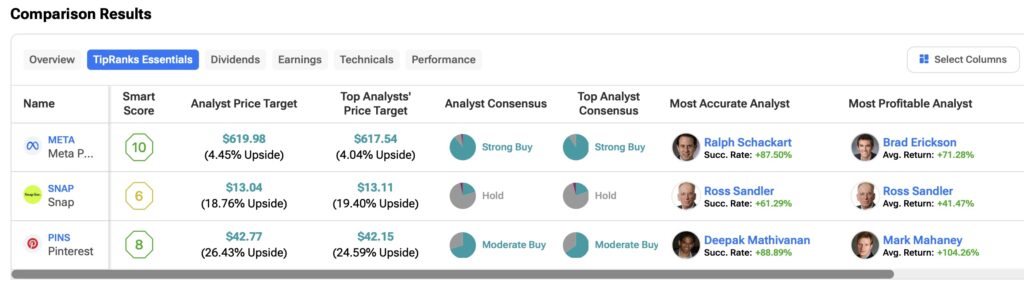

In this article, I use the TipRanks Stock Comparison Tool to analyze social media companies Meta Platforms (META), Snap Inc. (SNAP), and Pinterest (PINS). Considering recent performance, growth potential, valuation, and Wall Street consensus, I maintain a bullish stance on Meta and Pinterest, while taking a neutral outlook on Snap. Ultimately, I believe Pinterest presents the greatest upside potential due to its growth prospects and valuation, despite experiencing bearish momentum recently.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Meta Platforms

I hold a bullish view of Meta Platforms, which dominates the social media landscape with sites such as Facebook, Instagram, and WhatsApp that, together, have 3.27 billion monthly active users. The stock has risen nearly 85% in the past year and trades well above its 200-day moving average of $484.77, as the chart below demonstrates.

Despite its market dominance, META continues to attract users, achieving a 7% year-over-year increase in Q2. The company has effectively monetized its user base, generating $39.1 billion in revenue, a 22% annual increase. This has resulted in average revenue per person (ARPP) of $11.89, up from $10.42 during the same period a year earlier.

However, much of Meta’s investment thesis has centered on artificial intelligence (AI), aiming to enhance advertising and consumer behavior. Meta plans to scale AI-based products such as Meta AI and AI Studio. In its latest quarter, the company raised its annual capital expenditure forecast from $35-$40 billion to $37-$40 billion, with further increases expected by 2025 due to AI investments.

Meta’s Growth, Valuation and Wall Street Consensus

My optimism about Meta stock is largely based on its growth prospects, fueled by significant investments in AI. Analysts project earnings per share (EPS) growth of 19.3% over the next three to five years, with revenues expected to rise at a compound annual growth rate (CAGR) of 13% through 2026. With a forward P/E ratio of 27.6x, this results in a PEG ratio of 1.43x. While this suggests Meta is not cheap, its market dominance justifies a premium valuation as solid future performance can be expected.

However, even with a bright long-term outlook, the near 85% gains over the past 12 months may indicate that the stock has reached some limitations. According to TipRanks, the Wall Street consensus rates META as a Strong Buy, with an average price target of $618.05, implying potential upside of 4.02%.

Snap

I hold a neutral view of Snap, the developer of Snapchat, which primarily appeals to a young audience. This outlook is based on disappointing recent financial results and an unfavorable balance between growth and valuations. Although the stock is up 13% over the past 12 months, SNAP is trading well below its 200-day moving average of $13.30, which can be seen in the following chart.

For Q2 of this year, Snap reported revenues of $1.24 billion, slightly below the $1.25 billion forecast, resulting in a 27% drop in stock price the following day. Weak guidance that called for Q3 revenues between $1.33 billion and $1.37 billion didn’t help matters, especially as the consensus was for $1.36 billion.

Despite these challenges, some positive metrics emerged: daily active users (DAUs) increased by 9% to 432 million, and average revenue per user (ARPU) rose to $2.86, up from $2.69 the previous year. However, this figure remains significantly lower than the all-time high of over $4 per user reached in 2021.

Snap’s Growth, Valuation and Wall Street Consensus

My skepticism about Snap is due mostly to its weak growth prospects and current valuation. Although EPS is projected to reach $0.22 by the end of 2024—a 144% increase—this growth trend is unsustainable. Analysts estimate a 14.1% decline in EPS growth over the next three to five years while revenues are expected to grow at a CAGR of 13.4% through the end of 2026.

Furthermore, Snap’s forward price-to-earnings (P/E) ratio stands at 50.6x, significantly higher than the industry average of 13.7x. Even with EPS projections of $0.59 for 2026, the P/E ratio would still be nearly 19x. I believe this remains a stretched multiple, considering the company’s history of earnings volatility since its initial public offering (IPO).

Therefore, it is no surprise that, according to TipRanks, Wall Street rates SNAP as a Hold, even though it has an average price target of $13.09, indicating potential upside of 18.89%.

I maintain a bullish stance on Pinterest as it targets a different audience than either Snap or Meta Platforms, focusing on women with purchasing power and emphasizing shoppable features. However, despite a 24% increase over the past 12 months, its stock still trades below its 200-day moving average of $36.51, as can be seen in the following chart.

Pinterest has prioritized cost control and reducing losses, showing significant improvement in this regard. However, like Snap, its stock fell sharply after reporting earnings. Although it beat market estimates, the company issued soft revenue guidance, projecting Q3 2024 revenue of $885 million to $900 million.

The Q3 forecast for operating expenses ranges from $485 million to $500 million, largely driven by hiring AI talent, indicating an anticipated 17% to 20% expense increase that will outpace revenue growth of 16% to 18%. Despite these challenges, Pinterest reported positive metrics, with global monthly active users rising 12% year-over-year to 522 million and average revenue per user increasing by 8% year-over-year to $1.64.

Pinterest’s Growth, Valuation and Wall Street Consensus

Despite recent results weighing on its outlook, Pinterest’s projected growth trends remain bullish. Analysts anticipate EPS growth at a robust CAGR of 44% over the next three to five years, while revenues are expected to grow at a CAGR of 18.7% over the next three years.

Aligning this growth with the current forward P/E ratio of 23.4x suggests a PEG ratio of 0.5x, indicating potential undervaluation. Furthermore, with EPS projections of $2.19 for full-year 2026, Pinterest would trade at a P/E of 15x, significantly lower than peers like Meta.

Therefore, at TipRanks, Wall Street consensus rates PINS stock as a Moderate Buy, highlighted by an average price target of $42.69, suggesting potential upside of 25.71%.

Conclusion

While Meta dominates the social media landscape and has strong long-term growth potential, I rate Snap as neutral due to its unjustifiable valuation. In contrast, I believe Pinterest is the best investment among the three, as it is well-positioned for stronger growth at a reasonable price and may offer greater upside potential than either Meta or Snap.