Social media company Meta Platform’s (NASDAQ:META) efforts to strengthen its position in the AI (artificial intelligence) race have gained significant traction in recent months. The stock has risen by 162% year-to-date, outperforming the S&P 500’s (SPX) 12% gain, and analysts see more upside ahead. Meta’s attempt to strengthen and monetize its already popular social media platforms by adopting generative AI could boost its revenue and earnings in the next few quarters. Hence, I am bullish on META stock now.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Meta Platforms: Gearing Up for Another Strong Quarter

Meta (formerly Facebook) is a part of the big tech FAANG group, which also includes Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Alphabet (formerly Google) (NASDAQ:GOOGL).

Meta Platforms owns social media platforms Facebook, WhatsApp, Instagram, Messenger, the recently launched Threads, and others. These fall under one of its segments, Family of Apps (FoA). Its augmented and virtual reality-related products and services fall under its other reportable segment, Reality Labs (RL).

Reality Labs hasn’t been profitable for the company. In Q2, it reported a $3.7 billion operating loss, however, thanks to its FoA segment, which is making up for the damage done. It brought in $31.7 billion in revenue, accounting for a chunk of total revenue, resulting in a $13.1 billion operating profit.

CEO Mark Zuckerberg had set 2023 as the “year of efficiency” and has been working hard to make that happen. It entailed layoffs, reducing spending on less significant projects, and focusing on more AI-related projects. During its Q2 earnings call, the company discussed how its AI-related investments over the years are finally paying off.

Meta Stock: Powering Through AI Innovations

Certainly, it has been a year of efficiency. Most recently, at Meta’s Connect conference, CEO Mark Zuckerberg unveiled the company’s new generative AI products, which sparked market excitement. Meta AI is an advanced conversational assistant that can generate text responses and photo-realistic images and is integrated with Meta’s popular products, WhatsApp, Messenger, and Instagram.

Meta AI is powered by Llama 2, its large language model, which it released in July in collaboration with Microsoft (NASDAQ:MSFT). The company intends to incorporate Meta AI into its mixed reality headset, Quest 3, and another new offering, a new generation of Ray-Ban Meta smart glasses. The company will launch Quest 3 on October 10.

Zuckerberg described Quest 3 as the best value in the industry for combining digital and real-world experiences at a low cost. Indeed, it is low-cost, priced at $500, while competing with Apple’s Vision Pro Headset, which will come with a price tag of around $3,500. Apple’s headset is set to hit the market in early 2024.

What’s more, its new generation of Ray-Ban Meta smart glasses, in collaboration with EssilorLuxottica, are priced at $299. The glasses will be launched in the third week of October. Meta claims the glasses can take pictures, record videos, and connect to social media.

Along with these, Meta has added generative AI stickers to its messaging apps. It could use AI to unlock more monetary potential in the wildly popular messaging app WhatsApp, which it purchased for $19 billion in 2014. More features from the company include its monthly subscription charges for ad-free Instagram and Facebook app use in Europe, which could be around 10 euros ($10.60 at current exchange rates).

CFO Susan Li stated that the company’s capital expenditures could rise in 2024 as it navigates AI and metaverse opportunities by expanding its workforce with more technical roles.

Looking ahead, management anticipates revenue in the third quarter to be in the $32 billion to $34.5 billion range, representing an impressive 16% to 25% increase over Q3 2022. Meanwhile, analysts expect its revenue to be in the $29 billion to $34 billion range, with earnings estimates ranging from $2.27 to $4.27 per share, with the consensus EPS estimate landing at $3.59. On October 25, Meta will report its third-quarter earnings.

Additionally, Meta closed its Q2 with a hefty cash balance of $53.5 billion and $18.3 billion in long-term debt. Given the company’s rapid growth in revenue and profits, repaying the debt shouldn’t be hard. Furthermore, it generated a sizable $11 billion in free cash flow in the quarter, which should aid in debt repayment and future project financing.

While in pursuit of getting ahead in the AI race, Meta also believes this technology is still in its early stages and thus intends to build it responsibly.

Is META Stock a Buy, According to Analysts?

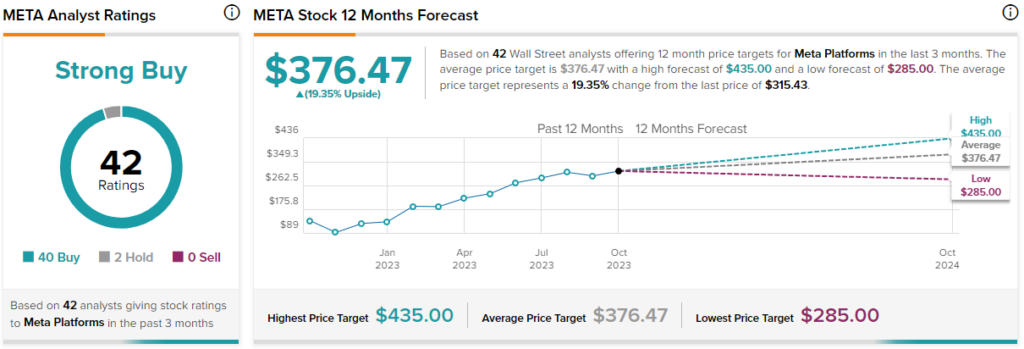

Turning to Wall Street, TipRanks rates Meta as a Strong Buy, with 40 Buys, two Holds, and no Sell ratings assigned in the past three months. The average META stock price target of $376.47 implies 19.35% upside potential. The highest price target for the stock stands at $435, while the lowest is at $285 per share.

The Takeaway

Summing up, sitting at a market cap of $811.6 billion, Meta is very close to joining the $1 trillion club. With Meta’s efforts to monetize its social media apps and capitalize on the massive growth brought about by AI, the company is well-positioned to achieve this goal. Though the AI niche is enticing, it is also susceptible to market fluctuations. But for now, I share Wall Street’s optimism about META stock’s outstanding long-term prospects.