Shares of electric vehicle (EV) maker Tesla (NASDAQ:TSLA) have been under pressure due to concerns over the company’s declining margins amid rising competition, persistent macro headwinds, and the delay related to the Cybertruck rollout. TSLA stock has declined 21% over the past one month, although it is still up 60% year-to-date. Analysts are increasingly pointing out the impact of CEO Elon Musk’s price cuts on the company’s profitability. They are worried about the road ahead, given the growing rivalry in the EV space and other near-term headwinds, which could limit the upside potential in the stock in the days ahead.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Near-Term Headwinds Could Weigh on the Stock

On Monday, Tesla shares fell by about 5%, as battery production cut by key supplier Panasonic Holdings (PCRFF) raised concerns about a slowdown in EV sales. Panasonic reduced battery cell production for the September quarter due to the slowing demand for high-end EVs in North America, raising concerns about the demand for Tesla vehicles.

On the Q3 earnings call held on October 18, Musk said that he was worried about the affordability of Tesla’s EVs in a high interest rate environment. Musk also cautioned about the company’s much-awaited Cybertruck, saying that it would take 12 to 18 months before the electric pickup truck becomes a notable cash flow contributor.

While Musk emphasized that the Cybertruck is one of those special products that comes along only once in a long while, he admitted that it is very difficult to bring it to market and ramp up volumes. “I mean, we dug our own grave with Cybertruck,” said Musk.

Aside from macro woes and Cybertruck worries, investor sentiment has also been hit by declining margins due to the company’s decision to slash prices to boost volumes in a highly competitive market. Tesla’s operating margin in the third quarter plunged to 7.6% from 17.2% in the prior-year quarter. While the CEO had earlier brushed off worries about slumping margins and expressed confidence in the company’s long-term potential, several analysts are unconvinced.

Analysts Concerned About the Path Ahead

On October 19, Citi analyst Itay Michaeli reiterated a Hold rating on Tesla stock and lowered the price target to $255 from $271 following the Q3 print.

The analyst said that Tesla’s Q3 performance was a “somewhat worse outcome” compared to his neutral-to-slightly negative expectations. He noted that the company’s tone on the conference call was “noticeably more cautious” and that he prefers to be on the sidelines until there is a more attractive entry point with visible near-term fundamental catalysts.

Further, on Monday, Bernstein analyst Toni Sacconaghi reiterated a Sell rating on Tesla stock with a price target of $150, contending that the Street’s Fiscal 2024 consensus margin and volume estimates remain very high. He expects deliveries of 2.15 million units next year with earnings per share (EPS) of $2.59 versus analysts’ estimates of 2.3 million deliveries and EPS of $3.30.

Sacconaghi pointed out that throughout the year, Tesla bulls have been “calling for margins to bottom as ongoing cost reductions increasingly offset the impact of price cuts.” However, Tesla’s margins have missed analysts’ estimates and declined sequentially in the first three quarters this year.

The analyst believes that the Musk-led EV maker will likely deliver lower margins and also disappoint on the volume front. He added that it remains unclear if Tesla can further slash prices enough to boost demand without turning free cash flow negative.

What is the Target Price for Tesla?

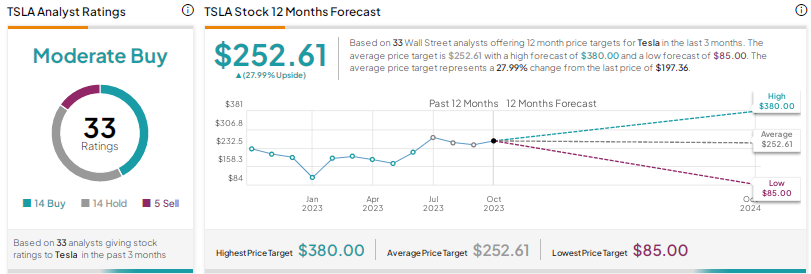

Wall Street has a Moderate Buy consensus rating on TSLA stock based on 14 Buys, 14 Holds, and five Sells. The average price target of $252.61 implies 28% upside potential.

Conclusion

The notable decline in Tesla stock over the past one month, mainly following the company’s third-quarter results, clearly reflects the effect of macro challenges and declining margins on investor sentiment. Several analysts believe that near-term pressures might limit the upside in the stock in the days ahead.