Over the past few years, major players in the streaming wars such as Netflix (NFLX), Walt Disney Co. (DIS), and Warner Bros. Discovery (WBD) have achieved strong user growth and increased their earnings. In this article, I use the TipRanks Stock Comparison Tool to explain why I’m bullish on NFLX stock and neutral on both DIS and WBD. As a pure streaming play, I believe Netflix is the best choice among these three securities.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Netflix (NFLX)

As the undisputed leader in streaming, I have a bullish outlook on Netflix. The company has over 275 million global subscribers and remains well-positioned to execute its growth strategy. Netflix is projected to post an average revenue growth rate of around 13% over the next two years, though this might be conservative considering its expanding monetization channels. A key driver of growth is Netflix’s ad-supported tier. The company recently announced a 150% increase in upfront advertising sales from 2023 levels.

In terms of valuation, Netflix is trading at 36 times its forward P/E ratio and 30 times its 2025 forecast. While this isn’t a bargain, it’s justifiable given the company’s operational and financial momentum. If net paid additions remain robust, there’s a strong likelihood that earnings per share (EPS) growth will surpass current baseline estimates.

Netflix’s Recent Performance

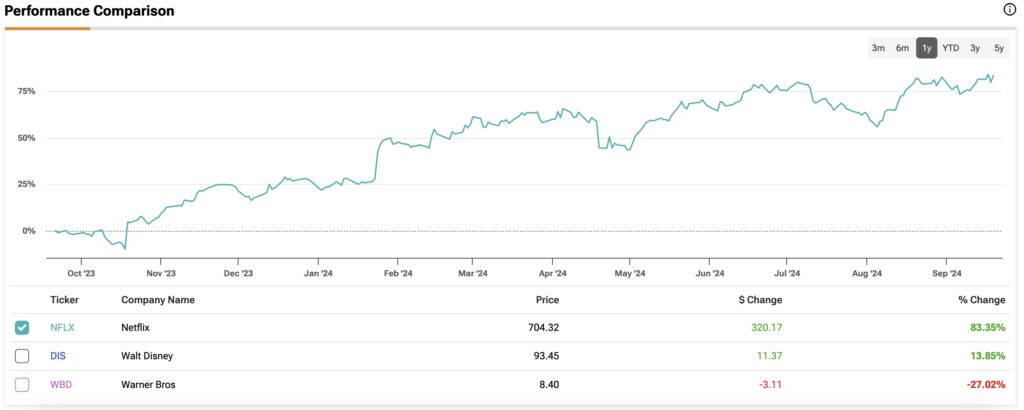

Despite NFLX stock’s 82% gain over the past year, I remain bullish. The stock’s rise is driven by its consistent ability to beat earnings estimates and demonstrate sustained growth.

Netflix leads the streaming industry in profitability too, reporting a 27% operating margin in Q2, slightly down from Q1 but still above guidance. These margins are far superior to competitors such as Disney, whose Entertainment and Sports segment posted an 11.3% margin in Q2.

Is NFLX Stock a Buy?

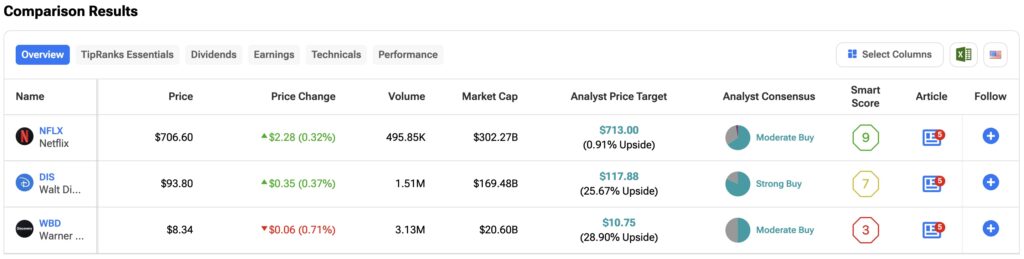

Thirty-eight Wall Street analysts rate NFLX stock a Moderate Buy. This is based on 24 Buy, 12 Hold and one Sell recommendation made in the past three months. The average price target on Netflix stock of $713 suggests 1.57% upside from current levels.

Read more analyst ratings on NFLX stock

Walt Disney (DIS)

I hold a neutral stance on Disney. This is mostly because the company has faced significant challenges in recent years. Intense competition, squeezed margins, and high debt levels have led to a steep decline in the share price. Unlike Netflix, Disney boasts a vast ecosystem, from theme parks to merchandise. In fact, the Parks & Experiences segment accounted for 70% of the company’s profits last year.

Disney’s recent third-quarter results highlighted many of the challenges. Operating income for U.S. parks declined 6%, while international parks experienced a modest 2% increase. Both results were impacted by inflation-driven costs, rising technology expenses, and new guest offerings.

On the bright side, Disney’s Streaming unit (comprised of Disney+, Hulu, and ESPN+) reported its first-ever profit. Although management had forecast profitability for by year’s end, the streaming business turned an unexpected profit of $47 million in Q3. That compares to a loss of $512 million a year earlier. The key question remains whether streaming growth can offset the ongoing decline in Disney’s traditional businesses, particularly its amusement parks.

DIS Stock’s Recent Performance

My neutral position on Disney mirrors the market’s cautious outlook, as the stock has significantly underperformed the S&P 500 index. Despite trading at a forward P/E of 18.9 times—55% below its historic average—it doesn’t appear to be undervalued.

While Disney’s streaming segment has shown strong earnings growth, management’s modest Disney+ forecast likely won’t offset the slowdown in the Parks and Experiences division, which faces challenges both domestically and internationally.

Is Disney Stock a Buy or Sell?

Wall Street remains optimistic about Disney’s turnaround and future. A total of 22 Wall Street analysts rate the stock a Strong Buy. This rating is based on 18 Buy and four Hold recommendations made in the last three months. There are currently no Sell ratings on the stock. The average price target of $117.88 suggests potential upside of 26.47%.

Read more analyst ratings on DIS stock

Warner Bros. Discovery (WBD)

Like Disney, I also hold a neutral opinion of Warner Bros. Discovery. Within the streaming space, WBD has positioned itself as a competitor through HBO Max and Discovery+, offering a mix of premium and reality TV content. However, the company is burdened by significant debt from its merger with Discovery and continues to face challenges in reducing it.

Currently, WBD has $41.4 billion in gross debt, translating to a net debt-to-earnings leverage ratio of four times. Despite generating a solid $7.47 billion in cash flow last year, there is skepticism about the company’s ability to meet its leverage target of 2.5 to three times by the end of 2024. The major concern is that Warner Bros. Discovery is not yet profitable, with analysts forecasting profitability sometime in 2025.

The path to profitability largely depends on the company’s direct-to-consumer (DTC) business strategy, which includes Max. So far this year, the segment is still operating at a small loss, but is experiencing global growth with 103.3 million subscribers. While U.S. HBO cable subscribers are declining, U.S. price hikes have offset lower average revenue per user, which is about $8—half of Netflix’s level. Profitability may take time, but Warner Bros. Discovery’s valuation remains attractive, trading at nearly 25% below the industry average.

WBD’s Performance

My neutral stance on WBD stock is mostly due to its nearly 30% decline this year resulting from weak earnings. In Q2, total revenue fell 6%, earnings dropped 16%, and free cash flow plunged 43% year over year, impacted by declining linear TV viewership and substantial debt.

Is Warner Bros. Discovery Stock a Buy?

Despite these concerns, Wall Street remains fairly bullish on WBD stock. Seventeen professional analysts give the shares a consensus Moderate Buy rating. This is based on 10 Buy, six Hold and one Sell recommendation made in the last three months. The average price target of $12.50 suggests 49.97% upside potential from current levels.

Read more analyst ratings on WBD stock

Conclusion

I am bullish on Netflix and consider the stock to be the best investment of this group. Netflix has strong margins and growth potential, which justify its premium valuation. On the other had, I view Disney as a Hold. While it has promising revenue streams and restructuring potential, challenges in its parks segment persist. Warner Bros. Discovery also gets a Hold rating. While it might be a high-risk, high-reward opportunity, its current debt load is a significant issue and the company remains unprofitable.