, for the fiscal second quarter of 2024 (December quarter). The company beat the forecasts on both revenue and earnings. The top line came to $326.4 million, for a 19.6% year-over-year gain, and was $2.03 million ahead of the estimates. At the bottom line, the adj. EPS of $1.49 beat the Street’s forecast of $1.28.

Nevertheless, despite those solid numbers, PCTY shares fell after the earnings release. Investors were seemingly disappointed with the company’s forward guidance. Total revenue for FQ3 is anticipated in the range between $395.0 million to $399.0 million, amounting to roughly a 17% improvement but falling shy of the analysts’ expectation of $401 million.

For BTIG’s VanVliet, however, this stock simply presents a solid player with a firm base in its industry. He writes of the company, “Paylocity stands as a leader in the HCM space as it successfully catered to the needs of companies in a sudden remote environment during the pandemic and customers haven’t looked back from all the time and capabilities Paylocity has been able to provide. Paylocity has a diverse revenue base where no customer accounts for 1% or more of revenue which we believe is critical for companies that are operating in an uncertain macro environment. Paylocity differentiates itself with its keen focus on innovation that provides capabilities to foster a sense of community and a knowledgeable salesforce that is able to identify the needs of its customers.”

Along with these comments, the analyst puts a Buy rating on PCTY shares, with a $200 price target that suggests a 20% one-year upside potential for the stock. (To watch VanVliet’s track record, click here)

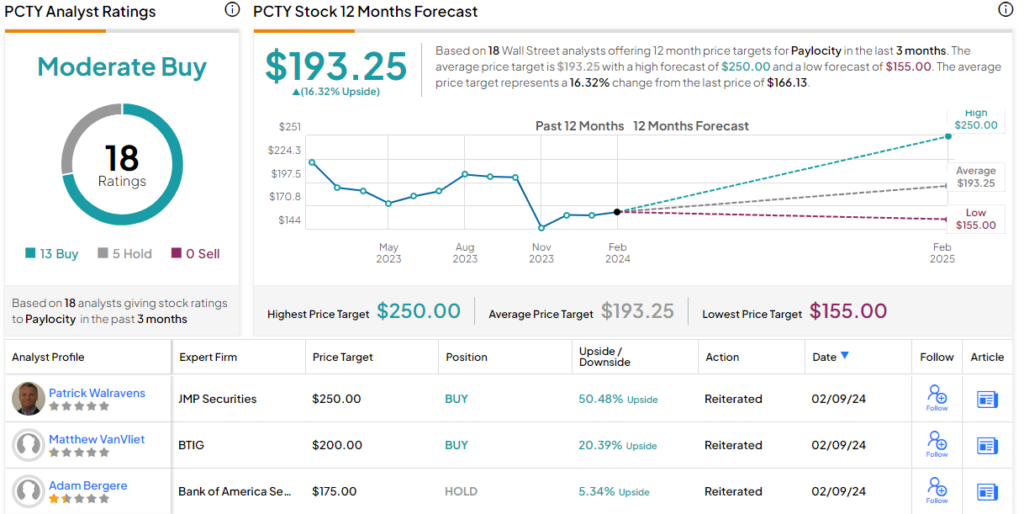

The 18 recent analyst reviews on Paylocity stock include 13 Buys and 5 Holds, giving the shares their Moderate Buy consensus rating. The stock is currently selling for $166.13, and its $193.25 average target price implies a 16% increase in the next 12 months. (See Paylocity’s stock forecast)

Paycor HCM (PYCR)

Next up is Paycor, another HCM provider operating in America’s business landscape. Paycor, which is based in Cincinnati, Ohio, can boast some recognizable names in its customer base, including the Wendy’s burger chain, Two Men and a Truck movers, and the Detroit Zoo. The company offers its customers a unified HR software platform with the features that businesses need: tools for talent development, for data analytics, and for easy integration with third-party applications – as well as the ability to customize the platform for specific customer and industry needs.

Some numbers will sum up both Paycor’s industry position and the scale of its success. The company has more than 30 years in the business, and provides its platform to more than 40,000 business clients around the country. Paycor’s HR solutions support more than 2.5 million users across all 50 states.

The company has based its business on making it easier for enterprise clients to take a holistic view of workforce management, viewing employees, contractors, seasonal workers, and even volunteers as a unified whole. Paycor’s solutions for its customers also include talent acquisition, benefits management, and payroll software. All of this has provided the company with a solid base.

The company also recently released its fiscal second quarter of 2024 (December quarter) report which showed strong results. The $159.5 million in total top line revenue was up 20% from the year-ago period, and came in $3.71 million better than had been expected. The company earnings, by non-GAAP measures, came in at 11 cents per share, beating the forecast by 2 cents per share.

We’ll check in again with analyst VanVliet, who is impressed by Paycor’s ability to develop recurring revenue and its proven history of highly focused sales activities. VanVliet writes, “Paycor has one of the highest potential recurring revenue sources per employee given their robust suite with a current identified total potential PEPM of $51. While many HR-focused cloud-based companies target a specific area to differentiate themselves, we believe Paycor’s differentiation lays in its focus on talent management and vertically focused offerings that appeal to specific client bases. We view specific solutions as providing an environment where its focused sales force in specific markets is able to obtain a high win rate because of a strong priority for innovation and tailored solutions.”

Looking ahead, the analyst puts a Buy rating on this stock, and his $30 price target points toward a one-year gain of 30% in the offing.

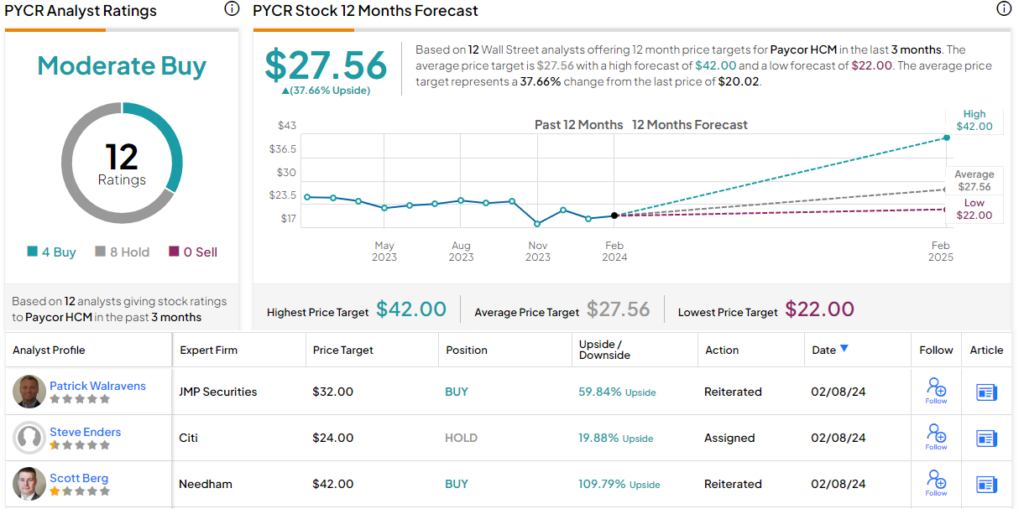

This is another stock with a Moderate Buy consensus rating from the Street, with the 12 recent analyst reviews breaking down to 4 Buys and 8 Holds. The shares have a $27.56 average price target, which implies they will gain ~37.5% over the one-year timeframe. (See Paycor’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.