The modern cloud computing infrastructure has been expanding over the past two decades, and what was once a convenient backup system has now become the backbone of the digital world. Cloud computing lets subscribers – at all levels, from individuals to large enterprises – tap into the speed and flexibility of high-end data centers, without having to build or maintain the physical servers. Seen from the other side, cloud computing lets server operators run their systems with a minimum of downtime.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

By some estimates, well over 90% of businesses globally are using cloud services of some sort. For the rest of us, the cloud makes possible a wide range of daily activities, including GPS navigation, smart home technology, mobile data usage – even high-end sewing machines can be connected to access online patterns. Cloud technology makes possible the flexibility and scalability that eases our path through modern life.

The analysts at Morgan Stanley understand this and are picking out cloud-related stocks that deserve investor interest. Specifically, firm analyst Elizabeth Porter, in her coverage of the cloud sector, sees two cloud stocks that are presenting compelling entry points.

We’ve opened up the TipRanks database to get a closer look at both of them; according to the data, both have Buy ratings from the Street and double-digit upside potential. Here are the details.

Twilio, Inc. (TWLO)

The first stock we’ll look at is Twilio, a tech firm involved in cloud computing and software, particularly in the communications field. Twilio offers its enterprise clients a customer engagement platform that supports a wide range of communication tools, including messaging, email, and voice channels, as well as customer data analytics and identity authentication for anti-fraud security.

Twilio’s platform is designed to let its customers build what they need, on the basic framework. Developers, marketers, data engineers, and sales teams can all find the tools necessary for effective customer contacts and communications management. Twilio has been integrating AI tools into the platform, in the form of conversational AI that enhances human interactions instead of replacing them. The AI can provide automated customer support, can assist agents during and after customer calls, and can analyze support center data.

In short, Twilio’s cloud-based communications system offers a full array of tools that cover all aspects of B2C contacts. The company aims to streamline the communications flow, allowing businesses to improve their contact procedures with personalized tools that meet the needs of both companies and clients, while creating advantages with AI-powered data analysis.

All of this has allowed Twilio to take a leading position in its niche, in a short time. The company was founded in 2008, just 17 years ago, but today is a $17 billion tech innovator that generated $4.46 billion in total revenue last year. For the first half of this year, the company’s revenue total, $2.24 billion, was up 15% year-over-year. The company’s last set of quarterly results, from 2Q25, showed $1.23 billion at the top line, for a 13% year-over-year increase and beating the forecast by $40 million. The $1.19 quarterly non-GAAP EPS in Q2 was 14 cents per share better than had been anticipated.

In her coverage of Twilio for Morgan Stanley, analyst Porter restates her belief that the company is a leader in its field – and more importantly, that it has plenty of room for continued growth.

“We continue to see TWLO as best positioned within communication software, remaining confident on path towards DD% growth on the back of improved GTM and cross sell initiatives. While gross margin noise has weighed on the name, Q2 results provided further confidence in the path to improving growth, during which the company’s Comms business saw its 4th consecutive quarter of acceleration. On Q3 results, we expect 200-300bps of upside to organic (ex-surcharges) Comms revenue (implying ~11.5% Y/Y growth), passed through to 4Q/ FY25, with 4Q revenue guidance coming in closer to 8% (vs. consensus of ~7.5%). Given valuation of ~16.5x EV/’26e FCF, we do not believe this expected upside has been priced in,” Porter opined.

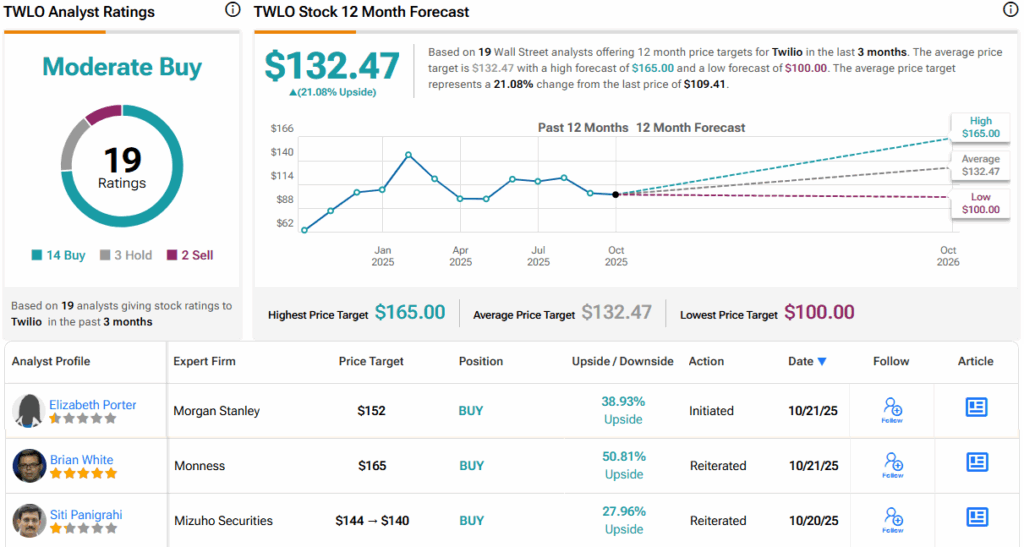

Quantifying her stance, Porter rates TWLO as Overweight (i.e., Buy), with a $152 price target that implies a one-year upside potential of 39%. (To watch Porter’s track record, click here)

Overall, Twilio gets a Moderate Buy rating from the analyst consensus, based on 19 recent reviews that include 14 to Buy, 3 to Hold, and 2 to Sell. The stock is currently trading for $109.41, and its average target price of $132.47 suggests a gain of 21% in the coming year. (See TWLO stock forecast)

NICE, Ltd. (NICE)

Next on the list is NICE, a US-based tech firm that specializes in customer relationship management (CRM) and workforce engagement management – and particularly in applying AI to both of those fields. NICE is an old-timer in the field, having been founded in 1986, and has been publicly traded on the NASDAQ since 1996. The company is a market leader in its field, and its unified platform is designed to bring out the endless possibilities of customer engagement (CX) in digital, voice, and AI channels.

NICE’s platform is purpose-built for AI but still puts people first. It’s designed to turn automated engagements, the backbone of digitally based AI customer contact, into proactive intelligent actions that allow individuals and organizations to smooth out the process of devising actions from interactions. The platform is scalable and can be applied in both large global enterprises as well as the myriad small- to mid-sized businesses that drive the US economy. The company is trusted by such major enterprise clients as Valvoline, Bose, Sony, and Pfizer.

By putting all of its functionality onto one platform, NICE makes it possible for users to reap the advantages of cloud computing, AI integrations, customizable dashboards, automated regulatory compliance, and even AI-enhanced voice contacts – all without switching systems. Customers can choose which functions are most relevant and can enable or disable functions based on what they need. The AI-powered platform can handle everything from customer contacts to workforce augmentations.

Summing up, NICE gives its clients Contact Center as a Service (CCaaS), bringing the popular as-a-service model to the world of CRM.

In its last reported quarter, 2Q25, NICE’s revenue came to $727.7 million, up 9.5% year-over-year and some $14.5 million more than had been anticipated. The company’s non-GAAP EPS was up 14% year-over-year to reach $3.01 and beat the forecast by 2 cents per share.

That performance hasn’t gone unnoticed. Morgan Stanley’s Porter credits NICE’s success to its dominant position in CCaaS and sees even greater potential ahead.

“NICE is a leading player in the CCaaS market with limited competitors able to offer the same feature functionality at scale, and has strong conversational AI partnerships. NICE has a large base of legacy on-prem WEM customers, providing key proof points for winning new large customers and a durable source of growth as these customers transition to cloud at higher ARPUs,” Porter said. “We continue to believe that valuation of ~8x EV/26e FCF is overly punitive relative to the company’s opportunity in CCaaS, though see a larger catalyst in the Capital Markets Day shortly following the quarter on November 17th in NYC – during which updated medium term financial commentary/targets are expected.”

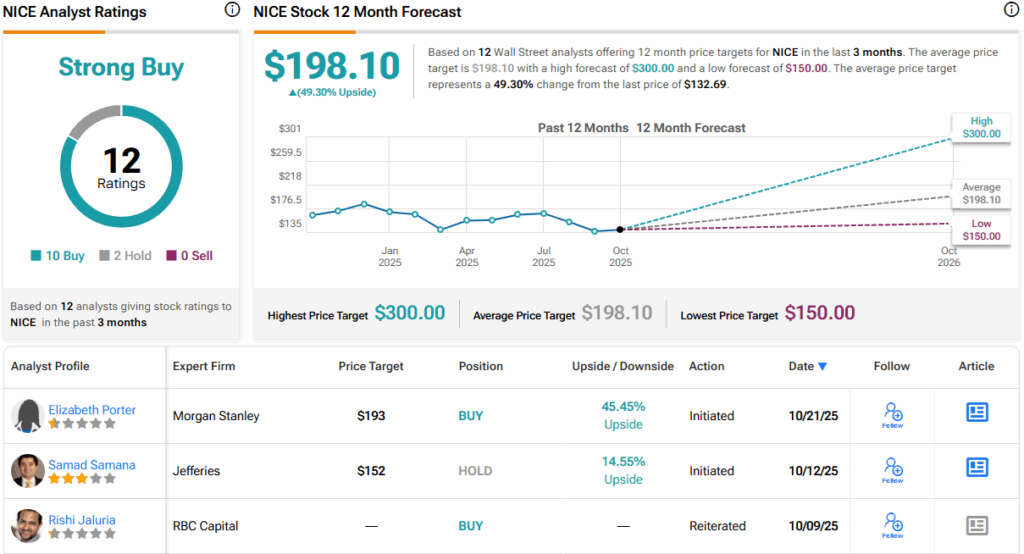

Porter goes on to rate NICE shares as Overweight (i.e., Buy), with a $193 price target that points toward a 45.5% upside on the one-year horizon.

The Morgan Stanley analyst is hardly the only bull here; NICE has a Strong Buy consensus rating on the Street, based on 12 analyst recommendations that include 10 Buys to just 2 Holds. The stock’s $132.69 selling price and $198.10 average target price together imply a 49% gain for the shares over the next 12 months. (See NICE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.