SBA Communications (NASDAQ:SBAC), offering critical infrastructure to telecom giants through its ~40,000 towers, has seen its stock come under pressure lately. The reasoning seems to involve lackluster Site Development revenues. Yet, this is a non-core division for SBA and likely serves another purpose. In the meantime, SBA’s core Site Leasing business continues to deliver solid metrics. Investors should likely focus on that, as SBA’s ability to create strong shareholder value remains robust. Hence, I am bullish on SBAC stock.

Focus on SBA’s Core Business, Not Development Revenues

To reasonably assess SBA’s investment case, I believe that investors should focus on its core business. The seeming downturn in SBA’s Site Development throughout 2023, which has likely contributed notably to keeping shares under pressure, should be largely irrelevant to the stock’s investment case. Let’s take a look at the company’s recent numbers, which will illustrate my point.

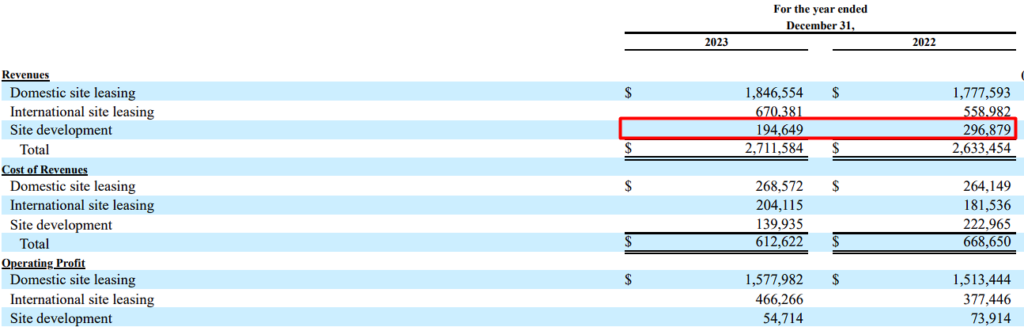

For context, SBA’s revenue mix can be split into two parts: Site Leasing, which is the company’s main cash flow source, comprising 93% of its total revenues in Fiscal 2023, and Site Development, which made up the remaining 7% for the year.

Site Leasing – All That Really Matters

All that matters for SBA is delivering robust performance in its core Site Leasing segment. This is because the recurring nature of the segment’s revenue and the underlying organic growth drivers set to push it higher over time are what ensure the REIT’s long-term success.

Site Leasing revenues once again grew by 3.7% and 7.7% in Q4 and FY2023, respectively. In addition to acquiring and constructing new towers, the division’s growth was driven by organic catalysts, including expanding the number of tenants and/or antennas per tenant on each telecom tower and SBA enforcing the annual rent escalation mechanism embedded into long-term leases.

The Site Leasing revenue bridge below, comparing the end of 2022 to the end of 2023, underscores these drivers and the overall mission-critical aspect of SBA’s core business model. As you can see, SBA maintained a tenant churn as low as 3.5% last year ($82 million in churn against $2.34 billion of revenues last year). This is because SBA’s telecom towers comprise essential infrastructure for the major telecom providers that lease them.

In fact, evident by the $97 million in new leases and amendments, which more than offset this figure, the churn itself can be largely attributed to antenna relocations by lessees to enhance efficiency. Therefore, the churn itself is by no means indicative of SBA’s tenants struggling to meet payment obligations, which we would otherwise assume if we were assessing a conventional (retail, commercial, industrial) REIT.

Site Development – Strong Financials Are Not Necessarily the Goal

Besides its core Site Leasing business, which generates the majority of revenues and is non-cyclical in nature, SBA also has a Site Development business. However, it’s essential for investors to recognize two things here:

First, it’s crucial to note the cyclical nature of this business when evaluating SBA’s overall performance. Notably, the only reason SBA’s total revenues declined in Q4 was due to the 49.1% drop in Site Development revenues.

Second, it’s essential to understand that SBA partly maintains this business to maintain strong relationships with the telecom majors that lease its towers. It doesn’t seem like making actual money from this division is a concern for SBA.

Here’s what SBA outlined in its latest 10K filing:

Our site development business…is complementary to our site leasing business and provides us the ability to keep in close contact with the wireless service providers that generate substantially all of our site leasing revenue and to capture ancillary revenues that are generated by our site leasing activities, such as antenna and equipment installation at our tower locations.

SBA Communications

Considering that two-thirds of SBA’s total revenue comes from T-Mobile (NASDAQ:TMUS), AT&T (NYSE:T), and Verizon (NYSE:VZ), it’s important for SBA to maintain solid relationships with these giants. Nevertheless, the Site Development division should be viewed more as a strategic component for market positioning rather than a substantial revenue stream. After all, this division doesn’t generate substantial profits.

Profitability Remains Very Strong, Forms Compelling Opportunity

Besides SBA’s revenue mix, it’s important to remember that its underlying profitability prospects remain very strong. Therefore, its capacity to continue to create shareholder value also remains very strong.

In particular, SBA’s adjusted funds from operations per share (AFFO/share, a cash-flow metric used by REITs) for Fiscal 2023 came in at a record $13.08, up 12.7% compared to the previous year. Further, management expects AFFO/share to be between $13.15 and $13.51, the midpoint of which implies another year of record profitability.

Given SBA’s highly resilient business model, continuous growth in its core leasing division, expanding profitability, and growing capital returns (its quarterly dividend was raised by 15.3% to a rate of $0.98 in February), combined with the fact that shares are currently hovering at their 2019 levels, form a compelling buying opportunity, in my view.

Is SBA Stock a Buy, According to Analysts?

Looking at Wall Street’s view on SBA Communications, the stock has attracted a Strong Buy consensus rating based on seven Buys and two Holds assigned in the past three months. At $264, the average SBA Communications stock forecast implies 21.7% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell SBA stock, the most accurate analyst covering the stock (on a one-year timeframe) is Ric Prentiss from Raymond James, with an average return of 10.83% per rating and a 76% success rate. Click on the image below to learn more.

The Takeaway

Overall, while recent setbacks in SBA’s non-core business may have spooked investors, I believe that a closer look at its revenue mix reveals a more comforting reality. SBA’s Site Leasing, which constitutes the majority of revenues, showcases consistent growth and stability. In the meantime, the Site Development division should be appreciated, as it’s of strategic importance for SBA and should not be assessed based on its underlying financials.

Simultaneously, SBA’s strong profitability last year, promising outlook, and rapidly growing dividend form a compelling opportunity against the stock’s pressured price.