Volatility is back on Wall Street. Following a meteoric rise, fears that valuations have grown too high have put pressure on stocks. With the upcoming presidential election, ongoing pandemic and flaring U.S.-China tensions only adding fuel to the fire, investors are trying to gauge where the market goes from here.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Even though many economists believe the Fed’s low interest rate policy fueled the market’s historic five-month rally, Morgan Stanley’s chief cross-asset strategist Andrew Sheets is singing a different tune.

Sheets argues that the market’s charge forward wasn’t necessarily driven by the Fed’s actions. Rather, the run-up came as a result of better-than-expected economic data. “As much as the steady rise of markets seems disconnected from the conditions in the real economy, I’d argue that actually they’re more closely related. And going forward, that is a double-edged sword,” he explained. “This improvement, rather than any new policy that central banks have been enacting, might be the real story of this summer’s strength.”

In other words, should the data slow, stocks might sink even if interest rates stay low. That said, if the trend continues to improve, stocks could continue climbing higher.

Taking this outlook into consideration, we used TipRanks’ database to take a closer look at two names identified by Morgan Stanley as strong value stocks. The firm’s analysts noting that each could gain more than 40% in the year ahead.

Freeline Therapeutics (FRLN)

Using AAV technology, Freeline Therapeutics develops gene therapies to deliver safe and effective gene replacement to the liver to produce sustained therapeutic protein expression for diseases like hemophilia B and Fabry disease. Based on its cutting-edge pipeline, Morgan Stanley is pounding the table.

Representing the firm, 5-star analyst Matthew Harrison points out that its “broad platform provides significant gene therapy opportunity, which can drive $1 billion-plus in unadjusted peak sales.” Highlighting its lead candidate, FLT180a, its gene therapy for hemophilia B (a disease that is characterized by decreased clotting and uncontrolled bleeding), the analyst believes it has major potential.

The current standard of care for hemophilia B involves regular infusions of Factor IX (FIX) protein into the blood, but the FIX activity typically doesn’t remain stable. “FLT180a has the potential to deliver a single-dose cure for patients by achieving FIX levels in the ‘normal’ range of 50-150%. Although active clinical programs for hemophilia B include Spark/Pfizer and uniQure, they have been unable to achieve a mean expression level in the normal range. We thus believe that FLT180a has the potential to be a best-in-class product with $500 million-plus in peak sales potential,” Harrison commented.

With the Phase 1/2 data already de-risking the asset, the implications go even further, in Harrison’s opinion. Along with the hemophilia B program, FRLN has another therapy, FLT190, targeting Fabry disease, a lysosomal storage disorder. While only one patient has been dosed, the analyst argues “the Freeline platform sets up this program for success.”

Expounding on this, Harrison stated, “Given the data in hemophilia B, Freeline’s platform has high potency which can provide high protein expression levels at low doses, and Freeline’s prophylactic immune management regimen appears to prevent immune reactions, which could affect the durability of those high protein expression levels. Because FLT190 is using the same capsid and promoter and the same immune regimen as used for hemophilia B, we believe that, although still at an early stage, FLT190 is primed for success.”

Adding to the good news, the company has early stage programs for hemophilia A, a multi-billion market, according to Morgan Stanley, and Gaucher disease, another lysosomal storage disorder. “While both programs are early, we believe the platform supports their potential,” Harrison mentioned.

It should come as no surprise, then, that Harrison stayed with the bulls. To this end, he kept an Overweight (i.e. Buy) rating and $28 price target on the stock, implying 65% upside potential. (To watch Harrison’s track record, click here)

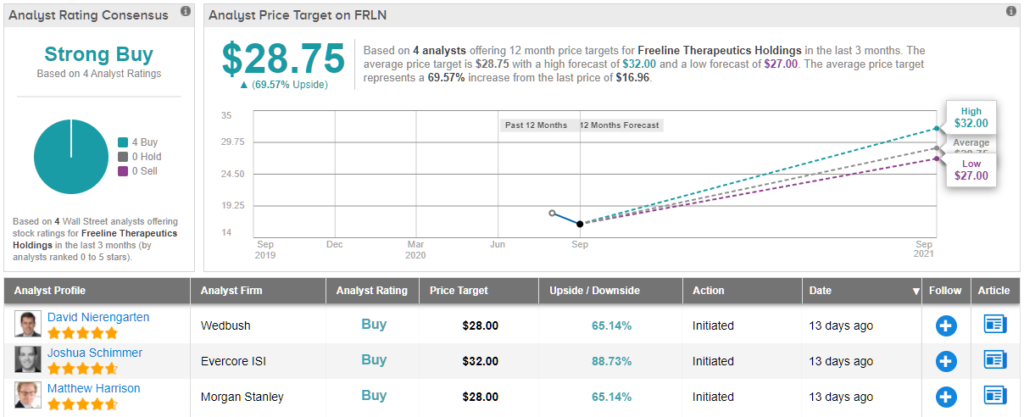

What does the rest of the Street have to say? Only Buy ratings, 4 in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. In addition, the $28.75 average price target suggests 69% upside potential. (See FRLN stock analysis on TipRanks)

Cloudera Inc. (CLDR)

Switching gears now, we come across Cloudera, which delivers an enterprise data cloud for any data, anywhere, from the Edge to AI. Even with ARR ramping up, Morgan Stanley believes this tech company is undervalued.

Firm analyst Sanjit Singh points to CLDR’s Q2 performance as reaffirming his confidence. “Q2 results highlight what has been true now for several quarters – CLDR is now a much more stable business.”

Digging into the details of the print, ARR accelerated to 12% year-over-year, beating the consensus estimate. Subscription revenue growth came in at 17%, also besting the Street’s 14.5% call. The outperformance continued when it came to operating margins and cash flow, which landed at 13.9% and $32 million, respectively. “Resilience within the customer base underscored by improvement in churn rates combined with sharp operational execution helped management raise its FY21 subscription revenue outlook to $755-$765 million (13-15%) from $745-$755 million prior,” Singh noted.

Following the strong print, there is one question on investors’ minds. As both the CDP Public Cloud and CDP Private Cloud have now been officially launched, will the CDP platform become a key revenue driver?

Addressing this question, Singh commented, “The early signs are encouraging with customer count and bookings doubling in the quarter. Management expects revenue traction in FY22 and we are cautiously optimistic that CDP can enable modest improvement in growth particularly as the spending environment recovers.”

Some investors were taken aback by CLDR’s Q3 subscription revenue guidance, which implies a minor quarter-over-quarter decline, but Singh offers an explanation. “This reflects the impact of becoming a pure open source model which results in less up-front revenue recognition vs. Last year when Cloudera was operating a part proprietary/open source model,” he stated.

Summing it all up, Singh said, “Recent results highlight management’s ability to meet investor expectations while delivering on key product milestones, most notably CDP, which better positions the company in the data management market. We see the launch of CDP sustaining growth by improving retention rates and securing new customers as the spending environment recovers. Furthermore, a growing focus on larger enterprises should provide leverage going forward given their more attractive unit economics. With low expectations, achievable ARR estimates and a new product cycle, we see shares attractively valued.”

All of the positives prompted Singh to leave his bullish call and $16 price target unchanged. This target conveys Singh’s confidence in CLDR’s ability to climb 46% higher in the next year. (To watch Singh’s track record, click here)

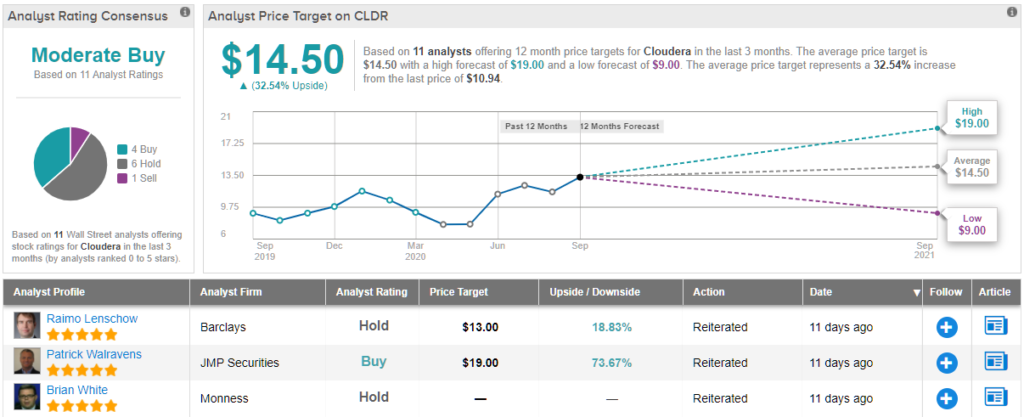

Looking at the consensus breakdown, 4 Buys, 6 Holds and 1 Sell have been published in the last three months. Therefore, CLDR gets a Moderate Buy consensus rating. Based on the $14.50 average price target, shares could rise 32% in the next year. (See CLDR stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.