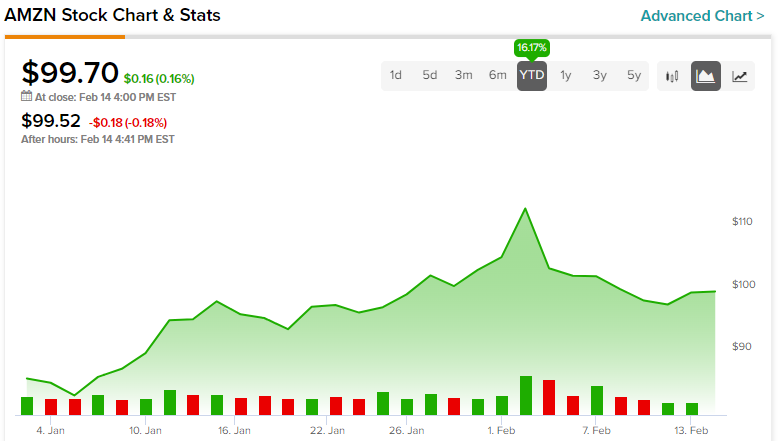

2022 was brutal for e-commerce giant Amazon (NASDAQ:AMZN) stock. However, so far this year, AMZN stock is up around 16% despite its recent dip following its mixed Q4 results. Nonetheless, I believe the current Amazon Web Services (AWS) segment headwinds are only temporary and that the business will rebound as soon as economic headwinds fade away. The long-term growth story of Amazon remains intact. Therefore, I’m bullish on the stock and will buy it at its current levels.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

AWS Disappointed; What Does Its Future Hold?

The major focus of the Q4 results was AWS, which witnessed a continuous slowdown during Q4. AWS revenue growth slowed from 40% in Q4 2021 to 28% in Q3 2022 and 20% in Q4 2022. Further, there was a significant operating margin contraction from 29.8% in the prior-year quarter to 26.3% in Q3 to 24.3% in Q4.

Amazon also provided lackluster guidance that fell below analysts’ expectations. Q1 revenues are expected to grow by 4%-8% year-over-year and be in the range of $121 billion-$126 billion versus consensus estimates of $125.3 billion. Operating income guidance of $0-$4.0 billion (compared to $3.7 billion in the first quarter of 2022) also added to investors’ woes.

Management stated that enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions. What’s more discouraging is that these headwinds are expected to continue for “at least the next couple of quarters,” as stated by the company.

Likewise, management also pointed out that AWS’s revenue increased only 15% year-over-year in January. If AWS ends Q1 at 15% year-over-year growth, it will mark the first quarter-over-quarter revenue decline for AWS since its inception. These indications are truly disappointing.

AWS is a cloud computing business that provides options to enterprises to scale up or down based on demand. Given the expectations of a recessionary downturn, companies accordingly downsized their demand for cloud services.

However, given the strong secular tailwind, the long-term secular growth trend of the cloud industry remains intact. Sometimes, bad news now can bring good news in the future.

The fact is that the cloud provides the ability to optimize costs relatively quickly, especially during times of economic uncertainty. It will, thereupon, attract more enterprises to migrate to the cloud, especially once the macro environment improves.

Also, a recession, like any other business cycle, will not last forever. It is, thus, only a matter of time before the AWS business will return to its growth phase again.

Ex-AWS, the Rest of AMZN Numbers Were Reassuring

While revenues decelerated at AWS, other segments showed impressive growth, especially the e-commerce space, with Third-Party Seller Services registering robust 20% year-over-year growth.

Q3 saw a “record-breaking holiday season with customers purchasing nearly half a billion items from small businesses in the U.S.” from Thanksgiving through Cyber Monday.

It is worth noting that during the five-day period, small businesses in the U.S. generated more than $1 billion in sales. This is commendable, especially given the current macroeconomic scenario. In addition, advertising sales also grew 19%, with subscription services jumping 13%.

Region-wise, North America sales grew 14% year-over-year in constant currency, while international segment revenue growth of 5% (in constant currency) was weaker than expected. However, management shared some encouraging numbers during the earnings call.

CEO Andy Jassy stated, “if you look at the compounded annual growth rate from 2019 to ’21, in the U.K., it was over 30%; in Germany, it was 26%; in Japan, it was 21%. And the fact that we haven’t given back that growth and these are all net of FX, but if you look at even the last couple of quarters where we’re continuing to grow and we haven’t given back some of that growth… and we’re excited about that.” Therefore, Amazon continues to grow well in its international footprint despite the lackluster Q4 numbers.

Meanwhile, the value proposition from the expansion of Amazon Prime also continues to grow. This includes faster delivery speeds on more products, an ever-growing slate of Prime video and music offerings, and the addition of new offerings like Buy-with-Prime and RxPass in the healthcare space.

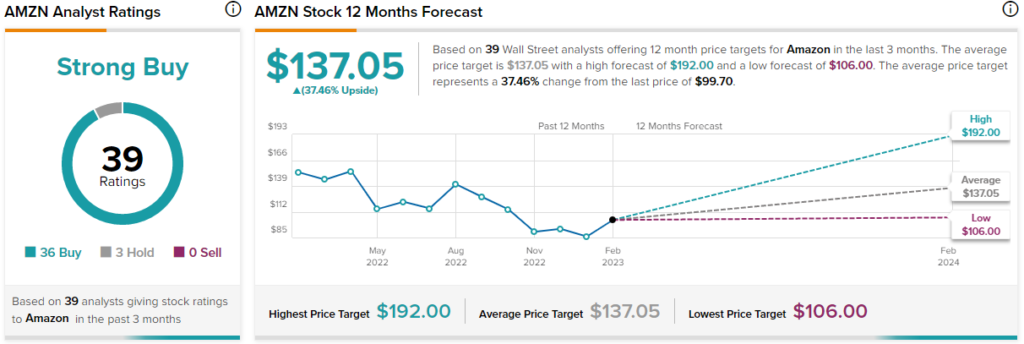

Is Amazon Stock a Buy, According to Analysts?

The Wall Street community is clearly optimistic about Amazon stock. Overall, the stock commands a Strong Buy consensus rating based on 36 Buys and three Holds. The average AMZN stock price target of $137.05 implies 37.46% upside potential from current levels.

As Amazon houses multiple businesses under its radar, I believe EV/EBITDA is the best metric to evaluate the stock’s valuation. Being an industry leader, the company has historically traded at high multiples. At present, however, Amazon stock is trading at around 12.9x EV/EBITDA (on a forward basis) compared to its own five-year historical average of 23.35x. This implies a huge 45% discount.

It’s no wonder, then, that Amazon stock has a very positive signal from hedge fund managers, who cumulatively added 29 million shares from Q2 2022 to Q3. Retail investors are following suit. TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Amazon, with 4.9% of investors on TipRanks increasing their exposure to AMZN stock over the past 30 days.

Conclusion: Consider Buying Amazon on the Dip

While Q4 AWS numbers disappointed, the cloud industry is still in its nascent stage and should bounce back as soon as the macro uncertainty fades away. With that, profit margins should also recover further, aided by cost-cutting initiatives. Additionally, there are other areas of profitable growth, including e-commerce, Prime memberships, as well as a strong advertising business.

Knowing well that the money invested in AMZN may not show great returns in the near term, the stock still remains attractive in the long term.