Low-cost carrier Southwest Airlines (NYSE:LUV) has significantly underperformed its largest U.S. legacy peers over the past few years. While demand has bounced back in recent years, Southwest has struggled with cost management, resulting in dismal margins. Also, the company’s expensive valuation does not inspire much confidence in a turnaround thesis. Therefore, I maintain a neutral stance on LUV.

In this article, I will delve into the reasons behind the underperformance, its valuation, and assess whether the turnaround presents a compelling opportunity for investors.

Southwest’s Volatility

This year alone, LUV stock has fallen by 5%, trading around $27 per share, despite reaching almost $35 per share in March. The stock had been on a strong rally since the end of October last year, driven by bullish sentiment returning to the markets.

However, the euphoria abruptly halted after Southwest Airlines reported below-expectation Q1 results, prompting a re-evaluation of its full-year guidance. The company’s stock plummeted nearly 30% from March to May, largely due to Southwest cutting its Boeing 737 MAX delivery planes forecast from an initial expectation of 79 to 46 for the year.

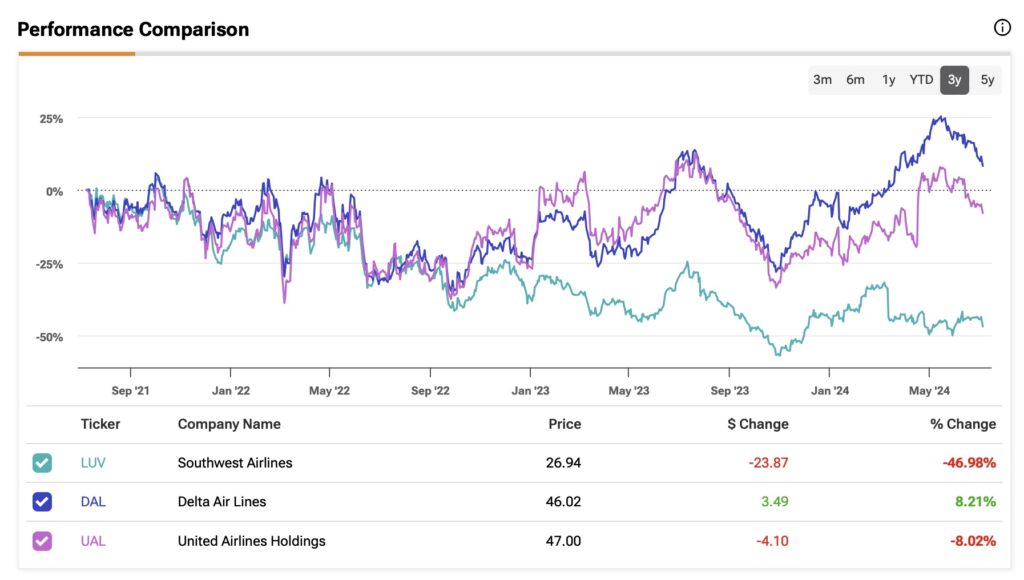

Zooming out to a broader perspective, Southwest Airlines shares have been in free fall since April 2021, when the company recovered from the initial impacts of the pandemic. Since then, Southwest has lost about 60% of its market value, transitioning from one of the most profitable large U.S. carriers to one of the least profitable.

Over the past five years, Southwest’s earnings have fluctuated significantly from $2.30 billion in 2019, dropping to a loss of $3.07 billion during the pandemic, and rebounding to a profit of $977 million in 2021. The post-pandemic recovery has been somewhat resilient for Southwest, but earnings declined in 2022 and 2023, reaching $539 million and $465 million, respectively.

Reasons Behind the Underperformance

Southwest Airlines has been struggling for several reasons over the past five years that have been weighing heavily on shareholder’s confidence.

The first one can be linked to the prolonged grounding of the Boeing (NYSE:BA) 737 MAX aircraft due to safety issues, which significantly disrupted Southwest’s operations and fleet strategy. Southwest was the largest Boeing 737 MAX operator back then. In 2019, Southwest had to deal with the sudden removal of 34 aircraft from its fleet, one year before the pandemic.

Later, back in 2021, while still navigating pandemic-related challenges, Southwest (as well as the industry as a whole) was struggling with staffing shortages, operational disruptions, and increased fuel costs.

More specifically, at the end of 2022, Southwest experienced a significant technology outage during the busy holiday travel season, resulting in several flights being canceled. I believe that this episode also harmed the company’s reputation for customer service.

While demand has returned to 2019 levels of available seat miles (ASM) in the past two years, and with revenues in 2023 reaching more than 16% above the 2019 figure, the company has struggled to improve its bottom line. The main reasons were higher costs, especially fuel, which rose approximately 42% from Q1 2019 to Q1 2024, coupled with increasing labor costs.

This increase resulted in a much higher cost per available seat mile (CASM), which was nearly 30% higher in the first quarter of 2024 compared to the same period in 2019. This translated into much higher cost per available seat miles (CASM), almost 30% higher in the first quarter of 2024 compared to the same period in 2019.

But the bigger problem was that Southwest’s operating margins fell well below those of its legacy peers, which theoretically faced similar industry headwinds during this period.

Last year, Southwest reported earnings of $465 million, with operating margins at a dismal 3.74% compared to 13.5% in 2019. Delta Air Lines (NYSE:DAL), for example, reported profit margins of 10.48% last year, while United Airlines (NASDAQ:UAL) reported 9.85%.

The Premium Valuation Doesn’t Help Either

Southwest trades at a forward P/E ratio of 27x, nearly 50% above its average over the past five years. This premium could be justified by Southwest’s historically strong balance sheet in the airline industry, backed by its low-cost carrier model ensuring earnings stability across economic scenarios. Indeed, a strong balance sheet is a must in the dynamic and volatile airline industry. Southwest appears to remain in a safe position with its reported $11.5 billion in liquidity, which is well above its outstanding debt of $8 billion.

However, I believe that, given the company’s recent bottom-line struggles, paying 27x earnings for Southwest may not be the wisest choice when investors could pay 6.9x earnings for Delta and 4.6x earnings for United.

Nevertheless, Southwest’s valuation seems appealing to some. In early June, the well-known investment firm Elliott Investment Management acquired a $1.9 billion stake in the airline. This purchase has reignited momentum, as the firm believes that LUV shares could reach $49 per share if Southwest modernizes its business infrastructure and replaces its CEO, Bob Jordan. However, Southwest promptly adopted a “poison pill” strategy to avoid a potential hostile takeover.

While this could be positive for the company’s future direction, it’s speculative whether it will mark a significant turning point in the company’s operational capabilities.

Is LUV Stock a Buy, According to Analysts?

According to Wall Street analysts, now is not the time to get excited about LUV shares. The consensus rating suggests a Hold stance, with only four out of 16 analysts bullish, two bearish, and the remainder neutral. The average price target for LUV stock stands at $27.92, indicating modest upside potential of 3.5%.

The Takeaway

Southwest Airlines has significantly underperformed compared to its legacy U.S. peers over the past few years. Despite the guidance revision for 2024 offering little optimism, the company’s premium valuation does not seem attractive, given its ongoing bottom-line pressures. However, the internal pressure from a new major shareholder could potentially alter the trajectory of LUV stock.

While this remains speculative, I believe the airline industry, by its nature, is too volatile and vulnerable to economic environments, and I do not view LUV as a safe investment under current conditions, especially given its stretched valuation.