The tech sector has been powering market gains over the past year, and AI stocks have been at the forefront of tech. AI has the potential to overturn the tech world and recast the general economy; in doing so, it also has the potential to be a gold mine for investors.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

But not every AI stock will fully realize that potential. Some are clearly going to lead in innovation or bring higher returns, and Wall Street’s analysts are busy now sorting out the equity landscape to find those shining opportunities.

Covering the AI/tech world from Oppenheimer, two 5-star analysts are taking divergent views on Meta Platforms (NASDAQ:META) and Microsoft (NASDAQ:MSFT). Both companies have been making waves in the AI world lately; Microsoft was an early backer of generative AI, while Meta has recently been finding innovative ways to use the technology.

So, let’s take a closer look to find out which one is the investment bank’s choice as the superior AI stock to buy.

Meta Platforms

We’ll start with Meta, the parent firm of Facebook and the world’s leader in the social media field. The company was founded as Facebook, 20 years ago; in 2021, after Facebook had made several social media acquisitions, the company rebranded as Meta Platforms. Today, Meta owns and operates Facebook, as well as Instagram, Messenger, and WhatsApp. Through these platforms, the company can reach out to a huge audience – at the end of 2Q24 this year, Meta reported a Daily Active People (DAP) number of 3.27 billion, or nearly 40% of the world’s total population. An audience of that magnitude is an asset that cannot be discounted.

Meta’s audience-asset lies at the heart of the company’s chief revenue driver, digital advertising. This is Meta’s core business, and in the second quarter of this year, the last quarter reported, the company showed a 10% increase in ad impressions delivered across its platforms – as well as a 10% increase in the average price paid per ad. That led to a 22% year-over-year revenue gain, to a quarterly top line of $39.07 billion – a figure that also beat the forecast by $760 million. At the bottom line, Meta beat the Q2 forecast again, with the $5.16 EPS coming in 40 cents per share ahead of expectations.

Solid revenues and consistent profits are only part of the story, however. Meta has been preparing itself to meet the future of the online world – and understands that that future is AI. The company is no stranger to AI tech, having put it to use in developing targeted digital advertising over the past several years, and using AI in its translation algorithms to make its social media platforms more widely accessible.

But the real work is in generative AI, and Meta has two chief developments in this field. The first is Llama, Meta’s open-source AI software model. The company has already released Llama 3, and aims to use the platform to create a flexible and readily usable AI environment. Making the platform open-source allows users to develop tweaks and additions that will meet idiosyncratic needs, as well as permitting the public to make improvements.

In addition to Llama, Meta has released an online AI chatbot/assistant, dubbed Meta AI. This interactive tool is available across all of the company’s social platforms, and has rapidly become a successful addition to the company’s toolbox – and popular with users. The chatbot had 400 million monthly active users at the end of August this year, with that number trending upwards quickly. Meta created Meta AI as a gen AI challenger to ChatGPT, and is well on that path.

For Oppenheimer analyst Jason Helfstein, the most important factor here is Meta AI. He notes the recent expansion of the online assistant, and lays out how it will benefit the company as a whole. “META AI on track to be most-used AI assistant by year-end, ~500M MAU, with more country launches,” the 5-star analyst explained. “We believe the long term benefits from AI content recommendation, ad targeting, business messaging and ads generation will become more exciting to investors overtime, and support META’s terminal value. We believe China ecommerce remains strong, with results/guidance implying continued acceleration on 2-year growth (and no cautionary comments). Near term, we are also encouraged from the positive commentary surrounding US Facebook and Whatsapp young adult engagement.”

These comments support Helfstein’s Outperform (Buy) rating on the shares, although his price target of $615 implies a modest 4% gain on the 12-month horizon, a low upside that is indicative of the stock’s continued gains (up 68% year-to-date). (To watch Helfstein’s track record, click here)

Overall, META shares have a Strong Buy consensus rating from the Street’s analysts, based on 46 recent reviews that include 42 to Buy, 3 to Hold, and 1 to Sell. However, due to the strong rally, the average target price of $611.20 suggests an upside of just 3% over the coming year. (See Meta stock forecast)

Microsoft Corporation

Now on to another tech giant. Microsoft made its name in the 70s and 80s as a leader in the PC market, and now its Windows operating systems and Office software packages have become the industry standard for home, small business, and enterprise-level PCs and laptops. Microsoft has managed this through a combination of developing quality products that do what the user needs and wants – and through smart marketing, making its Windows logo one of the world’s most recognizable brands. Today, Microsoft boasts a market cap of $3.08 trillion and is the world’s third-largest publicly traded company.

Like Meta above, Microsoft has not been resting on its laurels. The company reached the top of the heap on its track record of proven products, and it’s using its deep resources and long expertise to adapt itself to the changes that AI is bringing to the world of tech. One of the most prominent of Microsoft’s uses of AI is the integration of the AI-powered Copilot online assistant feature to its Windows and Office software packages.

Microsoft has been able to do this by building on its status as an early backer of generative AI tech. The company put billions into OpenAI, the firm that brought ChatGPT to the market – $13 billion, more precisely. In return for that investment, Microsoft has secured rights to 75% of OpenAI’s future profits. Microsoft’s royalties will drop to 49% once the initial investment is recouped.

The company’s large AI investment hasn’t just brought it an additional income stream – Microsoft has also been able to integrate generative AI technology into its search engine, Bing. Bringing AI to the search engine has made the engine more responsive to natural language queries and improved search results, both of which make the search feature easier to use and more competitive with Google.

AI has also become ever-more important to Microsoft’s cloud computing system, Azure, which competes with Google’s Cloud and Amazon’s AWS. Azure already has more than 200 cloud-based software tools available to subscribers, and adding AI to the mix provides enhancements and greater flexibility for users.

Building out all of these AI features and tools, and adding them to existing platforms, does not come cheap – but as noted, Microsoft has deep pockets. And the company has buttressed that with consistent revenue growth. In the last quarter reported, fiscal 4Q24, the company brought in $64.7 billion at the top line, beating the forecast by $260 million and growing 15% year-over-year. The company’s earnings came to $2.95 per share, up 10% y/y and 2 cents per share ahead of the forecast.

The company’s Azure cloud segment, however, grew at a slower pace than expected – rising 29% y/y compared to the 30% to 31% revenue growth that analysts were looking for.

5-star analyst Timothy Horan, however, is more worried about potential slowdowns and headwinds in the AI field. In his Oppenheimer note on MSFT, Horan explains his position, “We believe estimates for revenue and EPS are too high. Open AI losses are the primary concern and could be in the $2-3B range in FY25, which we were not previously modeling. As per our recent AI report, enterprises have been slow to adopt AI and associated revenues will likely disappoint. Other factors include the impact of heightened CapEx on higher depreciation, lower interest income and higher OpEx to support AI. Because MSFT are investing in once-in-a-generation technology, we don’t believe expanding margins will be a short-term priority. MSFT is trading at the midpoint of its five-year range of ~25x-35x P/E, and could trade to the lower end.”

Horan follows this by downgrading his stance on MSFT from Outperform to Perform (Hold) and withholding a price target for the stock. (To watch Horan’s track record, click here)

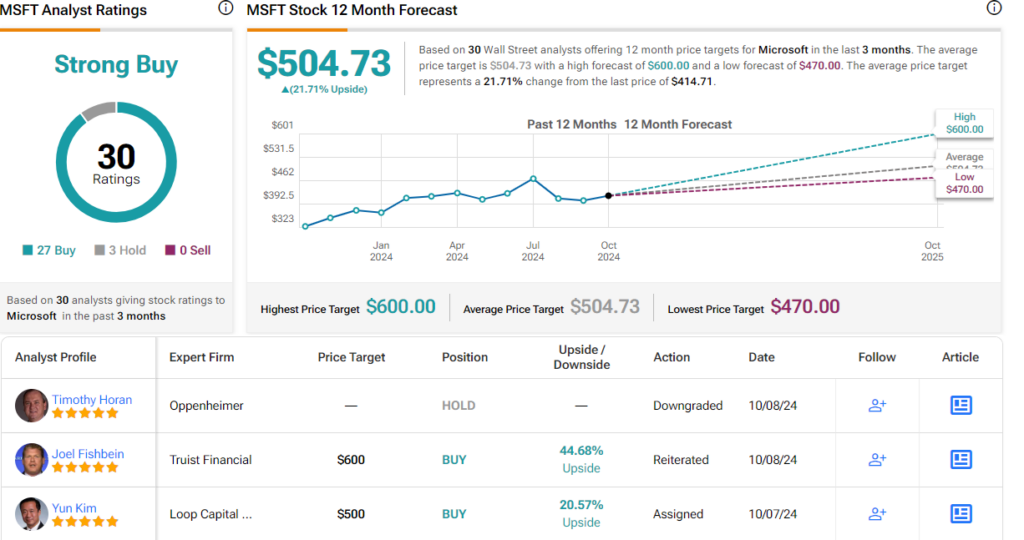

While the Oppenheimer view is cautious, Wall Street remains bullish on Microsoft. The 30 recent reviews, including a lopsided 22 to 3 Buy-Hold ratio, give the stock a Strong Buy consensus rating, while the $504.73 average target price and $414.71 trading price together suggest a 22% gain on the one-year horizon. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.