At first glance, intimacy wellness specialist PLBY Group (NASDAQ:PLBY) might appear to be a controversial idea. After all, the company came into existence originally as Playboy Enterprises or the house that Hugh Hefner built. Nevertheless, social norms have shifted dramatically over the past several years, affording the industry wider acceptance. Additionally, the lifestyle brand benefits from a surprisingly robust total addressable market. Therefore, I’m bullish on PBLY stock and have a position in it.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

PLBY Stock May Benefit from Evolving Norms

According to a Gallup poll last year, 67% of Americans aged 30 to 49 years own publicly-traded securities, as do 66% of people aged 50 to 64 years. Further, equity ownership correlates heavily with household income. Given these statistics, it’s not difficult to understand why many, if not most, investors are hesitant about PLBY stock.

Generally speaking – though it’s a debatable topic – as people age, they become more conservative. Therefore, It’s not particularly shocking that resistance to intimacy-related businesses may stem from the old guard. However, contemporary investors must realize that social norms have almost undergone a paradigm shift. What were once conversations discussed in carefully hushed tones now occur rather openly.

Adjusting for this new framework, PLBY stock shouldn’t encounter the same kind of social resistance as it may have during another time period. Also, according to PLBY’s investor deck, women purchase half of the company’s products. As well, the Playboy brand enjoys 90% global awareness among members of Generation Z.

What’s more, PLBY stock benefits from a large addressable market. Per Grand View Research, the global intimacy products market size reached a valuation of $32.7 billion in 2022. Further, experts project that between 2023 to 2030, the sector could expand at a compound annual growth rate (CAGR) of 8.5%. At the forecast culmination point, the industry could see revenue of $62.3 billion.

Now, look at the market capitalization of PLBY stock. At $85.9 million, it’s flirting with nano-cap territory, which is around $50 million. Basically, PLBY only needs to take an appropriately sized share of the market for shares to realistically fly higher. Not only that, but because of the global recognition of the Playboy brand, it enjoys a clear edge in the ecosystem.

PLBY Could Give the Bears a Run for Their Money

Despite some optimistic dynamics favoring PLBY stock, it hasn’t enjoyed an auspicious start to the new year. Also, in the past 52 weeks, shares have fallen by 62%. Stated differently, the onus lies with the bulls to make an exceptionally good argument for PLBY. Otherwise, skepticism is the order of the day.

Sure enough, the short interest of PLBY stock jumped to 13.11% of its float. Bear in mind that anything above 10% is considered fairly high. Further, the short-interest ratio is quite elevated at 13.19 days to cover. In other words, it would take more than two-and-a-half calendar weeks for the bears to fully unwind their short positions based on average trading volume.

Should bullish sentiment hit PLBY stock for whatever reason, the bears may be forced to cover, which would be great for contrarian optimists. Such a circumstance could very well impact options traders, many of whom are selling call options; that is, collecting income through the sale of derivative contracts on the assumption that PLBY will stay deflated.

Conspicuously, on January 25, major traders sold 2,784 contracts of the Jan 17 ’25 2.50 Call. The face-value assumption here is that PLBY stock will not rise to the $2.50 strike price by the January 17, 2025 expiration date. Since a more than 100% gap exists between this strike and the most recent closing price of $1.16, it seems like a reasonable wager for the bearish trader to make.

In turn, because it’s so unlikely that PLBY stock will rise to the strike, the premium collected for the aforementioned transaction was only $50,253. Put differently, the call buyer acquired some ultra-cheap options, again because it’s such a long-odds wager.

Still, if the call becomes in the money, the payout could be enormous for the bullish speculator. And because short interest is so high, it’s not inconceivable that PLBY could go on a run.

Financial Considerations

While the intimacy wellness brand may have plenty of things going for it, the company remains a financially risky idea. After enjoying a relatively strong year in 2021 with revenues of $246.59 million, the growth trend noticeably faded. In 2022, the company posted sales of $266.93 million. On a trailing-12-month (TTM) basis, it’s only printing $188.34 million on the top line.

Admittedly, that’s not a great look. However, context matters. After suffering years of high inflation and later high borrowing costs, consumers began saving money. However, with the Federal Reserve hinting at lower interest rates later this year, the message broadcasted confidence regarding possible economic stability.

With everyday people feeling more assured that the ground won’t fall underneath them, PLBY stock should eventually represent a beneficiary. After all, worrying about an economic collapse could easily contribute to low desire.

Is PLBY Group Stock a Buy, According to Analysts?

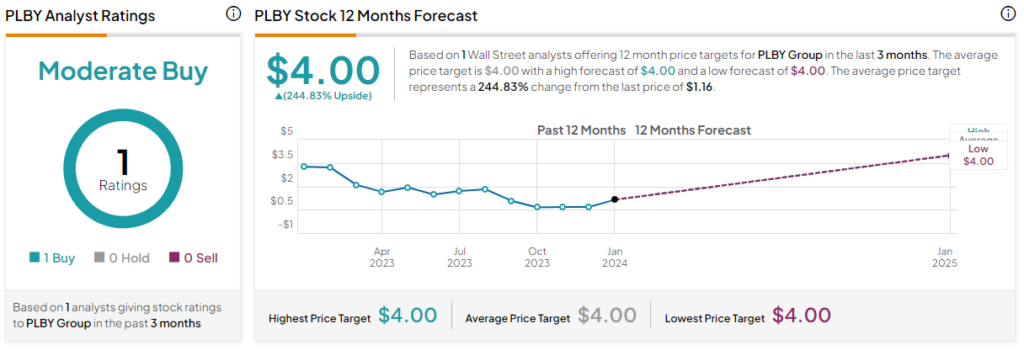

Turning to Wall Street, PLBY stock has a Moderate Buy consensus rating based on one Buy, zero Holds, and zero Sell ratings. The average PLBY stock price target is $4.00, implying 244.8% upside potential.

The Takeaway: PLBY Stock Has the Power to Surprise

Despite its controversial nature, PLBY Group presents a potential investment opportunity due to evolving social norms, a sizeable addressable market, and strong brand recognition. While recent stock performance and financials are lackluster, potential catalysts like easing interest rates and shifting consumer behavior suggest bullish possibilities.

Furthermore, high short interest creates a potential squeeze scenario, making call options an intriguing, albeit risky, option for investors seeking significant upside in this unconventional play.