Are you ready for the New Year? We’re getting down to the wire, 2020 is almost gone, and Wall Street’s analysts are engaged in the time-honored tradition of picking stocks for next year.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In the background, we have, finally, a foundation of good news. The election is settled. For better or worse, former VP Joe Biden will take office on January 20, but he’ll have to deal with a Congress that features the narrowest partisan divide in decades. It’s a situation that lends itself to institutional gridlock – and oddly, that has investors feeling confident. It’s unlikely that the next four years will see any sweeping legislation. Investors foresee a period of stability, which is conducive to market gains.

Even better, the availability of COVID vaccines promises a return to normal life sooner rather than later. The prospect of large-scale immunity is a net positive by any measure.

And there is momentum. Markets have been gaining since March, and all three main indexes, the Dow, the S&P, and the NASDAQ, are at – or near – record-high levels. They are riding on the optimism of election results and the COVID vaccines – but the markets’ own gains have become another reason for optimism. It’s a virtuous circle.

With this in mind, Needham’s analysts have chosen three stocks they like for next year. While the firm’s analysts believe the three are poised to surge at least 25% in the year ahead, we wanted to get the rest of the Street’s opinion. After using TipRanks’ database, we learned that each ticker has scored Buy ratings from other members of the analyst community as well.

Synaptics, Inc. (SYNA)

Our computer systems are only as good as their user interfaces. The array of keyboards, pointers, touchpads, trackballs, and touchscreens we’ve developed gives testament to this basic fact of digital work. Synaptics is a tech company that develops high-end user interfaces systems, including flex-screens, touch-screens, VR systems, video interfaces, and vision tracking systems for IoT applications.

Our digital world puts a premium on both user interface systems and security, and Synaptics has delivered on both fronts. The company was the first to market a viable touchpad pointer system, and the first to develop the biometric tech for fingerprint sensors. Synaptics markets its products primarily to device companies in the mobile sector, and to computer display manufacturers.

2020 was a hard year for Synaptics. In Q3, the company was starting to show a recovery from the COVID recession, with the top line rebounding back to $328 million, but both revenues and earnings were down year-over-year. The company’s shares, however, are on their way up. The stock has gained 47% this year, with a notable spike in the last two weeks.

Needham’s Rajvindra Gill is impressed by Synaptics’ forward path. He writes, “We believe that recent M&A deals (acquisitions of Broadcom’s wireless IoT business and DisplayLink) have transformed the business and will increase higher margin revenues while simultaneously opening new markets and creating opportunities for cost synergies. We look for the IoT business to have opportunities in the Edge computing, wireless connectivity and USB-C categories. In the remaining mobile business, SYNA is dominating the high-margin OLED touch controller market, winning virtually every new design by major handset OEMs.”

In line with those comments, Gill makes SYNA his ‘best pick’ for 2021 and has a Buy rating on the shares. The analyst’s $130 price target implies a 33% upside potential for the next 12 months. (To watch Gill’s track record, click here)

Overall, Wall Street is quite positive on this ‘Moderate Buy’ stock: SYNA has received 5 Buys and 2 Holds in the past three months. Running the numbers across the Street, the 12-month average price target lands at $105.5, suggesting about 8% growth in the new year (See SYNA stock analysis on TipRanks)

Duck Creek Technologies (DCT)

Sticking with the tech sector, we’ll look at Duck Creek. This Boston-based software company has found a home in the insurance world, producing software products that are industry-specific and designed to ease insurance carriers’ routine tasks of managing services. Duck Creek’s customers include such major names as AIG, Geico, and Berkshire Hathaway Specialty Insurance.

Duck Creek offers insurers a full range of software systems, including tools for policy rating, billing, and claims, along with data insights, distribution management, and reinsurance management.

The value of the products can be inferred from the company’s successful IPO. When DCT started trading on the NASDAQ this past August, the stock closed its first session at $40 per share – after opening at $27. The 48% gain in the company’s first day followed a total capital raise of $405 million for the IPO.

Since the IPO, Duck Creek has issued one quarterly report as a public company. That report, for Q3, showed revenue at $58 million, or up 23% sequentially. The solid revenue was powered by a 54% year-over-year gain in subscription sales. The company finished its FY20 with a 24% yoy revenue gain, and reported over $389 million in cash on hand.

5-star analyst Mayank Tandon, in his report on DCT for Needham, was impressed enough by the company to call it his ‘best pick.’

“We are highlighting DCT as our top pick for 2021 and adding it to the Needham Conviction List. We believe DCT has a long growth runway. With the global P&C insurance industry in the early days of a long transition to modern, cloud-based software solutions and DCT’s leading SaaS offerings and best-in-class execution, we believe the company will deliver outsized growth over the next several years… We see the robust industry-wide secular growth and the strong potential for beat and raise performances serving as positive catalysts for the shares,” Tandon wrote.

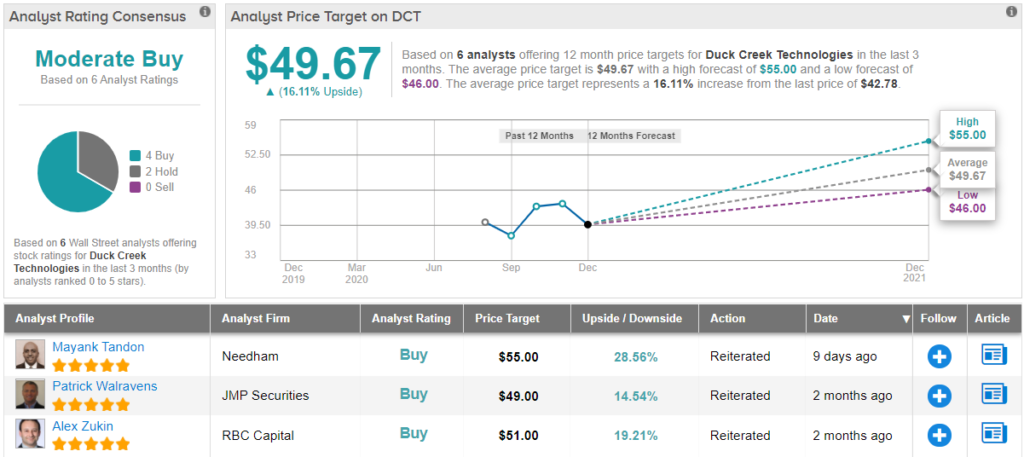

To this end, Tandon rates the stock a Buy, and his $55 price target indicates confidence in a one-year upside of ~28%. (To watch Tandon’s track record, click here)

The Buy-Hold split here is 4 to 2, making this another stock with a Moderate Buy rating from the analyst consensus. The shares sell for $43.11 and the $49.67 average price target suggests 16% growth from that level. (See DCT stock analysis on TipRanks)

Anaplan, Inc. (PLAN)

The third ‘best pick’ we’re looking at from Needham is Anaplan, another cloud software company. Anaplan offers business planning software, that facilitates connections among people, their data, and their plans. By easing connections, Anaplan’s software makes decision making processes smoother, in everything from finance to HR. Anaplan boasts over 1,500 business customers.

Anaplan’s revenues have been rising steadily in 2020, along with the share value. For the first, the top line sales have increased in each quarter of the year, going from $104 million in Q1 to $115 million in Q3, a gain of 10.7%. Meanwhile, PLAN shares have gained 37% year-to-date.

5-star Needham analyst Scott Berg clearly sets out the bullish case for Anaplan when he writes, “We are selecting Anaplan as our 2021 best idea and adding it to our Conviction List. Our industry work suggests that demand for Anaplan’s leading Planning platform will climb in 2021, as this year’s economic slowdown convinced companies to free up the time and resources companies needed to replace lagging legacy solutions that were ill-equipped to deliver business data during the most critical time periods in the pandemic.”

Berg backs his bullish thesis with a Buy rating and a $95 price target. This figure implies a 32% upside potential in the next 12 months. (To watch Berg’s track record, click here)

All in all, PLAN has 12 Buy-side ratings given in recent weeks. These are partially balanced by 5 Holds and 1 Sell, making the analyst consensus view a Moderate Buy. The stock’s strong gains through the year have pushed its share price to $71.60, almost to the $74.89 average price target and leaving room for just ~4% growth. (See PLAN stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.