Meta Platforms (NASDAQ:META), the most dominant social media company in the world, has seen its market value surge by 167% this year, erasing the losses registered in 2022. Even on the back of this stellar performance, Meta stock still offers upside potential for growth investors with a long-term perspective. The ongoing monetization of WhatsApp and the prospects for the Asia-Pacific region are at the center of my investment thesis for the company. I am bullish on Meta stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

WhatsApp Monetization Gathers Pace

In 2014, Meta Platforms acquired WhatsApp for a staggering $19 billion. When this deal was finalized, many investors and analysts cast doubt over WhatsApp’s monetization potential. Over the last few years, Meta has introduced several features to improve the earnings potential of WhatsApp. Today, the company is on the brink of turning WhatsApp into a cash cow.

Meta’s monetization plans for WhatsApp are centered around the WhatsApp Business application. This app, which works as a standalone app, offers many useful features for businesses, including options to create a business profile, send automated messages to existing and potential customers, and even accept payments through WhatsApp Pay in a few markets, including Brazil, India, and Singapore.

Meta recently started charging fees from WhatsApp Business users in exchange for advanced features. According to the price documents published by the company, users will have a free quota of messages every month and then will be charged based on the usage. The company has introduced four conversation categories — marketing, utility, authentication, and service — to accelerate the monetization of users accordingly.

According to Statista, there are almost three billion monthly active WhatsApp users worldwide. This is a massive target market for businesses of all scales and sizes. In the future, many businesses are likely to pay for the premium features unveiled by WhatsApp Business to reach their target audiences, paving the way for Meta to aggressively monetize the rich user data collected by the company for almost a decade.

The APAC Opportunity

Meta is the undisputed leader in the social media industry and Facebook is its crown jewel. A closer look at Facebook earnings reveals there is a long runway for the company to grow in the Asia-Pacific region.

As of the third quarter, the Asia-Pacific region was home to 1.35 billion monthly active Facebook users, making it the largest geographical market segment for the platform. This region, however, currently contributes to a small portion of Facebook’s revenue due to monetization challenges that are inherent to this region.

For context, in the third quarter, Facebook’s average revenue per user (ARPU) in the U.S. and Canada was $56.11, substantially above the Asia Pacific’s ARPU of just $5.12. This highlights a major anomaly, where Facebook is generating the bulk of its revenue from a region that is home to just 271 million active users – the lowest among all regions.

There are many reasons to believe that this anomaly will be short-lived.

First, the Internet penetration rate in many Asian countries is improving, which creates a platform for ad dollars to shift from traditional routes to online channels. From a meager 21.5% in 2010, Asia’s Internet penetration rate has improved to 67% today, aided by multi-billion-dollar IT infrastructure development projects. The digitalization of Asian economies will accelerate in the next phase of the business cycle once recession fears subside, creating a strong platform for Meta-owned Facebook to grow its ARPUs in this region.

Second, smartphones have become the go-to device to access the Internet in many Asian countries, which should help Facebook attract a higher percentage of online ad dollars in the future.

For instance, in the populous Southeast Asian region, 88% of Internet users accessed the Internet via a smartphone in 2022. With the smartphone adoption rate in the Asia-Pacific region expected to eclipse 90% by 2030, social media platforms stand to emerge as big winners in the online advertising industry. Facebook’s dominance, therefore, will be handsomely rewarded.

Third, Facebook Watch is growing in popularity as one of the most preferred platforms to watch videos from different types of content creators, which should aid ARPU growth in Asia in the future as advertisers have shown a tendency to direct a higher proportion of their ad budgets to video advertising in recent years.

In addition to these factors, the rise of social commerce and Meta’s adoption of programmatic advertising will act as catalysts driving APAC region ARPUs higher in the next few years.

Is Meta a Buy, According to Wall Street Analysts?

Despite a strong comeback from Meta stock in 2023, many analysts continue to believe in the company’s potential to deliver attractive shareholder returns both in the short and long run.

On December 13, UBS analysts highlighted Meta as one of their top picks for 2024, which does not come as a surprise, as the global advertising industry is expected to recover next year, paving the way for Meta to grow its ad revenue. On December 11, Goldman Sachs (NYSE:GS) analysts identified Meta as one of the frontrunners to benefit from the continued growth of AI and automation. Oppenheimer has also listed Meta as a potential winner of AI’s rise.

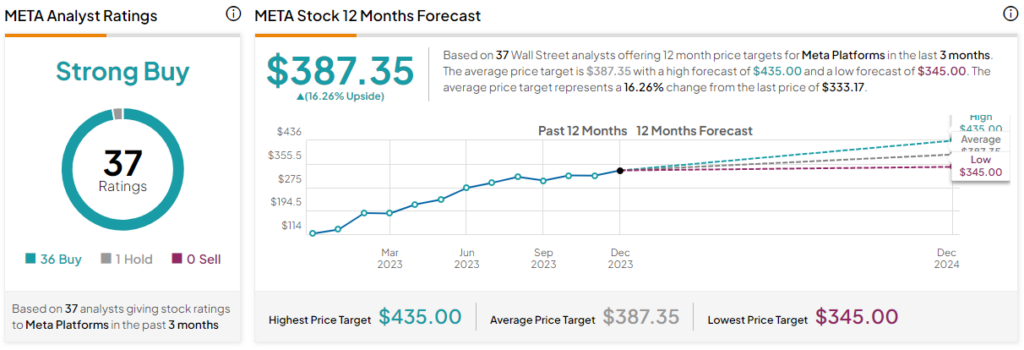

Based on the ratings of 37 Wall Street analysts, META stock comes in as a Strong Buy. Further, the average Meta Platforms stock price target is $387.35, which implies upside potential of 16.26% from current levels.

Meta is not cheaply valued at a forward P/E of 23.35, but the company is entering a phase where growth is likely to accelerate, which justifies its premium valuation. In addition, it seems rational to attach above-average earnings multiples to Meta, given that it enjoys quantifiable competitive advantages over its peers.

The Takeaway: META Stock is Still Attractive

A couple of years ago, many investors feared Meta’s growth prospects, as the company struggled to maintain double-digit growth amid the challenges faced by the advertising sector. However, Meta has returned to growth this year, with revenue growing by 11% and 23% year-over-year in Q2 and Q3, respectively. With WhatsApp monetization beginning to show promising results and the Asia-Pacific region setting up for growth, Meta Platforms stock still looks attractive despite recent gains.