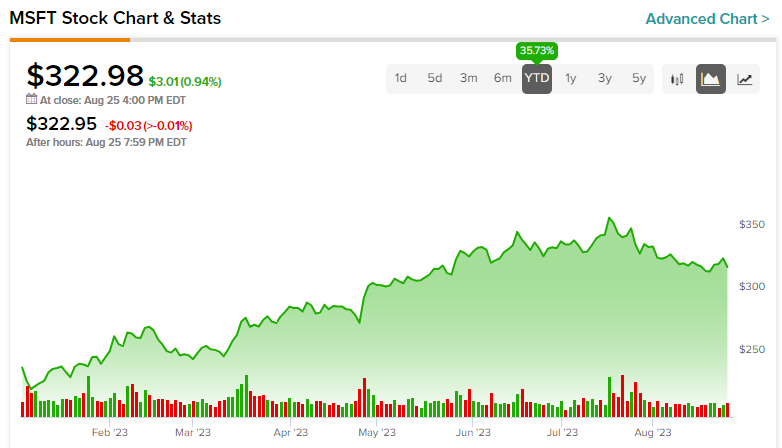

Most investors may think that Microsoft (NASDAQ:MSFT) has already been there and done that. With the stock gaining over 35% year-to-date, they are not entirely wrong. However, it’s crucial to recognize that the tech sector has rebounded strongly in 2023 after experiencing a bloodbath in 2022. Despite MSFT’s close proximity to all-time highs, I believe that it remains a very promising long-term investment. This belief stems from MSFT’s robust presence across multiple growth fronts, including AI, cloud computing, gaming, and more.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Microsoft Continues to Report Upbeat Quarterly Results, Robust Margins

On July 25, Microsoft reported upbeat Q4 results for the fourth consecutive quarter. Q4 adjusted earnings per share of $2.69 grew 21% year-over-year and handily beat the consensus estimate of $2.55 per share.

Besides that, it’s Microsoft’s robust profit margins that are drawing investors in. MSFT’s Q4 gross margin was 70%, while its operating margin was strong at 43%, representing top-notch margins in the tech industry. Operating income grew by 21% (on a constant-currency basis) to $24 billion, while net income grew by 23% (in constant currency) to $20 billion.

Additionally, free cash flows grew by 12% year-over-year to $19.8 billion. These are outstanding numbers, especially in the current market environment. Management, however, provided cautious guidance, indicating that AI growth will be gradual and capital expenditures are expected to remain high.

On a full-year basis, revenues grew by 11% in constant currency to $212 billion, while operating margins soared to around 40%, which is also commendable.

Looking back at the last six years, Microsoft’s revenues have more than doubled from $97 billion in Fiscal Year (FY) 2017 to $212 billion in FY2023. What’s even more applaudable is that the firm’s earnings have almost trebled from $25 billion to $72 billion over the same period, thanks to its robust profit margins. This data gives a huge sense of comfort in the solid business fundamentals and growth trajectory Microsoft has consistently maintained over the years.

Dual Growth Catalysts for the Future: AI & Cloud Computing

AI is going to be the major growth catalyst for most tech companies globally. The global AI market is expected to grow by 20x to almost $2 trillion by 2030 versus the current figure of under $100 billion, for a compound annual growth rate (CAGR) of around 33%, according to Next Move Strategy Consulting.

Microsoft is clearly going to be one of the leading beneficiaries of the AI boom. By backing OpenAI, the company that took the world by storm by launching ChatGPT, MSFT undoubtedly has an edge against competitors. MSFT is revolutionizing its web search engine Bing by empowering it with AI.

Having a partnership with ChatGPT maker OpenAI means that MSFT will remain on top of the latest innovations in the AI space. Much of that can already be seen as MSFT continues to integrate AI in a range of its product offerings, which include GitHub, Bing, Excel, and Azure, to name a few.

Microsoft’s AI-driven product portfolio will begin to ramp up in the coming quarters and will start contributing to revenues gradually. Therefore, it’s only a matter of time before AI tailwinds start making their way into revenues and earnings.

It’s not just AI. MSFT is also quickly moving up the cloud computing ladder. The Cloud business is going to be a direct beneficiary of the humungous growth in AI. As more and more companies switch to AI, it will create a higher demand for incremental cloud-based services to create and maintain AI applications. It’s no wonder, then, that Microsoft is making meaningful investments to enhance its cloud infrastructure in the coming quarters.

During the recently reported Q4 results, the Intelligent Cloud Segment, which includes Azure, represented 43% of total revenues from just 40% a year ago, growing 15% year-over-year to $24 billion. Also, Microsoft Cloud’s gross margin remained robust, growing by 300 basis points to 72%. Therefore, the Cloud segment has become a strong source of recurring revenue and margin growth.

Within the Cloud segment, “Azure and other cloud services” revenue grew by 26% year-over-year. It is noteworthy that cloud service Azure Arc has achieved outstanding customer acquisition growth. It now boasts 18,000 customers, up a massive 150% year-over-year. Moreover, it has a list of premier clients up its sleeves that include Carnival Corp. (NYSE:CCL), Domino’s (NYSE:DPZ), and Thermo Fisher (NYSE:TMO), to name a few. On top of that. Management conceded that Azure OpenAI Service has gained almost 100 new customers every day during the Q4 quarter.

On a separate note, MSFT’s long-due controversial proposed acquisition of gaming software rival Activision Blizzard (NASDAQ:ATVI) for $69 billion may get finalized soon. If the deal does materialize, it will add to the MSFT’s diversified revenue stream.

What is the Target Price for MSFT Stock?

As per TipRanks, Microsoft stock commands an average price target of $391.52, implying 21.2% upside potential from current levels. The Wall Street community is clearly optimistic about the stock. Overall, the stock commands a Strong Buy consensus rating based on 32 Buys, two Holds, and one Sell.

Microsoft’s Valuation Isn’t Cheap but Isn’t too Expensive Either

As mentioned earlier, MSFT stock has significantly rallied, gaining over 35% year-to-date. Likewise, it may look expensive, trading at a P/E of 33.8x currently. Nonetheless, I believe the premium is justified, given its favorable industry-leading market position, robust margins, diversified revenue stream, and huge exposure to high-growth AI and cloud businesses.

Interestingly, Microsoft has consistently increased its dividends over the years but its dividend yield remains low at around 0.8%, with a low payout ratio of 27.7%. Notably, the fact that the company continues to buy back shares despite high prices indicates that management remains confident of the growth trajectory from here.

Conclusion: Consider Buying MSFT for Its Long-Term Growth Drivers

Microsoft stock is all set for high growth over the coming years, thanks to its exposure to multiple sectors that include AI, cloud services, gaming, and more. With the accelerated penetration of its AI and cloud computing services, the stock is likely to see higher highs in the coming years. Therefore, I will be buying the stock at current levels, holding a long-term investment perspective.