Consumer staples giant PepsiCo (PEP) reported mixed Q2 earnings results on July 11. The results fell short from a top-line perspective, particularly in the Frito-Lay segment, exacerbated by tough comparisons with previous periods. While I maintain a bullish outlook on PEP due to its defensive nature, the stock’s momentum has been challenged by headwinds such as high interest rates and inflation affecting consumer behavior, which also had led it to trade at a historically low valuation.

This recent underperformance of PEP stock reflects, in my opinion, a market trend favoring high-beta stocks over defensive names like PepsiCo itself. In this article, I’ll delve into why PepsiCo’s Q2 results were underwhelming yet decent and why investing in PepsiCo at its current price could be a smart move.

PepsiCo’s Q2 Earnings Review

PepsiCo recently reported its Q2 results, once again topping earnings estimates with EPS of $2.28, while the consensus was $2.16. As a high-quality company known for consistently beating estimates, these figures didn’t come as a surprise. However, PEP shares saw only modest movement after hours and opened the next trading session virtually unchanged.

The major concern this quarter was PepsiCo’s top line, which came in at $22.5 billion against an expected $22.59 billion. There were already concerns about one of PepsiCo’s popular brands, Frito-Lay, and these concerns proved valid. Organic volume for Frito-Lay segment in North America dropped by 4%. The snacking category is under pressure due to macroeconomic factors and the emergence of GLP-1 drugs, which suppress appetite and could lead to reduced snack purchases.

It’s crucial to note that this issue isn’t isolated to PepsiCo but affects the entire snacking industry. This signals a warning for other packaged food companies, which may need to increase spending beyond their initial forecasts to boost sales volume in the current market environment.

Despite these challenges, PepsiCo’s CEO, Ramon Laguarta, signaled plans to pursue disciplined commercial investments, saying, “For the balance of the year, we will further elevate and accelerate our productivity initiatives and make disciplined commercial investments in the marketplace to stimulate growth.”

Essentially, this means they’ll focus on stabilizing operations rather than aggressively pursuing market share. This lack of competitive pressure from their main rivals, in my opinion, bodes well for investors, as it helps maintain profitability and avoids costly price battles that could eat into margins.

Looking at the broader picture, PepsiCo reported 2% organic non-GAAP revenue growth in Q2 and a 9% year-to-date increase in earnings per share for the first half of 2024. Across its product categories and geographies, there was a 5% increase in effective pricing, which resulted in a 3% decrease in total organic volume, as you can see in the image below. PepsiCo has been raising prices for over a year and a half now, with continuously increasing effective net pricing. But finally, consumers are pulling back, and that’s a significant change this year.

It’s worth noting that PepsiCo faced tough comps from Q2 last year when consumer behavior favored more home-based spending. While these comparisons are challenging, I think it’s decent that PepsiCo is still achieving 2% organic revenue growth.

The real highlight, though, is how well PepsiCo managed costs despite slower revenue growth. Non-GAAP cost of sales dropped from $10.1 billion to $9.9 billion this quarter, and SG&A expenses fell by 30%. This resulted in a 10.6% increase in operating profit year-over-year. This solid expense management helped balance things out and likely avoided more negative reactions.

Why Owning PEP Now Is Compelling

In the market we’ve seen over the past year, cyclical and high-beta stocks have been favored over defensive ones. And, to be clear, PepsiCo stands out as a solid defensive pick. With a low two-year beta of 0.33, PepsiCo’s stock tends to move about one-third as much as the overall market in the same direction. This characteristic means that during economic turbulence, owning stocks like PepsiCo provides an added cushion for risk-adjusted returns.

The case for including PepsiCo in a portfolio becomes even more compelling when considering its current valuation. The stock trades at a forward P/E ratio of 20.9x, which represents a discount of 14.2% compared to its historical average over the last half-decade.

This discount, I believe, reflects the Consumer Staples sector’s challenges with high interest rates and ongoing inflation. These factors have curbed consumer spending and squeezed PepsiCo’s revenue, leading to two revenue estimate misses in the last three quarters (Q4 2023 and Q2 2024).

While facing headwinds that have impacted the company’s top-line growth, PepsiCo maintains a robust balance sheet with an increasing cash position, as evidenced by its $6.35 billion in cash and equivalents, marking a nearly 4% year-over-year increase.

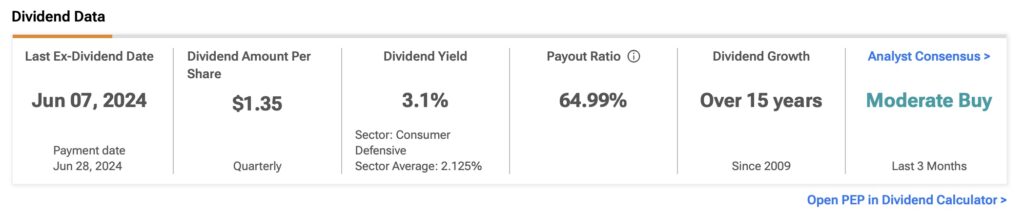

Also, its dividend yield remains above 3%, which is 10% higher than the average of the last five years. Moreover, the company raised its dividend by 7% in Q1, continuing a streak of increases over the past 51 years. This indicates a payout ratio of 65%, slightly below its historical five-year average.

Is PepsiCo Stock a Buy, According to Analysts?

While not all Wall Street analysts are overwhelmingly bullish on PepsiCo shares, the consensus rating is a Moderate Buy. Out of the 18 analysts covering the stock, 11 rate it as a Buy, while the remainder have Hold ratings. The average PEP stock price target is $186.41, suggesting upside potential of 10.1% based on the most recent share price for PEP stock.

The Takeaway

PepsiCo faced some tough comps in Q2, with consumer behavior more sensitive to pricing, impacting top-line growth. While these results fell short of expectations, robust cost control managed to stabilize things, avoiding what could have been a much worse quarter.

Overall, the bottom line is that while buying PepsiCo shares today may not be exciting in the short term, I believe the company’s track record as a defensive investment should prove successful over the long term. This remains true, as strong fundamentals and a discounted valuation should outweigh concerns about macroeconomic headwinds.