PubMatic (PUBM) shares have fallen over the past year, likely due to a rotation that has favored other sectors such as commodity stocks over technology stocks to anticipate rising commodity prices.

This stock is not only low compared to past prices, but it is also cheap given its upside potential. After the market holidays due to the annual Martin Luther King Jr. Day on January 17, the stock is restarting from around $26.

Thus, I am bullish on this stock.

PubMatic operates a cloud infrastructure platform through which the company offers real-time programmatic advertising transactions to global web content creators and advertisers.

These basically consist of real-time auctions, where advertisers buy ads from publishers the moment a visitor loads a website.

Founded in 2006, PubMatic is practically a global company as it has 15 offices and eight data centers in North America and internationally.

Q3 Earnings

From a revenue perspective, the third quarter was even better than the company’s rosier expectations after total revenue rose nearly 54% year-over-year to $58 million.

That was also well above the analysts’ median forecast of $52.4 million. The company said it delivered “best-in-class organic revenue growth” for the fourth straight quarter.

This was primarily due to a 103% year-over-year increase in the number of impressions processed to nearly 24 trillion in the third quarter, as PubMed saw further expansion of publishers’ inventories on its platform.

Revenue from mobile and omnichannel video, which are fast-growing formats of advertising layout — including connected TV (CTV) technologies for streaming video over the Internet — grew 64% year-over-year, while accounting for 65% of total revenue. CTV’s sales were seven times greater than in the same quarter of the previous year.

The company sees positive trends in revenue generation and double-digit growth in vertical advertising (this strategy targets customers within a specific industry or market niche). PubMatic also saw an improvement in the way the ad service was promoted and reported an increase in the use of its platform.

So selling was strong, and in response, GAAP earnings of $0.24 per share overperformed the median consensus estimate by $0.17.

For the third quarter of 2021, adjusted EBITDA came in at $24.3 million, an increase of 81.3%, and the EBITDA margin was 42% of total revenue, an increase of 700 basis points compared to the same quarter in 2020. Operating cash flow increased 617% to $26.4 million.

Internet Advertising: A Booming Market

Advertising is essential for businesses that want to grow their sales and profits over time. The Internet advertising market is on track to surpass $1 trillion in five years. It’s currently worth about $320 billion, which means it’s set to grow more than three times its size.

From the earnings report, it seems that PubMatic can capture the favorable trend of the market. From a technological point of view, the company continues to make good progress with solutions that allow the publisher to sell its product and the advertiser to reach potential consumers quickly and at the lowest possible cost.

Looking Ahead

The company is targeting higher revenues of no less than $74 million for the fourth quarter of 2021 (up 32% year-over-year), no less than $225 million for full-year 2021 (up 51% year-over-year), and no less than $281 million for full-year 2022 (up 25% year-over-year).

Adjusted EBITDA and margins are also projected at higher levels.

Wall Street’s Take

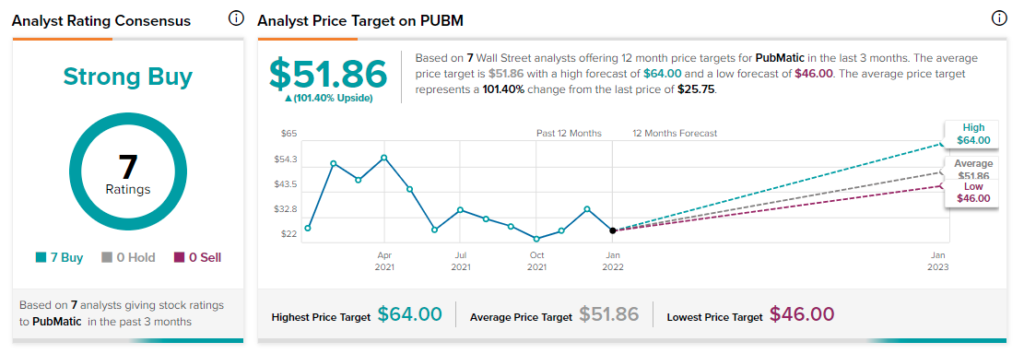

In the past three months, seven Wall Street analysts have issued a 12-month price target for PUBM. The company has a Strong Buy consensus rating, based on seven Buys, zero Holds and zero Sells.

The average PubMatic price target is $51.86, implying 101.4% upside potential.

Conclusion

The stock is improving earnings and sales, while the Internet advertising market is estimated to be worth more than $1 trillion within a few years. The stock should start growing.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure