Tesla’s (NASDAQ:TSLA) recent decline is reminiscent of the tech sector during the Great Recession. TSLA stock hit an all-time high of $414 last year but now trades closer to its 52-week lows. Investors may have been quick to judge Tesla, but there are plenty of reasons why people should hold onto its shares for the long haul. Though it missed revenue estimates for the third quarter, it produced record results across business units. Hence, we’re bullish on TSLA stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The EV giant has had an amazing year. It recently opened up two new Gigafactories that will double its previous annual production capacity from 1 million to 2 million cars. Recent comments by its maverick CEO, Elon Musk, suggested that the company is just starting with its global domination.

With 12 additional Gigafactories, Tesla will produce 20 million cars annually by 2030. Analysts predict that this will bring in about $120 billion in revenue in 2023. It’s hard to say if Tesla can maintain its market share in the long run with so many new entrants making their presence felt in the EV space. However, its incredible brand equity in the space positions it as a clear frontrunner in the sphere.

Plenty of Bright Spots in the Third Quarter for Tesla

Tesla delivered mixed results in its third quarter. Revenue increased 56% from the prior-year period to $21.45 billion, missing analyst estimates by a considerable margin. The miss was due to increased foreign exchange headwinds, with the U.S. Dollar faring much better than other currencies. Nevertheless, there were plenty of bright spots.

Despite the economy being on an inflationary rollercoaster, Tesla’s operating expenses only grew by 2% to $1.69 billion. It also etched out a 17.2% operating margin driven by higher average selling prices. Tesla’s Adjusted EBITDA increased by 55% over the past year and now stands at $4.97 billion, while overall net income was up a staggering 103%. Earnings per share also rose by 98% from the same period last year.

Its core growth driver was an increase in vehicle deliveries, which shot up 42% year-over-year to 343,830 vehicles and a 54% bump in production levels. Tesla’s market share is under 2% in the European and Chinese regions, so there’s still plenty of room for expansion. Even a small increase in market share could result in a massive sales windfall for the company.

Tesla Stock Has Multiple Growth Catalysts in Motion

Tesla has been steadily updating its product line with new vehicles that are revolutionizing the automotive industry. The company’s latest innovation, an electric semi-truck, will start being delivered to PepsiCo (NASDAQ:PEP) on December 1. Moreover, the firm’s Cybertruck is in its final design phases and should soon hit the markets. Furthermore, Musk says a lower-priced EV is coming, which will expand Tesla’s passenger car offerings even further.

There is also Tesla’s self-driving program, which has logged over 60 million miles from volunteers. The more miles the software logs, the better it “learns,” thus improving its capabilities. This will be a crucial part of the company’s robotaxi business, which would revolutionize how people move around communities by removing human intervention entirely.

In addition to vehicles, Tesla is looking into manufacturing robots. Known as Optimus bots, they could be used as replacements for human workers who are now needed more than ever before. If Tesla’s new Optimus functionalities are any indication, robots could soon take over many of the low-skill jobs that companies rely on today. These automated machines can operate around the clock and do so with little human intervention, making them an ideal replacement for factory workers.

Optimus is expected to hit markets in 2027. The potential for this technology is unprecedented. With a price tag of $20,000, the opportunity is expected to generate billions in sales over time.

Is Tesla Stock a Buy?

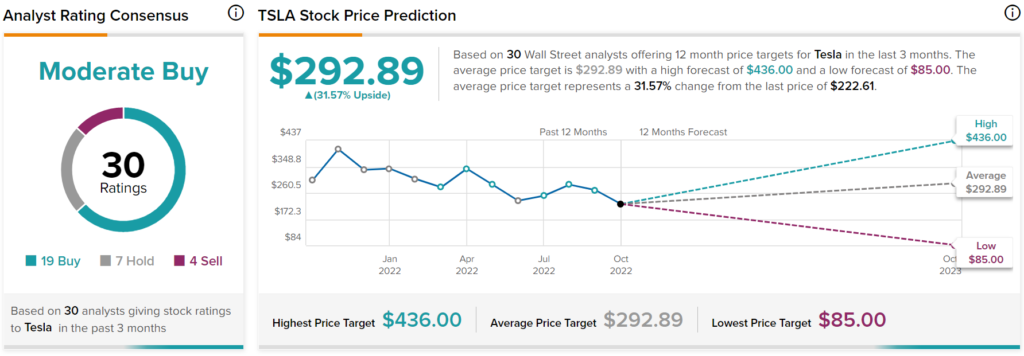

Turning to Wall Street, TSLA stock maintains a Moderate Buy consensus rating. Out of 30 total analyst ratings, 19 Buys, seven Holds, and four Sells were assigned over the past three months. The average TSLA price target is $292.89, implying 31.57% upside potential. Analyst price targets range from a low of $85 per share to a high of $436 per share.

Bottomline: TSLA Stock is for the Long Term

Tesla has been on quite the ride these past few years, with strong results and demand that’s only getting higher. Despite some mixed third-quarter financials, investors should stay committed to this company as it continues its success story. The company’s stock is surprisingly undervalued, and although the macro picture may present some short-term headwinds, it presents itself as a great long-term investment.