Shopify (TSE:SHOP) stock closed 16% lower on Wednesday despite posting better-than-expected Q4 results. Further, it is down about 54.7% in the past three months.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The significant erosion in its value reflects valuation concerns and a slowdown in its growth rate. It’s worth noting that Shopify’s Q4 sales and earnings exceeded Street’s estimates. However, management’s weak sales guidance for Q1 and 2022 remained a drag.

Shopify’s sales accelerated amid the pandemic, providing a significant lift to its stock. However, difficult year-over-year comparisons are expected to impact Shopify’s sales in Q1 2022. Providing 2022 sales guidance, Shopify’s CFO, Amy Shapero, stated that the 2022 sales growth rate would be lower than 2021 (Shopify’s sales increased by 57% in 2021).

Further, Shapero added, “We expect year-over-year revenue growth to be lowest in the first quarter of 2022 and highest in the fourth quarter of 2022.”

For the expected slowdown in Q1, Shapero blamed the absence of COVID-triggered e-commerce acceleration and difficult comparisons. Notably, Shopify’s Q1 sales growth rate in the prior year was 110%, the highest in its history. Moreover, Shapero expects that the company’s initiatives to boost sales will gain momentum in the latter part of the year.

Now What?

In response to Shopify’s Q1 guidance, William Blair analyst Matthew Pfau stated that the slowdown “is mostly due to one-time factors, and, in our view, the investments that Shopify is making should support long-term growth and make sense given the company’s massive addressable market.”

During the Q4 conference call, Shapero stated that Shopify would ramp up investments in growth that include strengthening SFN (Shopify fulfillment network), its in-house fulfillment network.

Pfau expects “the shift to take more fulfillment in house is the right move given it provides Shopify with more control over quality and capacity, and if executed properly, creates a competitive advantage that is difficult to replicate.”

The analyst added that the selloff in Shopify stock “creates a buying opportunity” for long-term investors.

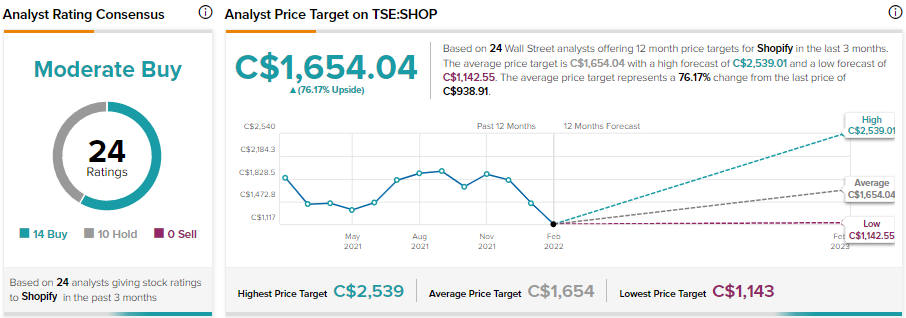

SHOP Price Forecast

Due to its considerable decline in value, SHOP’s stock price forecast on TipRanks shows solid upside potential. The average Shopify price target of C$1,654.04 implies 76.2% upside potential to current levels.

Further, SHOP stock has received 14 Buy and 10 Hold recommendations for a Moderate Buy consensus rating.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.