Recent security breaches such as the SolarWinds supply chain hack late last year serve as a reminder of the critical role that cybersecurity firms play in our increasingly digital world. Vulnerability Management (VM) is one of the key strategies used to protect businesses from cyber-attacks, by identifying and assessing IT assets for security weaknesses. Qualys, Inc. (QLYS) is one of the industry leaders in the field of VM, with the other major players being Rapid7 Inc (RPD) and Tenable Holdings Inc (TENB).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Qualys is arguably the most profitable Software-as-a-Service (SaaS) company, boasting an adjusted EBITDA margin of 43%. But unfortunately, the investment world doesn’t reward software companies strictly based on profitability, but rather on revenue growth and gains in market share.

While the three VM software vendors have comparable revenue and price/sales ratios, Qualys’ revenue growth is half that of its competitors, suggesting that Qualys is losing market share. This is one of the reasons why the company’s stock is languishing.

In addition to the potential loss of market share, the investment community is also wary of the company’s overall direction and not impressed by the weak guidance for 2021.

Beyond VM

Qualys is expanding into areas of cybersecurity outside of VM, including Security Analytics and Orchestration (SOAR), Endpoint Security, IT Asset Management, Compliance, and Web Application Security. However, the investment community doesn’t appear to be convinced that Qualys can compete outside of its market niche against competitors such as Wall Street darling CrowdStrike Holdings Inc (CRWD), which provides endpoint security and is growing revenue by an impressive 85% annually.

Despite the stiff competition, Qualys’ expanding suite of applications may ultimately be a smart approach for future growth as IT departments move to consolidate on software vendors. Qualys’ comprehensive suite of applications will undoubtedly appeal to many companies looking to reduce spend on IT vendor management, with the company also benefiting from cross-selling and up-selling opportunities.

Weak Guidance For 2021

Qualys had a good Q4’20, with year-over-year revenue increasing by 12% and non-GAAP EPS of $0.71 landing slightly higher than analysts’ estimates. But the market wasn’t impressed with guidance for 2021, with year-over-year revenue growth forecasted to be in the range of 10% to 11%, well below that of its competitors, which are growing at a 25% rate. That said, the soft guidance is conservative and does not account for the new products being introduced this year, which include Extended Detection and Response (XDR) and Cloud Security Management, among others.

Management guided for EPS of $2.60 to $2.65, also below expectations, with consensus estimates listed as $3.00. Margins are expected to be lower this year due to the ramp of S&M in conjunction with the above-mentioned new product introductions.

Wall Street’s Take

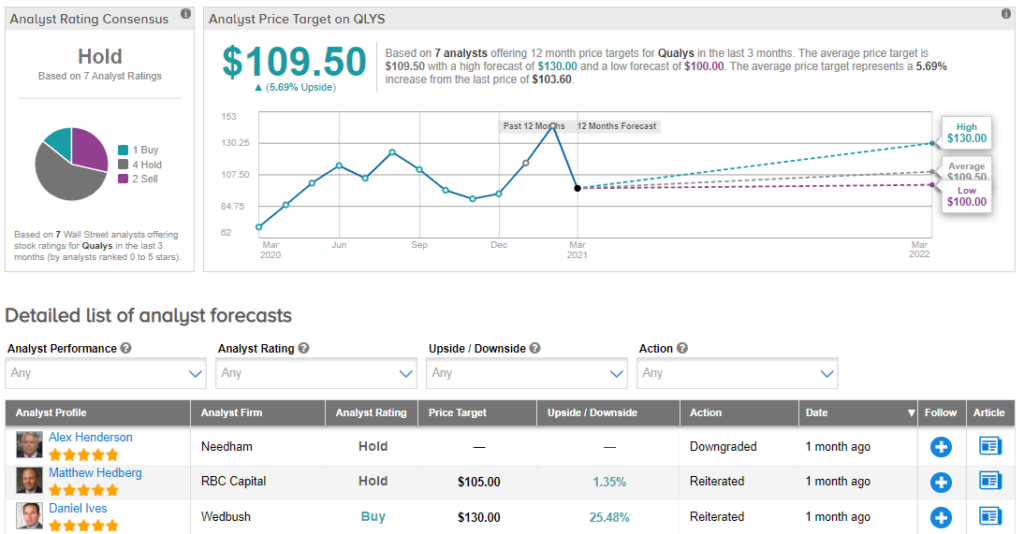

From Wall Street analysts, Qualys earns a Hold consensus rating, based on 1 Buy, 4 Holds, and 2 Sells. Additionally, the average analyst price target of $109.50 puts the upside potential at 6%. (See Qualys stock analysis on TipRanks)

Summary And Conclusions

Qualys is an industry leader in VM. Although the company is extremely profitable compared to other SaaS and cybersecurity companies, it is growing at a much slower pace than its competitors, Tenable Holdings and Rapid7, suggesting that Qualys is losing market share.

The company is moving into other areas of cybersecurity such as SOAR, Endpoint Security, and Web Application Security in an attempt to increase the company’s Total Addressable Market (TAM). However, competition is intense and there is doubt about how well Qualys will be able to compete against established players in these markets.

In any case, this will be an exciting year for Qualys, despite soft guidance that doesn’t account for new product introductions and its revamped salesforce. After suffering a recent drawdown following the Q4’20 earnings call, the stock appears to be reasonably priced with a Price/Sales Ratio of 11.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.