Roper Technologies (NYSE:ROP) is widely considered one of the most respected dividend growth stocks by income-oriented investors seeking growing income. The enterprise software giant features a special track record, boasting 30 consecutive annual dividend increases. Hence, Roper is a component of the highly-reputable Dividend Aristocrats Index. Despite this theme, Roper Technologies’ extended rally has expanded its valuation notably lately, reducing its charm, in my view. Hence, I am neutral on the stock.

Strong Q2-2023 Results – Outlook Boosted

Before delving into Roper’s valuation and its dividend growth prospects, it’s important to assess the company’s underlying performance, which is the primary factor that has led investors to trade the stock consistently higher. Roper’s most recent results, in particular, came in very strong, with revenues and adjusted earnings per share climbing by 17% and 20% to $1.53 billion and $4.12, respectively.

It’s truly astounding to witness a double-digit surge in growth from an enterprise software consolidator in the midst of a tough macroeconomic landscape. What elevates this feat to a level of true distinction is the remarkable acceleration in Roper’s revenues, surpassing not only the previous quarter’s impressive 14.9% expansion but also outpacing last year’s solid 10.2%. In fact, this quarter’s performance marks the strongest quarterly revenue growth Roper has achieved in nearly half a decade.

While Roper’s strategic approach to growth through acquisitions has undoubtedly bolstered its revenue, it’s essential to recognize that a significant share of this remarkable expansion stems from organic sources. Notably, Roper has achieved an impressive 9% organic growth rate, primarily fueled by an 8% surge in recurring Software revenue across the enterprise, coupled with an extraordinary 19% surge in its Tech-Enabled Product segment.

Furthermore, a key insight to highlight is the exceptional pace at which Roper’s adjusted EPS exceeded revenue growth. This displayed the company’s ability to retain bulky margins and the fact that Roper’s acquisitions were proven to be accretive on a per-share basis — a critical factor in successful company acquisitions.

After an exceptionally robust performance in the year’s first half, management oozed confidence as it elevated its projections. The new outlook projects a range of adjusted EPS between $16.36 and $16.50, a notable increase from the earlier estimate of $16.10 to $16.30. At the midpoint, management’s updated outlook implies year-over-year growth of 15% versus Fiscal 2022. Roper’s robust growth metrics clearly illustrate why investors continue to be thoroughly enthralled by the company’s investment case.

Roper’s Extended Valuation Erodes Dividend Growth Case

Roper’s remarkable financial performance has recently sparked a surge in investor interest, driving the stock to reach new all-time highs just a couple of weeks ago. That said, I believe that Roper’s extended rally has eroded its profile as a desirable dividend growth investment. This is because share price gains have considerably outpaced the underlying growth in dividends. Thus, Roper’s yield has become increasingly compressed, currently hovering below 0.6%.

Put differently, even if Roper manages to maintain its remarkable 10-year compound annual growth rate of 16% in dividends, the total payouts may still appear modest in comparison to the capital invested by any investor seeking a substantial return from Roper’s dividend. It’s almost impossible to justify buying Roper for its dividend growth prospects at its current yield, regardless of its otherwise impressive multi-decade dividend growth track record.

Besides, it’s worth mentioning that Roper’s extended rally is likely to put a constraint on shareholders’ future total returns. Sure, Roper’s management boosted the company’s guidance. Yet, the stock’s forward P/E of 28.4 is not only higher than the S&P 500’s (SPX) forward P/E of 20.4 but also notably higher than its historical average, despite interest rates being on the rise. Hence, I believe current investors also have a limited margin of safety against any potential downside.

In all fairness, Roper’s growth prospects are set to remain extraordinary in the foreseeable future, given the continued robustness of its M&A activities. Recently, the company successfully concluded the acquisition of Syntellis Performance Solutions at a net purchase price of $1.25 billion. This is projected to yield approximately $185 million in revenue and $85 million in EBITDA in Fiscal 2024.

Thus, it’s plausible that investors will still find it justifiable to accord the stock a premium valuation, thereby sustaining Roper’s elevated stock price. Nonetheless, a sense of caution is certainly warranted.

Is ROP Stock a Buy, According to Analysts?

Turning to Wall Street, Roper Technologies has a Strong Buy consensus rating based on nine Buys and three Holds assigned in the past three months. At $544.08, the average Roper Technologies stock forecast suggests 9.65% upside potential.

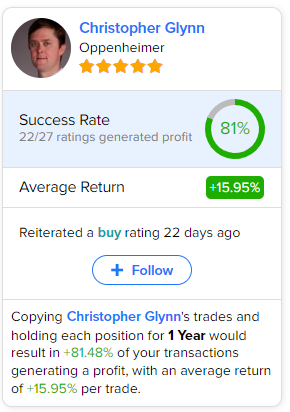

If you’re wondering which analyst you should follow if you want to buy and sell ROP stock, the most accurate analyst following the stock (on a one-year timeframe) is Christopher Glynn from Oppenheimer, boasting an average return of 15.95% per rating and an 81% success rate.

The Takeaway

In summary, Roper Technologies’ impressive second-quarter results showcase its exceptional growth, driven by both organic sources and strategic acquisitions. However, the stock’s extended rally has compressed its dividend yield, eroding its attractiveness for income-oriented investors. Further, the stock’s rich valuation and limited margin of safety raise concerns regarding its total-return prospects. Hence, while Roper remains a respected company, the current circumstances warrant a cautious stance.