Royal Bank of Canada (TSE:RY) (NYSE:RY), also known as RBC, is Canada’s largest bank, and we believe its stock presents a solid buying opportunity for a few key reasons. To start, its dividend currently yields a respectable 4.4% and has plenty of room to grow. Further, it’s a reliable company that’s reasonably valued and can likely provide investors with great returns from here. Its recent results were also better than those of every other big Canadian bank, so some may even consider RBC to be Canada’s best bank.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As a result, we’re bullish on the stock.

Royal Bank of Canada’s Impressive Dividend Stats

To give an idea of how reliable RBC is, the firm has consistently paid dividends since 1870 — over 150 years. Also, its dividend has grown at a compound annual growth rate of about 7.9% in the past 10 years and 7.3% in the past five years. If RBC keeps up its five-year dividend growth rate, which is very achievable, it will double its dividend in just under 10 years.

Also, the company’s payout ratio of ~46.6% is right around its five-year average of 46.4% and suggests that its dividend is well-covered and has room for more growth. Meanwhile, the bank can use its leftover profits for investments, buybacks, or to increase its book value per share by letting the profits sit on the balance sheet.

A Reasonable Valuation

Currently, RBC is expected to report earnings per share (EPS) of C$11.25 for Fiscal 2023 (ending in October 2023), which gives it a forward P/E ratio of 11. Looking out to Fiscal 2024, earnings are expected to grow by 5%, bringing the forward P/E down to 10.5.

In other words, by next year, RY stock is likely to produce an “earnings yield” (100 divided by the P/E ratio) of 9.5%. That’s a good annual yield for investors, which will compound over time, but what’s even better is that RBC is likely to keep growing over time, as it has in the past. Therefore, this already-high forward earnings yield will likely continue rising over the years.

The Best-Performing Canadian Bank Right Now

Royal Bank posted excellent results in its most recent quarter. Canadian bank earnings season concluded recently, and RBC was the only bank that beat estimates. It was also the only bank that saw EPS rise year-over-year. All other big Canadian banks, such as TD Bank (TSE:TD) (NYSE:TD) and Bank of Montreal (TSE:BMO) (NYSE:BMO), saw EPS declines. RBC outperforming every other bank is a testament to its high quality.

We recently compared the results of each bank all in one article, which you can check out here.

Is RY Stock a Buy, According to Analysts?

According to analysts, RY stock comes in as a Moderate Buy based on four Buys, three Holds, and one Sell rating assigned in the past three months. The average RY stock price target of C$140.71 implies 13.4% upside potential.

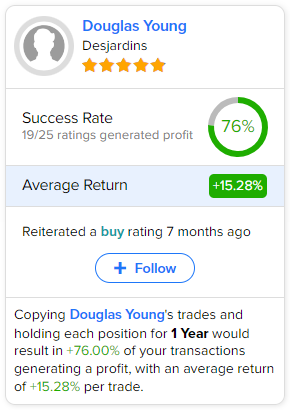

If you’re wondering which analyst you should follow if you want to buy and sell RY stock, the most accurate analyst covering the stock (on a one-year timeframe) is Douglas Young of Desjardins, with an average return of 15.3% per rating and a 76% success rate. Click on the image below to learn more.

The Takeaway

Royal Bank of Canada stock is attractive for several reasons. First, it has a reliable 4.4%-yielding dividend, with payouts that are poised to grow further. Second, its valuation suggests that investors are likely to see solid returns from here. Next, RBC showed its strength last quarter, outperforming every other bank in terms of earnings strength. Finally, analysts see a good amount of upside from here. All these factors combined make the stock relatively attractive.