I am bullish on Netflix (NFLX) due to its strong competitive positioning, growth momentum, and opportunistic valuation after the latest pullback in the share price.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Netflix is a video streaming service that has a broad global presence. The company streams content that it produces in-house as well as content produced by third parties. This article will discuss three reasons to be bullish on NFLX stock while also outlining a few of the risks involved in holding the stock.

Strong Competitive Advantages

NFLX enjoys several competitive advantages that have fueled its strong growth in the past and should enable it to continue growing in the years to come despite rapidly increasing competition in the streaming space.

NFLX is the largest online streaming business in the United States, and also enjoys the first mover advantage that has enabled it to build up a large and loyal subscriber network. It has leveraged its strong content library and scale in the United States to grow internationally, and now has a global subscriber base of about 223 million.

This scale and years of experience also gives NFLX a data advantage that it is applying machine learning models to in order to further improve its content creation, marketing, and customer retention capabilities, thereby maximizing growth and profitability.

Last, but not least, its scale and data advantages enable it to invest heavily in new content creation without eating too much into profit margins. This is a capability that its competitors will be challenged to match.

Robust Growth Momentum

Another reason to be bullish on NFLX stock is its strong growth momentum that appears poised to continue for the foreseeable future. While near-term growth appears to be disappointingly slow (the company only anticipates adding 2.5 million subscribers in Q1 2022 compared to 4 million in the year-ago quarter), it added 8.3 million net new subscribers during Q4 2021, and grew its global subscriber count by 9% in 2021.

Financial growth remains robust as well. Revenue grew by a healthy 18.8% in 2021 while EBITDA grew by 33% and normalized earnings per share soared by 84.9%. Over the next five years analysts expected normalized earnings per share growth to remain quite strong at a 22.2% CAGR.

Given NFLX’s competitive advantages and willingness to aggressively invest in data analytics techniques and content creation, this growth rate should be quite achievable as it moves beyond its mostly saturated North American market into international markets like India.

Opportunistic Valuation

A third reason to be bullish on NFLX stock is that it currently trades at an opportunistic valuation. Its EV/EBITDA ratio is cheap relative to its history at 23.12 compared to its five-year average of 46.85 times.

Furthermore, its P/E ratio is 31.91 compared to its five-year average of 77.34 times.

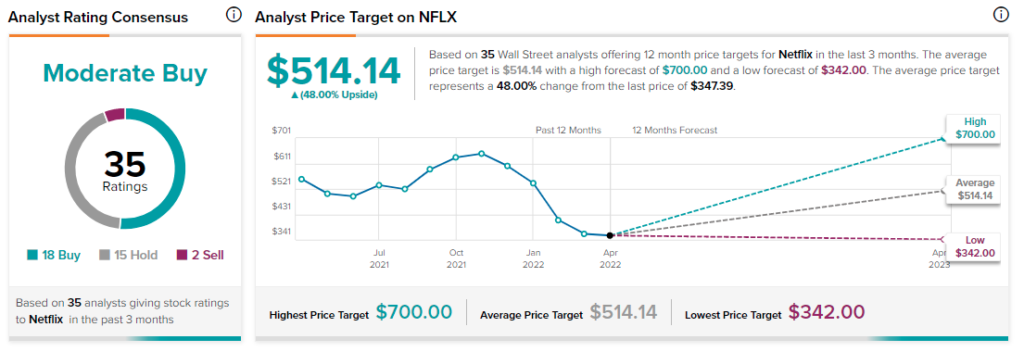

According to Wall Street analysts, NFLX earns a Moderate Buy analyst consensus based on 18 Buy ratings, 15 Hold Ratings and two Sell ratings in the past three months. Additionally, the average analyst Netflix price target of $514.14 puts the upside potential at 48%.

Summary and Conclusions

NFLX is a leading global video streaming company with an impressive growth and shareholder total return track record. Moving forward, the outlook remains positive as its competitive positioning remains strong, its growth momentum is robust and expected to remain so, and the valuation looks opportunistic after its recent pullback in share price.

That said, investors should keep in mind a few risks before buying the stock here. First, NFLX is having to rely increasingly on penetrating and winning in new international markets given that its core North American market is largely saturated. This could be challenging given that NFLX must cross cultural and language boundaries to win business.

Second, competition in the streaming space is heating up considerably with rivals like Disney and Amazon firmly in the mix. As a result, NFLX’s competitive advantages could be increasingly at risk and the company will need to continue investing aggressively in new content creation and improving the customer experience while keeping subscription fees at reasonable levels. This, in turn, could pressure profit margins.

Third, while its customer database gives it an advantage, there is still the risk that NFLX will fail to innovate successfully with new content, thereby losing customer interest and losing market share to competitors that might be more successful at creating attractive new content.

Fourth, while the stock looks attractively priced relative to its history and analyst price targets, the valuation multiples are still fairly lofty. With interest rates rising and risks to the growth thesis, if NFLX disappoints on growth projections in the future, shareholders could see disappointing total returns moving forward.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure