Several growth stocks announced better-than-expected third-quarter results recently, displaying their ability to navigate an uncertain macro backdrop. The Federal Reserve’s interest rate cuts are expected to provide relief to growth stocks and boost their prospects. Bearing that in mind, we used TipRanks’ Stock Comparison Tool to place Palantir Technologies (PLTR), Monday.com (MNDY), and SoFi Technologies (SOFI) against each other to find the most attractive growth stock, according to analysts.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Palantir Technologies (NYSE:PLTR)

Data analytics company Palantir Technologies impressed investors with its beat-and-raise Q3 results recently. The company’s third-quarter revenue grew 30% to $725.5 million, driven by artificial intelligence (AI)-led demand.

It is worth noting that the revenue growth of Palantir’s U.S. government business accelerated to 40% in Q3 from 24% in Q2, while the U.S. commercial business delivered top-line growth of 54%. In fact, the company highlighted that customer count in the U.S. commercial business jumped 77% compared to the 37% growth in Q3 2023.

PLTR shares have rallied 283% so far this year, as investors welcomed the stock’s inclusion in the S&P 500 (SPX) and are optimistic about the company’s AI tailwinds. Further, on November 15, PLTR stock surged 11% after the company announced its plan to shift its listing to Nasdaq from the NYSE. In contrast to the upbeat investor views, Wall Street is sidelined on PLTR stock.

Is PLTR a Buy, Sell, or Hold?

Following the Q3 results, Monness analyst Brian White reiterated a Sell rating on PLTR stock with a price target of $18. The analyst noted that Palantir’s enterprise value to revenue multiple of 26x is way higher than the 6.1x average of the stocks in his software group. He added that PLTR trades at a 39% premium to semiconductor giant Nvidia’s (NVDA) EV/revenue multiple.

While White believes that Palantir is well positioned to benefit from AI and capitalize on volatile geopolitics in the long run, he contends that the stock’s valuation is lofty, revenue recognition from government-related contracts has been uneven, and execution has been “spotty.”

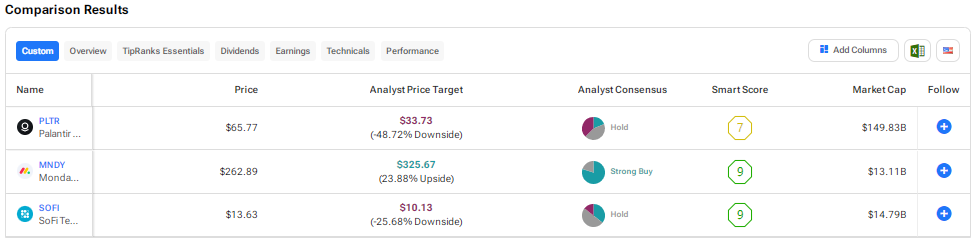

Overall, Wall Street has a Hold consensus rating on Palantir Technologies stock based on three Buys, seven Holds, and six Sell recommendations. At $33.73, the average PLTR stock price target implies about 49% upside potential.

Monday.com (NASDAQ:MNDY)

Enterprise management software maker Monday.com reported better-than-expected third-quarter results and raised its full-year guidance. The company’s revenue grew 33% year-over-year to $251 million, with adjusted EPS also rising 33% to $0.85.

However, shares fell after the earnings report as MNDY issued subdued Q4 guidance. The company expects Q4 revenue to grow in the range of 28% to 29%, which indicates a slowdown from Q3.

Nonetheless, the company highlighted its achievement of surpassing $1 billion in annual recurring revenue (ARR) in q3 and is optimistic about improving its retention rates, with a focus on larger customers. It is worth noting that MNDY’s net dollar retention rate came in at 111% in Q3.

Is Monday.com a Good Stock to Buy?

Following the Q3 print, JPMorgan analyst Pinjalim Bora reaffirmed a Buy rating on Monday.com stock with a price target of $350.The analyst stated that the company delivered a “fine quarter in a choppy macro backdrop,” with all major metrics surpassing the Street’s estimates. That said, he noted that the beat-and-raise magnitude moderated compared to historical norms, perhaps due to continued macro challenges that hit the business in September.

Additionally, Bora thinks that persistent underperformance in sales hiring could have pushed numbers into the next year from the second half of this year. Looking beyond the modest expectations miss, the analyst contends that Monday.com continues to execute well, driving 33% growth at a billion-dollar scale. He also highlighted some strength areas in Q3, like the slight sequential improvement in net retention rates, continued growth among some of the largest customers, and robust improvement in profitability and free cash flow.

Overall, Bora sees the pullback in MNDY stock as a good buying opportunity for long-term shareholders.

With 16 Buys versus four Holds, Monday.com stock scores a Strong Buy consensus rating on TipRanks. The average MNDY stock price target of $325.67 implies 24% upside potential. Shares have risen about 40% year-to-date.

SoFi Technologies (NASDAQ:SOFI)

SoFi Technologies shares have advanced about 37% so far this year. The fintech company delivered stellar third-quarter results, with revenue rising 30% year-over-year to $697 million. Moreover, the company swung to earnings per share (EPS) of $0.05 from a loss per share of $0.29 per share.

Management highlighted that the company’s strategy to shift towards capital-light, higher RoE (return on equity), fee-based revenue streams is delivering the desired results, with the Financial Services and Tech Platform segments now accounting for 49% of the company’s adjusted net revenue compared to the 39% in the prior-year quarter.

With a strong base of 9.4 million members and continued product innovation, SoFi raised its full-year guidance and is confident about the road ahead.

What Is the Price Target for SoFi Technologies Stock?

Following the results, JPMorgan analyst Reginald Smith reaffirmed a Hold rating on SOFI stock with a price target of $9. While Smith praised the company’s capital-light Loan Platform strategy, he noted that uncertainties persist with regard to partner depth, pricing, and the durability of this channel.

Smith added that SoFi’s long-term strategy and market positioning look promising. That said, concerns about the company’s accounting methodologies and valuation challenges over the near term keep him on the sidelines.

Overall, SoFi Technologies stock has a Hold consensus rating on TipRanks based on five Buys, seven Holds, and two Sell recommendations. The average SOFI stock price target of $10.13 implies about 26% possible downside from current levels.

Conclusion

Wall Street is currently sidelined on SoFi Technologies and Palantir stocks, while having a bullish view of Monday.com. Accordingly, analysts see higher see upside potential in MNDY stock from current levels than the other two growth stocks. As per TipRanks’ Smart Score System, MNDY stock earns a score of nine, which implies that it could outperform the broader market over the long term.