Tech is exciting. It’s long been known as the cutting edge of the digital economy, and really, who doesn’t like the ‘shiny new thing?’ Excitement and newness have always been selling points for tech stocks, and the software industry in particular, especially in recent years.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

But sentiment can be fickle. In recent years, conflicting currents have been pulling at the tech sector. These include the pandemic-era rush toward networking and online tech, followed by a pullback in 2022 as inflation started to hurt. More recently, inflation has been slowing and AI has captured our collective imagination – but we still don’t know how this will shake out.

A new note from Canaccord Genuity asks the logical question, “What if you could have the best of both worlds? That’s companies that are set for what seems like durable growth but have also done an exceptional job delivering operating leverage.”

The investment firm goes on to provide its own answer. Canaccord has screened the ‘broader software group,’ and found the companies that the filters brought to the top – and now Canaccord’s tech experts are taking a deep dive into their details. The result of their analysis? Two software stocks that should grab investors’ attention.

We’ve opened up the TipRanks database to find out the broader view on both of them. Canaccord’s picks have earned Strong Buy ratings from the Street, and each double-digit upside for the coming year. Here’s a closer look.

Klaviyo, Inc. (KVYO)

Boston-based Klaviyo is the first software company we’ll look at here. This company offers customers a marketing automation platform and has proven particularly popular as a tool for email and SMS marketing. Klaviyo’s platform brings a range of tools designed to let marketers automate the common, time-consuming tasks of digital marketing efforts. These include automated contact flows, digital campaigns, communication template design, and even online web forms. In addition, the platform is designed to draw from the user’s own database.

Klaviyo’s tools are designed to optimize growth, with features that allow accurate, multi-channel reporting via intuitive, visually oriented dashboards. Users can even generate custom reports, released on regular schedules. The use of benchmark data allows users to see how their own work compares to related brands, and generative AI helps make smarter decisions and speed up the content creation process.

Klaviyo was founded in 2012 and went public through an IPO in September of last year. In the recently released financial results for 1Q24, the company’s third such release since going public, Klaviyo showed total revenues of $210 million. This was up 35% year-over-year, and was $7.87 million better than had been expected. The company’s bottom line, at 13 cents per share by non-GAAP measures, was 2 cents ahead of the estimates.

Among the drill-downs, Klaviyo’s customer data should be particularly interesting for investors. The company counted a total of 146,000 customers at the end of Q1, up 21,000, or nearly 17%, year-over-year. Of this total, 2,157 customers were generating annual recurring revenue (ARR) of $50,000 or higher, for a 69% year-over-year increase. Klaviyo reported that these high-ARR customers now make up 31% of the company’s total ARR, making this the first quarter that this category has topped 30%. The company’s top 10 customers have an average ARR of $1.5 million.

When we turn to the Canaccord view, we find analyst David Hynes upbeat on Klaviyo’s international business and its solid ARR numbers. The analyst writes, “The firm’s international business grew 40% in Q1 and is about 30% of revenue, and Klaviyo is just now starting to put some muscle behind that effort with product localization and we presume some incremental marketing. The gradual push up-market has been showing steady progress as well, as the number of $50K+ ARR customers is growing nearly 70% and increasing in terms of their contribution to the mix. And finally, there’s a multi-product story still emerging here, as efforts like SMS, CDP, and Reviews are still relatively underpenetrated, and we expect there will be more to come on this front in the quarters and years ahead.”

“All told,” the analyst summed up, “we think it’s likely that Klaviyo will be a low-30% grower this year, which not only is rare in public software these days, but at 5.7x EV/R on C2025E, makes for a reasonably compelling risk/reward for a profitable growth story.”

Along with these comments, Hynes puts a Buy rating on the shares, complemented with a $32 price target that implies a one-year upside potential of 31%. (To watch Hynes’ track record, click here)

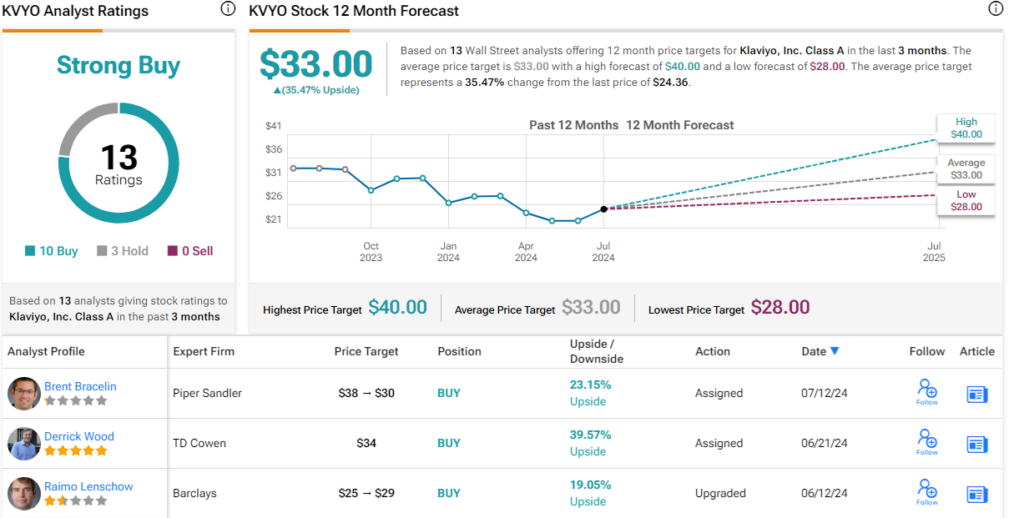

This software stock has 13 analyst reviews on file, with 10 Buys and 3 Holds all coalescing to a Strong Buy consensus rating. The shares are priced at $24.36, and the $33 average price target suggests that KVYO will appreciate by 35.5% in the year ahead. (See KVYO stock forecast)

GitLab (GTLB)

GitLab, the second Canaccord pick we’re looking at, is known for creating an open-source DevSecOps platform. While that sounds complicated, it’s simple – this company’s customers can access a specialized platform for the optimization of fast and efficient software development. The GitLab platform is open source, meaning that coders and developers out in the general public can create and add tweaks and improvements to the platform code – and that the platform itself is available to users free of charge. GitLab operates on the freemium model, a business model that allows all users to access the software at a basic level of functionality – while paying subscribers can access higher-level functions and upgrades.

Since it offers an open-source platform and uses the freemium model, GitLab has attracted a large body of total users, on the order of 30 million. Of that, approximately 1 million are paid subscribers with an active license, and there are some 3,300 active users making regular contributions to the open-source platform code.

GitLab’s platform and tools are used by a wide range of customers, including such major enterprise clients as Nvidia, Lockheed Martin, and Goldman Sachs. The platform allows developers to keep all of their DevSecOps tools in one place, for an efficient workflow, to accelerate software delivery while integrating security – and can be deployed anywhere, at the user’s convenience.

In May of this year, the company announced the introduction of GitLab Duo Enterprise, an end-to-end AI add-on to the platform that acts to increase efficiency at every step of the software development process. The company’s AI capabilities will allow for better-secured software through improved vulnerability explanation and remediation, and will improve development teams’ abilities to respond to failures and code errors.

With all of this going for it, it should come as no surprise that GitLab’s last quarterly results – from fiscal 1Q25, the quarter that ended on April 30 of this year – showed solid beats at both the top and bottom lines. The company’s revenue total came to $169.2 million, $3.09 million over the estimates and up more than 33% y/y. The company’s non-GAAP EPS of 3 cents was a net profit – and was 7 cents per share better than had been expected.

Moving from this background to a zoomed-out view, Canaccord’s Kingsley Crane writes of GitLab, “Bigger picture, this continues to be a growth-first software market and it’s increasingly rare to find a 30%+ grower at any stage. GitLab’s been able to accelerate subscription revenue for two quarters in a row. The company’s ability to continue to power revenue growth from seat expansions in this software buying environment is clear evidence, in our view, that the platform value proposition resonates with customers. Investing in the software supply chain remains a top priority for IT buyers, and GitLab’s end-to-end platform approach, beginning from source code is unique. Having reached profitability, we expect operating leverage to naturally emerge as the company scales into what is a large software deployment market.”

Crane quantifies his stance with a Buy rating, while his $65 price target indicates room for a 34% gain on the one-year horizon. (To watch Crane’s track record, click here)

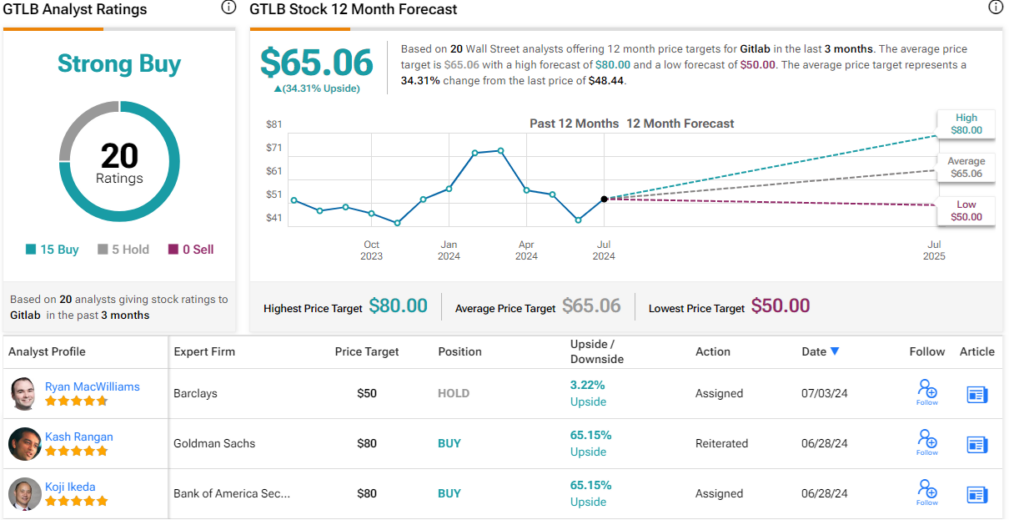

The 20 recent analyst reviews of this stock include 15 Buys and 5 Holds, for a Strong Buy consensus rating. The shares are currently trading for $48.44 and have an average price target of $65.06, practically the same as Crane’s objective. (See GTLB stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.