Consumer spending has long been a primary driver of the US economy. The average household, with its non-negotiable needs and its appetite for entertainment and relaxation, provides the support for a vast economic edifice – of retail, services, industry, and logistics. And, of course, for leisure.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Theme parks are popular entertainment destinations, perfect for day trips or as the centerpiece of a longer vacation. The park industry has seen headwinds this year – high inflation has forced them to raise prices, higher interest rates and tighter monetary policy together have put a crimp on consumers’ available funds, and even inclement weather hurt the industry earlier in the year. But according to analyst Thomas Yeh, from banking giant Morgan Stanley, some tailwinds are giving theme parks a second wind that may last into next year.

Yeh sums up the positives briefly, writing about the industry, “We view a tougher macro backdrop and concerns about slower consumer spending as priced into regional theme park shares. Easing weather comps in 3Q results and proof of underlying per-capita resilience in ’24E should enable the group to positively rerate.” For the near-term, Yeh sees the third-quarter earnings season as a potentially positive stock catalyst.

The Morgan Stanley analyst doesn’t stop there – he has also identified two names in the theme park niche that offer real buying opportunities for investors. According to TipRanks database, each also features a Strong Buy analyst consensus rating and a solid upside potential. Let’s take a look.

Don’t miss

- ‘The Stage Is Set for a Rally’: Canaccord Sees up to 290% Upside for These 3 Stocks

- These 9%-Plus Dividend Stocks Look Attractive Right Now, Says Top Analyst

- ‘Load Up,’ Says Goldman Sachs About These 3 ‘Strong Buy’ Stocks

SeaWorld (SEAS)

The first stock we’ll look at is SeaWorld, a name you probably recognize even if you didn’t know it was a publicly traded company. SeaWorld brings together the models of both theme parks and zoos, and its live animal attractions feature dolphins, orcas, and sea lions. In addition, the parks also sport the more familiar fare of thrill rides – the roller coasters and splashdowns that we all know and (mostly) love. The company operates 12 destinations and parks in the US, and has been in operation for 55 years.

While SeaWorld’s theme park is its most highly visible operation, and the best-known, the company is also active in the field of animal rescue – especially for aquatic animals. Working at this for more than 50 years, SeaWorld has rescued over 40,000 ill, injured, or orphaned animals, providing veterinary care and, in many cases, a return to the wild. The company uses its parks to help promote its rescue efforts, and to educate the public on animal husbandry.

On the financial side, SeaWorld saw some serious headwinds in 1H23. Unexpectedly bad weather during the summer impacted park attendance, as did the combination of high inflation and tighter consumer credit. For 2Q23, the last quarter reported, the company had a total of 6.1 million guests, down 0.1 million year-over-year. Total revenues in the quarter came to $496 million, a slip of 1.7% from 2Q22, and missing the forecast by $17 million. At the bottom line, the GAAP earnings figure came to $1.35 per share, which was 16 cents per share lower than had been expected.

Looking ahead, SeaWorld will report its 3Q23 results on November 8, and the Street is expecting them to show revenues of $547 million.

Turning to Thomas Yeh, and his coverage for Morgan Stanley, we find the analyst upbeat for the SeaWorld heading into next year, and willing to outline specific tailwinds: “SeaWorld’s higher relative exposure to travel-based attendance, tough compares in the Orlando market cited by peers, and rising concerns about competitor spending have left SEAS shares trading at 6-7x our ’24E EBITDA. We continue to expect 2H23 to benefit from favorable timing of delayed attractions coming on line, as well as potentially better weather comps. Other key tailwinds we are watching for are: the return of group and international visitation, plus growing contribution from high-margin licensing revenues.”

These comments back up Yeh’s Overweight (i.e. Buy) rating on SEAS, and his $65 price target implies the shares will gain 53% on the one-year horizon. (To watch Yeh’s track record, click here)

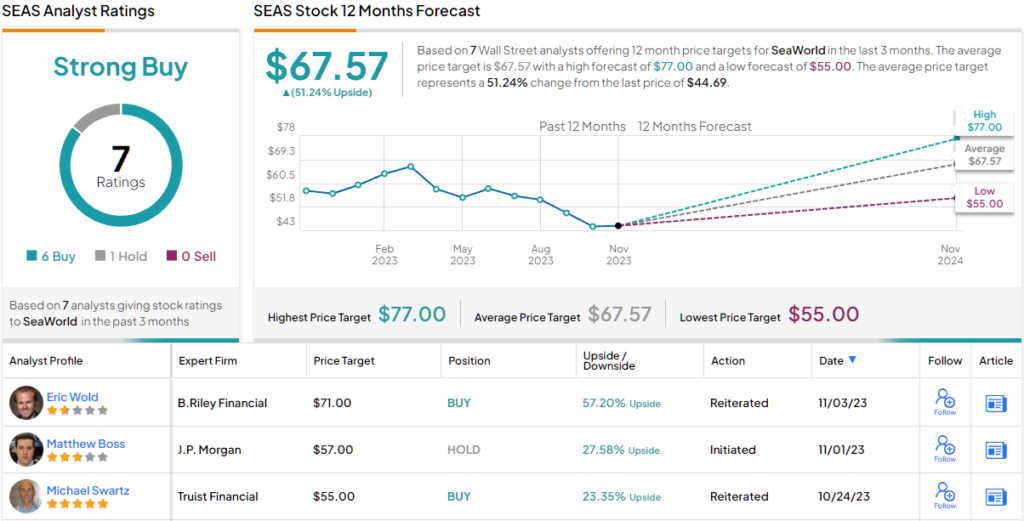

The Strong Buy consensus rating here is based on 7 recent analyst reviews, that break down 6 to 1 in favor of Buys over Holds. The shares are selling for $44.69 and their $67.57 average price target suggests a 51% increase in the next 12 months. (See SeaWorld’s stock forecast)

Cedar Fair Entertainment (FUN)

Next up, Cedar Fair is the parent company of Cedar Point, the famous amusement park located in Sandusky, Ohio. That’s just an out-of-the-way Midwestern town on Lake Erie, but several generations of kids from Ohio, Michigan, Indiana, and Pennsylvania grew up with it as a sort of pilgrimage destination. It wasn’t uncommon for schools to organize class trips to Cedar Point, or families to go for a day during long weekends or summer vacation. But while Cedar Point may be the company’s best-known asset, it is only the tip of this iceberg.

Cedar Fair has 15 entertainment parks, along with numerous accommodation properties, in multiple markets across the lower 48 states. The company boasted some 27 million attendees last year, employs 4,400 people full-time, and typically hires 49,000 seasonal and part-time workers. The company has been public since 1987, and since then has returned $2.7 billion worth of capital to its shareholders.

The company has just released its 3Q23 results, and the top-line numbers beat the forecasts. Revenue came in at $842 million; while this was down 1% y/y, it was $20 million ahead of the expected $822 million. The firm’s adjusted EBITDA came to $388 million, for an increase of 7%, or $27 million, year-over-year. These results were supported by sound attendance numbers, which hit 12.4 million in the quarter, a modest increase of 1% over the year-ago period.

On capital return, mentioned above, Cedar Fair pays out a dividend of 30 cents per common share, with the next payment scheduled for December 20. The annualized payment of $1.20 gives an above-average yield of 3.2%.

This company’s ability to deliver for investors caught the attention of Yeh, who wrote of the stock, “We look for further evidence of underlying consumer spending health, particularly given the recent divergent growth profiles seen within Cedar’s own footprint (Midwest parks attendance was up 7% in 2Q vs. California parks down). Strategic discounts on admissions pricing in CA could be a source of pressure on per cap growth near term, but we see offsetting benefits from driving healthy in-park spend (MSe +2% overall per cap growth in 3Q). Following a period of above-peer expense growth, incremental cost savings initiatives could deliver upside to our margin expectations.”

Yeh went on to rate FUN as Overweight (i.e. Buy), with a $48 price target suggesting a 27% increase in the year ahead. (To watch Yeh’s track record, click here)

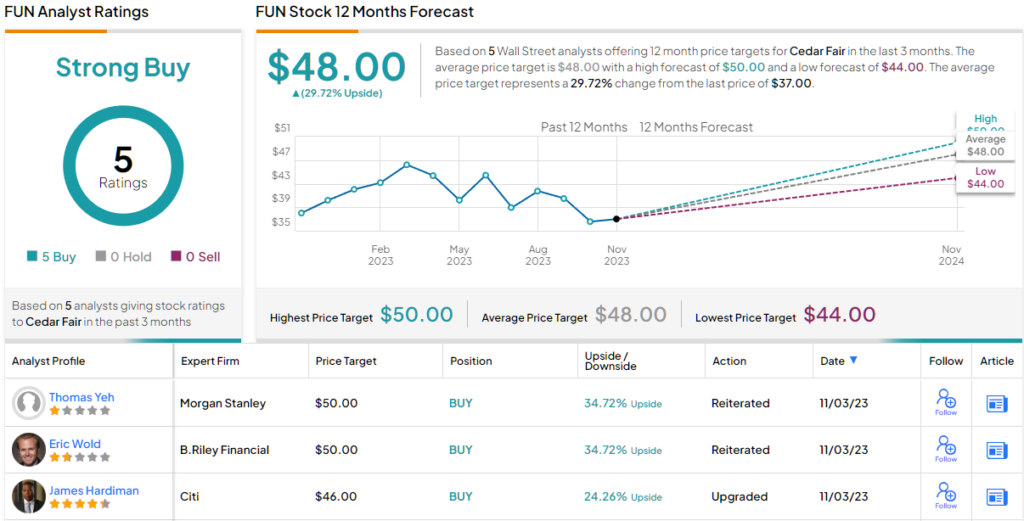

Overall, the 8 recent analyst reviews here include 7 Buys and 1 Hold, for a Strong Buy consensus rating. The stock is selling for $37 and its $48 average price target is similar to the Morgan Stanley view, implying a 29% one-year upside potential. (See FUN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.