With the ongoing digital transformation, Samsara (NYSE: IOT) continues to deliver stellar financial results. This is well reflected in its recent Q1 performance.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Through its Connected Operations Cloud platform, the company helps corporations automate business processes and improve efficiencies and is witnessing strong demand for its offerings. It delivered revenues of 142.6 million in Q1, up 63% on a year-over-year basis. Its ARR (annual recurring revenue) reached 607.2 million at the end of Q1, up 59% year-over-year.

What stands out for Samsara is the growth in the number of large customers (customers with an ARR of more than $100K). Samsara now has 897 large customers. Sequentially, it added 91 new large customers in Q1. Moreover, the large customer count increased by 379 or 73% on a year-over-year basis.

It’s worth mentioning that the ongoing global supply chain disruption continued to impact cost and lead times. However, Samsara improved its adjusted gross margins and adjusted free cash flows. Also, the company highlighted that it shipped ample IoT (Internet of Things) devices to meet all of its customer demand.

Momentum to Sustain

While Samsara’s first quarter was impressive, the momentum in its business will likely sustain. Its strategy of focusing on the large enterprise customers augurs well for growth and adds stability to its business in an uncertain macro environment. Large enterprise customers generally have higher net retention rates and better long-term unit economics, thus strengthening the company’s business.

Echoing similar sentiments, William Blair analyst Matthew Pfau stated that even in a recession, Samsara’s churn would not increase “given the company’s products are critical to customers’ operations.”

Highlighting Samsara’s shift in focus to large customers, Pfau added, “Samsara has also shifted its focus to enterprise customers (accounting for 45% of first-quarter ARR), which are unlikely to go out of business. And Samsara’s solutions can help companies operate in a higher-cost environment by driving cost savings on fuel, insurance, and vehicle maintenance and replacement.”

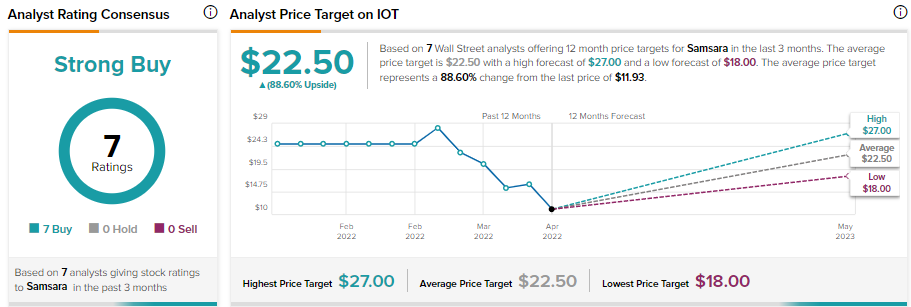

Including Pfau, Samsara stock has received seven unanimous Buy recommendations for a Strong Buy consensus rating.

Bottom Line

Samsara delivered strong Q1 performance and raised its full-year revenue guidance even amid a challenging macro backdrop, which highlights the strength of its business. Further, its growing base of large customers and multi-product adoption augur well for growth.

Due to the recent selling in tech stocks, Samsara lost a considerable portion of its value, which is why the average price target of $22.50 represents 88.6% upside.

Read full Disclosure