Following the exit of founding CEO Trevor Milton, Nikola Corporation (NKLA) has had a lot to prove. The new CEO has continued to move the company forward, but the General Motors partnership never materialized and the stock has now slumped to $15.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As the electric vehicle space has heated up in the Fall, Nikola has cooled off due to the Hindenburg Research fraud allegations and SEC investigation. The company still has a lot to prove in order for investors to not look elsewhere in the hot EV space.

Tre BEV Prototypes

Nikola hinted on social media that the first Tre BEV prototype had reached the U.S. The truck will head to Arizona in the next week for commissioning allowing the company to finally provide the market with a working prototype. The battery electric vehicle is the first of a series of prototypes being produced in Germany.

The lack of a working prototype and Hindenburg Research alleging the company presented to the market a truck rolling downhill has left a lot to prove. Several working prototypes could flip the switch on the view that previous CEO was overly promotional. Multiple prototypes running on test tracks and eventually with partners is where the stock could become interesting.

Hydrogen Future

Ultimately though, the EV space is highly competitive. Where Nikola is set apart from the competition is the hydrogen trucks slated for rollout in 2023. The company has to prove they can manufacture these BEV trucks before the investment story really gets exciting again with the fuel cell trucks

The original 2024 revenue projection had $1.5 billion out of the $3.2 billion revenue target coming from FCEV trucks and related services not even being built now.

The recent cancellation of the GM partnership to build the Badger pickup trucks eliminates one the of the future revenue sources that pushed the stock to nearly $80. GM is now a key partner in providing the fuel-cell technology needed to make the FEEV a reality, but it also again suggests Nikola lacks the technology when needing GM as a supplier of crucial technology to make the hydrogen fuel-cell class 7/8 trucks with a target for protypes at the end of 2021.

Takeaway

The key investor takeaway is that Nikola is a far more interesting stock now at $15 and without promotional CEO Trevor Milton. As the company starts working with prototypes and builds out the electric truck manufacturing plan in Arizona, the investment story gets far more interesting.

The company still has a lot more to prove to make the stock a buy with a $6.6 billion valuation and limited revenues until 2022 or even 2023. In addition, the company ended Q3 with only $908 million in cash on the balance sheet, but the EV space is highly capital intensive. In order to make the stock a real buy, Nikola should raise more funds in the next few quarters and the lower the stock goes, the more any investor could be diluted.

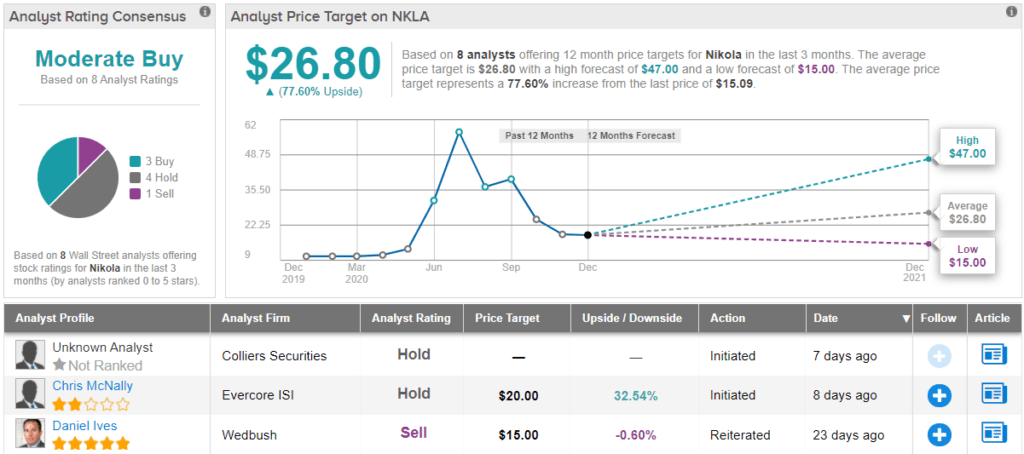

Amongst Wall Street analysts, opinions are currently split on whether Nikola constitutes a good investment. With 3 Buys, 4 Holds, and 1 Sell the stock has a Moderate Buy consensus rating. Although the bulls are edging ahead as the $26.80 average price target (~78% upside) indicates. (See NKLA stock analysis on TipRanks)

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.