For investors in search of long-term growth, India is a compelling starting point, and the iShares MSCI India ETF (BATS:INDA) is a great way to tap into this massive market’s potential. Here’s a breakdown of INDA and why India is becoming increasingly attractive from an investment perspective.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Apple of the Eye

Apple (NASDAQ:AAPL) CEO Tim Cook visited India recently, and the trip generated quite a bit of buzz not only for Apple but also for India itself. Apple recently opened its first two retail stores in India, and according to India’s deputy minister for information technology, Rajeev Chandrasekhar, Apple’s investment in the country will double or triple in the years to come. Apple is also shifting more production to India, leading JPMorgan (NYSE:JPM) to forecast that Apple could move a quarter of its iPhone production to India by 2025.

An Emerging Powerhouse

It’s easy to see why Apple is making a concerted effort to gain a stronger foothold in India. While China has long been the world’s most populous country, the U.N. forecasts that India’s population will surpass China’s by the middle of this year. Not only will India have the world’s largest population, but its population is also greater than all of Europe combined and all of the Americas combined. India is also the world’s largest democracy.

Perhaps most importantly, from an investment perspective, people under the age of 25 account for a staggering 40% of India’s population, according to Pew Research. India has the world’s largest population of people between 15 and 24 years old, and this is the demographic that will drive long-term growth, consumption, and productivity as they have the majority of their working lives ahead of them.

This stands in contrast to China and many Western countries, where the population is aging and there aren’t as many young people to support the aging population or replenish the workforce, which could lead to future economic challenges. For comparison, the median age in India is just 28, whereas the median ages in the United States and China are 38 and 39, respectively.

Over time, more of these younger Indians should enter the global middle class, which will increase demand and further propel the country’s economy.

Notably, the Asian Development Bank expects India’s GDP to grow by 6.4% in 2023 and 6.7% in 2024. For perspective, this is more than double the GDP growth that many economists expect for the U.S. in 2023.

India’s growing population, demographic changes, and growing stature as an economic hub could help it to solidify its standing as an economic powerhouse in the decades to come, making it an attractive area for long-term investments. If you don’t have boots-on-the-ground knowledge of the Indian market (or a local brokerage account), investing in an India ETF like the iShares MSCI India ETF is an easy and convenient way to add this long-term growth potential to your portfolio.

Gaining Momentum

INDA is a $4.6 billion ETF from BlackRock’s (NYSE:BLK) iShares that invests in large and mid-cap Indian equities. The ETF has an expense ratio of 0.64%, which is more expensive than the typical S&P 500 (SPX) or broad market ETF but isn’t out of line with other international ETFs.

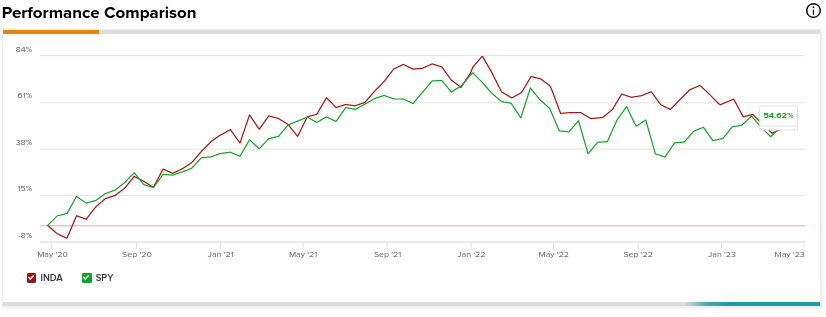

INDA has put together a strong track record in recent times, with a 20% annualized return over the past three years as of the end of the most recent quarter. This edges out the three-year annualized 18.4% return of the SPDR S&P 500 ETF (NYSEARCA:SPY) over the same time frame.

While INDA stock has underperformed SPY over a five and 10-year time horizon (with annualized returns of 5% and 6% for INDA over five and 10 years versus 11% and 12.1% returns for SPY over the same time frames), its momentum clearly appears to be building over the past three years. I would expect it to continue to sustain its momentum based on the demographic and economic trends discussed above.

Using the chart below from TipRanks’ ETF Comparison Tool, you can see the performance of INDA versus SPY over the last three years.

INDA’s Holdings

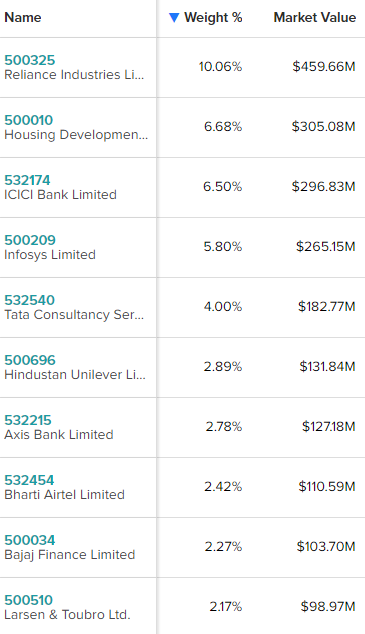

INDA holds 115 positions, and its top 10 holdings make up 45.6% of the fund. Reliance Industries accounts for over 10% of assets by itself, so INDA has significant exposure to India’s largest company. Below, you’ll find an overview of INDA’s top 10 holdings using TipRanks’ holdings tool.

The iShares MSCI India ETF is also relatively well-diversified across sectors. Financials are the most prevalent sector here, with a 26.25% weighting. Information technology has the second-largest weighting at 13.9%, followed by energy (12.35%) and consumer staples and consumer discretionary, both at 10%. No other sectors account for more than a 10% weighting.

Many of these stocks don’t have listings in the United States, making them inaccessible to U.S. investors that want to buy them in their brokerage accounts. Therefore, investing through an accessible and liquid ETF like INDA is likely the best way for most U.S. investors to gain exposure to these stocks.

One Cause for Concern

While the overall picture for India and its economic growth looks promising, there is one cause for concern worth discussing here. While part of the appeal of emerging market stocks is usually that they are cheap, especially in comparison with U.S. stocks, this isn’t really the case with India. In fact, the average price-to-earnings multiple for INDA’s holdings is 22.3. This is right about in line with U.S. stocks — the S&P 500 currently sports an average P/E multiple of 23.9.

While this valuation isn’t egregious by any means, you’re not getting the type of discount that you usually would in emerging markets that you might expect without looking beneath the surface. For reference, the iShares MSCI Emerging Markets ETF (NYSEARCA:EEM) has a significantly lower average P/E multiple of 11.2 (as of March 31).

While I still think INDA looks compelling based on India’s long-term growth characteristics, this higher valuation gives investors less margin for error.

Looking Ahead

The iShares MSCI India ETF has been gaining momentum over the past several years, and with India’s favorable demographics and growing population, the country’s economic growth could just be getting started. While the overall valuations of the holdings are not cheap, presenting some risk, over the next decade or so, it’s hard to imagine the market’s growth not winning out. INDA offers investors a convenient and direct way to tap into this growth story, making it an attractive ETF for long-term growth investors.