Sometimes it’s the industries that you never think about that bring up the most interesting stock opportunities. You probably haven’t thought much about electric forklift batteries today – or ever, unless you are connected to the warehousing industry in some fashion – but these niche energy units run the forklifts and pallet jacks that make modern warehousing possible.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

While many of these powered lift vehicles run on propane, industry analysts are noting a strong recent trend toward electrification. Improvements in technology, including better lead-acid and lithium-ion batteries, are making electric forklifts more powerful and more economical – and that makes the batteries a multi-billion-dollar business. Up to $9.3 billion by 2032, according to Global Market Insights.

But forklift batteries have also caught the attention of Roth MKM analyst Craig Irwin, who is impressed by the investment opportunities here.

“We see a large addressable market, where we believe the sweet spot is in fleets with under 100 forklifts. The Industrial Truck Association (ITA) states that 67% of the 344,330 forklifts sold in the U.S. in 2022 were electric, and we estimate over one million units in the total U.S. electric fleet. Assuming around 30% to 40% of the electric forklift installed base is in fleets with under 100 units and operate on at least a shift and a half, and typical replacement sales (of lead acid batteries), implies a served and available opportunity of over $1.0 billion in revenue,” Irwin opined.

Irwin follows this line by recommending two small-cap lithium-ion battery stocks that are primed to double or more in the coming months. A closer look, using data drawn from the TipRanks platform, may tell us why they could rally.

Electrovaya (ELVA)

First on our list is Ontario-based Electrovaya, a company working on the development and manufacture of advanced lithium-ion batteries and battery systems. The company specializes in developing batteries optimized for large-scale uses: the automotive industry, the warehousing sector, and energy storage. Electrovaya has taken a leading position in transforming the global energy sector, and its flagship products, which utilize the company’s Infinity technology, offer advantages in battery safety and longevity.

At the core of the Infinity battery lines are Electrovaya’s all-ceramic separators, a unique construction that enhances the safety of the battery cells. In addition, the company uses high-end electrodes, allowing for high-temperature battery operations – of the sort encountered in industrial applications. The company has applied the Infinity battery cell technology to both low-voltage (24, 36, and 48 volt) and high-voltage 400 and 800 volt battery systems. The latter have applications in E-buses and Trucks, as well as mining vehicles; the former can be found in material handling equipment, such as forklifts and pallet jacks.

By the numbers, we can see that Electrovaya has some laurels to boast about. The company has more than 100 patents protecting its intellectual property, and its battery systems power some 166 locations around the world. In raw dollar terms, the company saw more than 100% annual revenue growth from fiscal 2022 to fiscal 2023. And – the company has achieved this with a small market cap of just $124 million.

In the most recent report, for F1Q (December quarter), revenue reached $12.1 million, for a 40.7% year-over-year increase, while gross margins saw a 360-basis point improvement to 29% with battery systems surpassing 30%. Looking ahead, for the fiscal year ending September 30, the company expects revenue to hit the range between $65 to $75 million 2024, compared to $44.06 million in FY23.

In his comments on Electrovaya, analyst Irwin notes both the quality of Electrovaya’s technology and range of battery products the company has available. He writes, “The company is differentiated from peers by its use of its own cells that incorporate a proprietary all-ceramic separator. Three years of third-party testing at the DNV BEST Test Center in Rochester, NY validates the company’s cells achieve over 9,000 cycles, a multiple of the 3,000 to 4,000 cycles typical for conventional battery cells, and Electrovaya expects continued testing to confirm up to 14,000 cycles are available. The company now offers more than 40 battery models in materials handling and is expanding its lineup with high-voltage packs optimized for truck, bus, and energy storage applications. Management is also using its experience in separators and other battery technology to develop high energy density solid-state cells that could be a longer-term driver.”

“We would be buyers of Electrovaya for differentiated technology in heavy-duty lithium-ion batteries that is achieving impressive growth and scaling company profitability,” Irwin summed up.

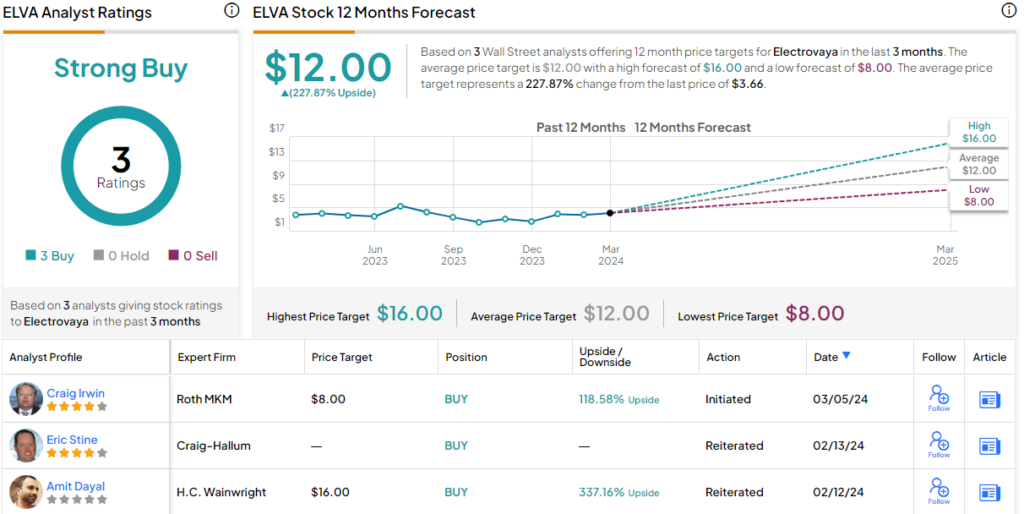

This Buy rating comes alongside an $8 price target that suggests a very robust 118.5% upside in the next 12 months. (To watch Irwin’s track record, click here)

While there are only 3 recent analyst reviews on this small-cap battery tech firm, they are all unanimously positive, giving ELVA its Strong Buy consensus rating. The shares are currently trading for $3.66, and their $12 average price target implies a highly bullish 228% upside potential for the coming year. (See ELVA stock forecast)

Flux Power Holdings (FLUX)

Next on the radar is Flux, a designer, manufacturer, and marketer/distributor of lithium-ion power solutions for a wide range of commercial and light industrial equipment. The company’s battery systems are marketed to – and are widely used in – the material handling sector, particularly in warehouses, factories, and airports. Flux has battery pack lines for everything from counterbalanced forklifts, narrow aisle forklifts, various 3-wheel forklifts, and powered pallet jacks; also, aerial lift units, floor cleaning machines, and airport luggage tugs, pushback tractors, and belt loaders.

These are all specialized pieces of equipment, and require reliable, powerful energy sources. Flux’s battery lines meet this need, and have gained the trust of such large names as Caterpillar, Pepsico, and Delta Airlines. Like Electrovaya above, Flux has built this business and reputation on a small-cap foundation; the company has a market cap of just $73 million.

Last month, the company released its report for fiscal 2Q24, the quarter that ended on December 31, showing solid financial results. Revenue reached a quarterly record of $18.3 million, up 6.4% year-over-year, and some $490K above the forecast. At the bottom line, Flux brought in a 5-cent earnings-per-share net loss in GAAP measures, a loss that was 2 cents per share narrower than had been expected. And in two metrics that bode well for the near future: Flux reported a record level of new purchase orders in fiscal Q2, totaling $26.6 million; and had a heavy work backlog, totaling $29.7 million, as of February 1 this year.

So it’s no wonder that Craig Irwin is bullish here. The Roth analyst liked what he saw in Flux’s quarterly performance, and was equally impressed by the company’s forward prospects. He wrote of the firm, “We see Flux as differentiated for leadership in the lithium forklift battery market, retaining roughly 30% market share, the company’s manufacturing capacity to support $150 million in annual revenue, UL product certifications, and strong engineering and technical support. After record bookings of $26.2 million in F2Q24 (Dec) we expect growth to reaccelerate on large new customer orders including programs in GSE, a new white label program with a large OEM forklift customer, and new heavy-duty products addressing the needs of already served customers. Management seems to be executing well on aims to add a couple of new Tier-1 customers each year, and we see near-term visibility as rapidly improving.”

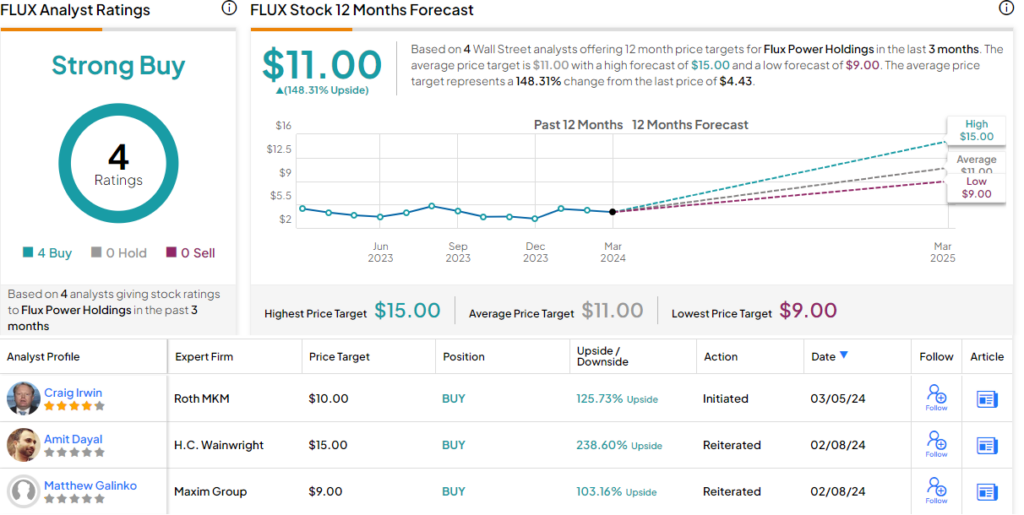

Irwin quantifies his stance with a Buy rating on FLUX, followed up with a $10 price target that points toward a one-year upside potential of 126%.

Like Electrovaya, Flux has a unanimous Strong Buy consensus rating from the Street’s analysts – but this time we’ve moved up a step, and the rating is based on 4 positive analyst reviews. FLUX shares are priced at $4.43 and their $11 average target price suggests a handsome 148% upside on the one-year time horizon. (See FLUX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.