Electric vehicle makers are facing multiple headwinds, including slowing demand due to macro pressures, intense competition, and additional tariffs on imports by certain countries. Nonetheless, Wall Street is optimistic about certain EV stocks due to their resilient performance in a tough business backdrop and improving financials. We used TipRanks’ Stock Comparison Tool to place Nio (NIO), Li Auto (LI), and Tesla (TSLA) against each other to pick the EV stock with the highest upside potential, according to Wall Street analysts.

Nio (NYSE:NIO)

Shares of Chinese EV maker Nio are down more than 42% year-to-date even after witnessing a solid rally in September due to China’s stimulus measures and improving numbers. However, uncertainty about the Chinese government’s measures to support the EV sector and intense competition continue to drag down Nio stock.

Despite a tough business backdrop, Nio reported solid deliveries in September. The company delivered 21,181 vehicles, reflecting a 35.4% year-over-year increase. Its Q3 deliveries grew 11.6% to 61,855 vehicles. The September numbers included 832 units of the company’s first mass-market model Onvo L60, which was launched on September 19.

Recently, Nio announced that a group of Chinese investors will invest RMB3.3 billion in its subsidiary Nio China, while the company itself will invest an additional RMB10 billion. Reacting to the news, Daiwa analyst Kelvin Lau noted that Nio China is the core operational entity for the company and the cash injection by existing shareholders is a favorable development that supports the business operations. Lau has a Buy rating on Nio stock.

Is Nio Stock a Good Buy?

HSBC analyst Yuqian Ding lowered the price target for Nio stock to $7.20 from $7.90 but maintained a Buy rating. The analyst has a constructive outlook on Nio’s volumes and margin growth, supported by strong NIO brand sales, the potential for volume expansion for ONVO L60, supply chain cost optimization, and better economies of scale.

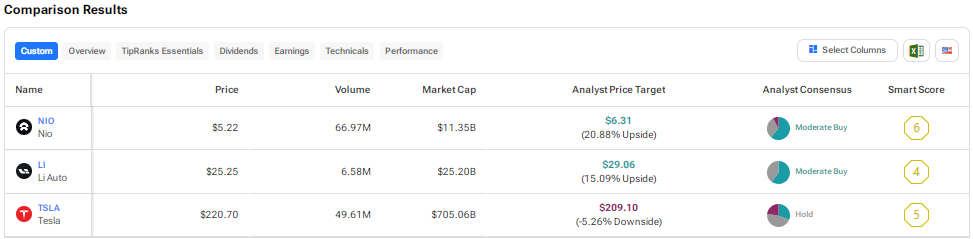

Overall, Wall Street has a Moderate Buy recommendation on Nio stock based on eight Buys, four Holds, and one Sell recommendation. The average Nio stock price target of $6.31 implies about 21% upside potential.

Li Auto (NASDAQ:LI)

Shares of Chinese new energy vehicles (NEV) maker Li Auto have rallied about 22% over the past month due to the news on China’s stimulus measures and the company’s solid September deliveries. However, LI stock is still down more than 32% year-to-date.

Recently, Li Auto reported about a 49% rise in September deliveries to 53,709 vehicles. Overall, the company’s Q3 deliveries increased 45.4% to 152,831. The company attributed the robust performance to solid order intake for Li L series and Li MEGA.

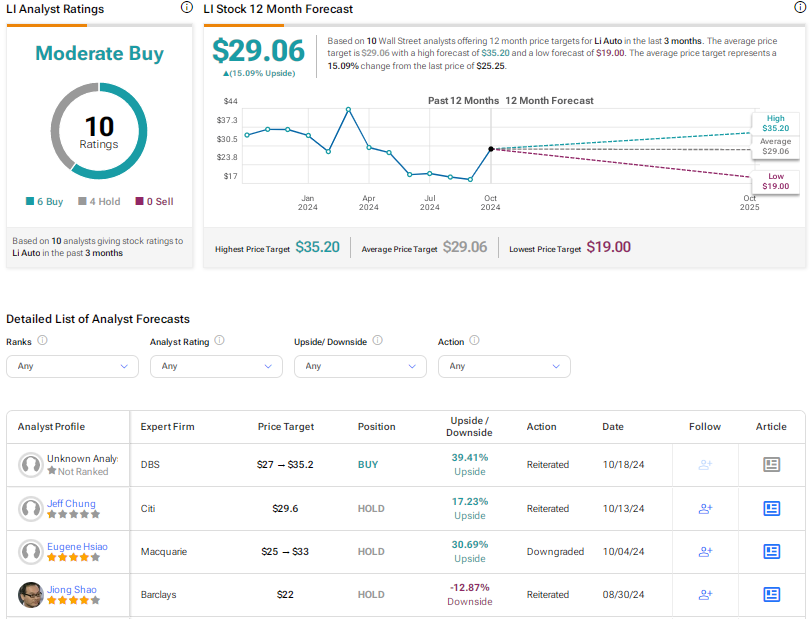

Despite the impressive numbers, Macquarie analyst Eugene Hsiao downgraded Li Auto stock from Buy to Hold but raised the price target to $33 from $25. The analyst thinks that LI stock is fully valued following the recent rally. He added that the stock lacks a catalyst with no new launches lined up in the second half of 2024.

What Is the Target Price for Li Auto Stock?

With six Buys and four Holds, Li Auto stock earns a Moderate Buy consensus rating. At $29.06, the average LI stock price target implies 15.1% upside potential.

Tesla (NASDAQ:TSLA)

Shares of Elon Musk-led Tesla are down over 11% so far this year. Investors are concerned about the company losing market share to emerging EV players and the decline in its margins due to discounts and other incentives.

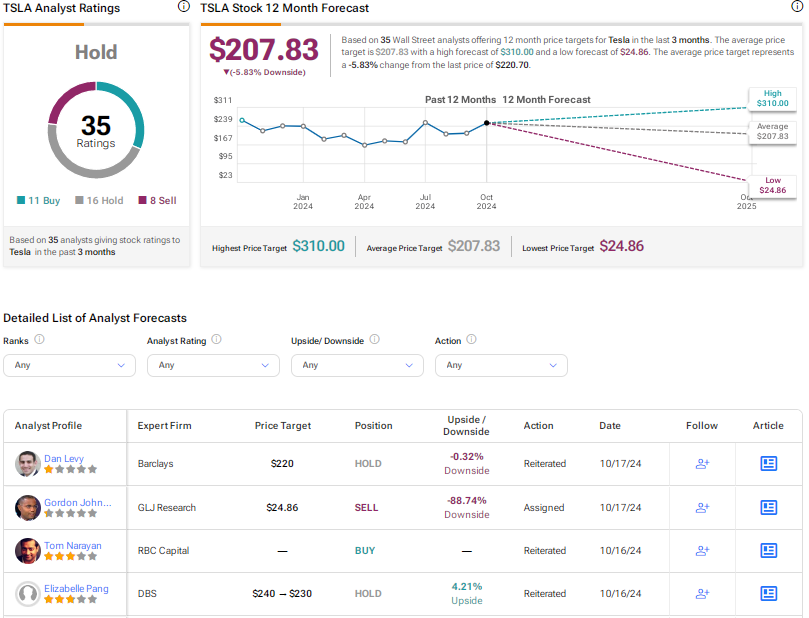

Moreover, Tesla’s Q3 deliveries of 462,890 vehicles fell short of expectations and reflected the impact of macro challenges and intense rivalry in China. To make matters worse, the company’s much-awaited robotaxi event failed to impress investors. Analyst Dan Levy from Barclays thinks that the robotaxi event was light on the details and did not highlight any near-term opportunities for the EV giant. Levy reaffirmed a Hold rating on TSLA stock with a price target of $220.

All eyes are now on Tesla’s Q3 results, scheduled on October 23. Analysts expect the company’s EPS to decline nearly 11% year-over-year to $0.59. They project revenue to rise more than 9% to $25.47 billion. Price cuts and increased production costs are expected to offset the company’s top-line growth and weigh on the company’s Q3 margins and EPS.

Is Tesla a Buy, Sell, or Hold?

Meanwhile, Levy thinks that TSLA’s Q3 results could act as a positive near-term catalyst, with focus now on the company’s fundamentals. While the analyst is optimistic about TSLA’s long-term prospects due to its leading position in the global EV transition, he prefers to be on the sidelines due to near-term pressures.

Wall Street is sidelined on Tesla stock, with a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sells. The average TSLA stock price target of $207.83 implies a possible downside of 5.8%.

Conclusion

Wall Street is cautiously optimistic about Nio and Li Auto but sidelined on Tesla. Analysts see a higher upside potential in Nio stock than in the other two EV stocks. Nio’s improving sales and its efforts to enhance its margins could drive the stock higher.