Popular social-media and camera technology firm Snap (SNAP) sent shockwaves across the entire stock market last week as it fell flat on second-quarter earnings, kicking off a daily plunge of around 40%. That’s an excessive decline that seems to price in some sort of existential crisis. At this juncture, the murky advertising business couldn’t be clouded with more uncertainty. Apple’s (AAPL) privacy-focused updates could cut deeper into Snap’s wounds as it grapples with a period of economic contraction.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Management’s lack of third-quarter guidance also seems to be adding to investor worries. The second quarter was undeniably horrid, and there’s fear that a lack of any guide is a red flag. Ad budgets are drying up, and increased competition from ailing video streamers could make social-media ads less compelling now that they’re not allowed to follow users around the web without their consent.

Amid the beat-down in Snap shares, CEO Evan Spiegel has been relatively quiet compared to Meta Platforms (META) CEO Mark Zuckerberg who’s been vocal about his company’s ambitious metaverse plans and distaste for Apple’s new policies. Spiegel did note that “forward-looking visibility remains incredibly challenging” and that Snap “must adapt [its] investment strategy.”

At writing, Snap stock now finds itself down 86% over the past year and around 89% from its all-time high of $83, and change per share hit last September. That’s a lot of damage dealt over such a short amount of time.

Like most other hard-hit tech companies, Snap’s reducing its workforce. Though it’s unclear how the firm can evolve amid profound headwinds, its $500 million buyback plan is an encouraging sign that management views shares as undervalued.

Though the path forward will not be easy for Snap as it looks to form a bottom and stage a recovery rally, I remain bullish on the stock. Much of the pain to come seems to be already in the stock’s rear-view mirror.

Further, Snap stock has become incredibly cheap at just 3.6 times sales, which discounts the firm’s ability to adapt. With the price at March 2020 levels, I think the risk/reward has become incredibly attractive.

Can the Stock Snap Back from the Ad Slide?

The onslaught on the ad business may be just the start. Digital ad spending could become even more challenged as we fall into a recession. Apple’s iOS changes have decreased the value of Snap ads while limiting advertiser flexibility. Still, I view the Snap platform as better able to navigate Apple’s privacy-focused changes than Meta’s Facebook.

Snap remains incredibly popular among younger audiences, and these young users could remain more engaged as higher costs of living and economic headwinds push users to spend more time on “free” forms of entertainment.

As Snap continues innovating with new enhanced features and functionality (think the Snapchat+ subscription), it has the means to continue growing its user base. Unlike Facebook, Snap isn’t experiencing a DAU (Daily Active User) free-fall. The latest quarter actually saw Snap’s user count grow 18%, although ad dollars per user did fall into the red.

As long as Snap can keep its users engaged, I do think the stock is capable of regaining its footing. The recent crash in the stock seems to have been exacerbated by management’s inability to forecast the magnitude of what’s to come. Leaving investors in the dark is a sure way to amplify investor pessimism.

At these depths, Snap stock has likely overshot to the downside. However, it remains unclear how Snap plans to evolve in an era of privacy. As a camera technology company, I think augmented reality (AR) innovations are the way to go. Snap can innovate its way out of the hole Apple and the broader economy kicked it in. As the metaverse hits the mainstream, it’s Snap’s camera tech that could prove its worth.

Wall Street’s Take on Snap

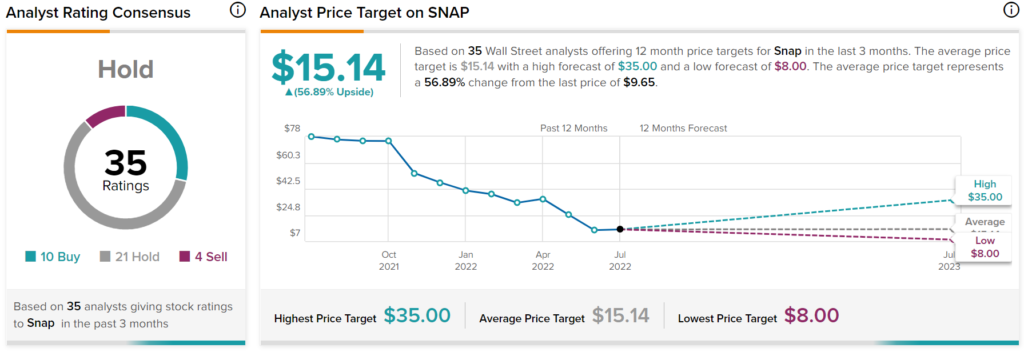

Turning to Wall Street, Snap has a Hold consensus rating based on 10 Buys, 21 Holds, and four Sells assigned in the past three months. The average Snap price target of $15.14 implies 56.9% upside potential. Analyst price targets range from a low of $8.00 per share to a high of $35.00 per share.

The Bottom Line: The Uncertainties Surrounding Snap May Create Opportunity

Snap is under a considerable amount of selling pressure. The company is sailing through the perfect storm, and not even management is comfortable throwing out guidance. Investors just hate uncertainty. Analysts covering Snap will have a much harder time valuing the firm. Many downgrades have struck the stock, and many more may come. Regardless, I think it’s a bad idea to bet against Evan Spiegel.

Snap is a high-tech company that may be able to innovate its way out of the rut in the fields of AR and camera tech — two areas of growing importance as companies set their sights on the metaverse. However, how Snap plans to enhance the value of its ads remains to be seen.