Fast-food stocks have faced challenges as the U.S. economy slows and consumers pullback on their discretionary spending. In this article, I use the TipRanks Stock Comparison Tool to evaluate some of the industry’s biggest names and determine which one is a good investment. In preview, I consider McDonald’s (MCD) to be the best option and rate the Golden Arches a Buy. I maintain a Hold position on Starbucks (SBUX) and a Sell position on Chipotle Mexican Grill (CMG).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

McDonald’s (MCD)

My bullish view of McDonald’s is based on its resilient business model, which leverages rents and royalties while selling burgers and fries to hungry masses. This approach makes the company highly adaptable across economic cycles.

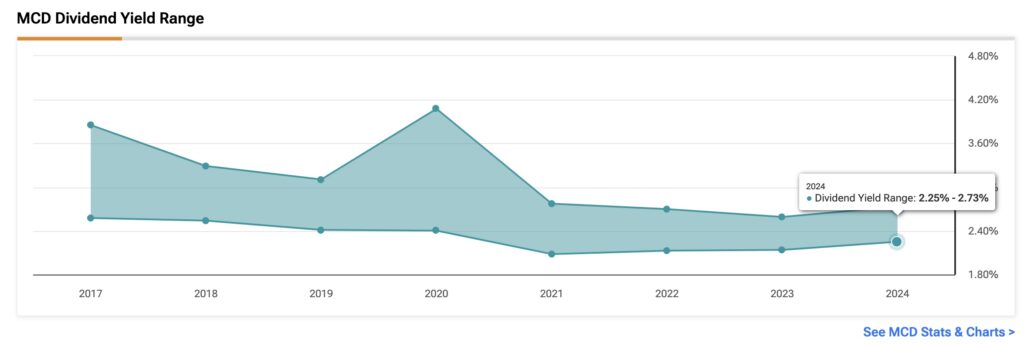

McDonald’s stock is best approached as a defensive investment. Leveraging its strong cash flow, McDonald’s has become an attractive dividend payer, having increased its payout for 48 consecutive years. MCD stock currently has a dividend yield of 2.2% and a five-year dividend growth rate of 8.3%.

If there’s a downside, it’s that McDonald’s trades at a 50% premium to the industry average with a forward P/E ratio of 24.7, though this is lower than its five-year average of 27.6. Given its slow growth—4.2% compound annual growth rate (CAGR) over the past five years and a projected 2.3% revenue increase this year—some investors may view the stock as expensive.

McDonald’s Recent Results

While I remain bullish on McDonald’s, the company’s recent results weren’t great. In Q2, McDonald’s missed both top and bottom line estimates, with $6.49 billion in sales, which were $150 million short of analysts’ consensus expectations. This was the first quarter of declining sales since the onset of the Covid-19 pandemic in 2020.

Owing to the poor financial results and signs of slowing growth, McDonald’s has underperformed the broader index, rising less than 8% year to date. Analyst Jon Tower at Citigroup (C) notes some improvement in U.S. consumer spending, but international markets face challenges due to inflation and rising unemployment.

Is MCD Stock a Buy?

The consensus view of 26 Wall Street analysts is that MCD stock is a Moderate Buy. This is based on 18 Buy and eight Hold recommendations made in the last three months. There are no Sell ratings on the shares. The average price target of $299.52 suggests a modest upside potential of 2.44%.

Read more analyst ratings on MCD stock

Starbucks (SBUX)

I am personally neutral on coffee chain Starbucks. The stock could be a decent long-term investment due to its high-quality business and product, and its hefty dividend that yields 2.39%. However, Starbucks comes with more risk than McDonald’s. While Starbucks trades at a 27 times forward earnings estimates —higher than McDonald’s—this is nearly 23% below its five-year average.

Like, McDonald’s Starbucks continues to increase its dividend payment to shareholders, lifting it by 7.5% in 2023. Yet, the yield may be unsustainable as management targets a 50% payout ratio, compared to the current 64%.

SBUX operations have also faced challenges this year. The company has reduced its full-year growth forecast from 7% to 10% to low single-digit percentages. This resulted in SBUX stock falling more than 15% between May and August. A CEO change, replacing Laxman Narasimhan with Brian Niccol, the former CEO of Chipotle Mexican Grill, caused shares to rebound to levels seen at the beginning of the year. However, the stock remains down 8% over the past three years.

SBUX’s Earnings

Supporting my neutral stance has been Starbucks weak financial results. The company most recently generated revenues of $9.1 billion, a 1.1% year-over-year decline that fell short of Wall Street estimates that called for $9.24 billion. This shortfall was due to a decrease in comparable store sales and a 5% decline in the number of transactions at Starbucks outlets.

Despite these results, the market was encouraged by the leadership change and fresh start under new CEO Brian Niccol. Morgan Stanley (MS) analyst Brian Harbour says that simplifying the menu and investing in labor and equipment to improve service speed could positively impact Starbucks financials moving forward.

Is Starbucks a Buy or Sell?

Twenty-four Wall Street analysts rate SBUX stock a Moderate Buy. This is based on 14 Buy, nine Hold and one Sell recommendation issued in the last three months. The average price target on SBUX stock of $99.50 suggests slight upside potential of 1.77%.

Read more analyst ratings on SBUX stock

Chipotle (CMG)

Last but not least we have Chipotle, which I am bearish on. Despite its strong performance compared to McDonald’s and Starbucks, the company’s high valuation and margin pressures lead me to be cautious about the company’s long-term prospects.

The recent departure of CEO Brian Niccol to Starbucks has added to uncertainty at Chipotle, with shares dropping 10% post-announcement. Despite strong growth prospects, Chipotle faces rising competition from new entrants such as Cava Group (CAVA). The stock’s 52 times forward P/E ratio is more than three times the industry average, though it is nearly 20% below its five-year average.

In recent months, Chipotle has faced criticism over its portion sizes, leading to more generous servings for customers. This adjustment could compress margins due to high food costs, potentially impacting profitability. Given its current premium valuation, Chipotle must demonstrate that it can maintain profitability and growth to justify its stock price.

Chipotle’s Financials

Despite my bearish stance, Chipotle’s recent Q2 earnings were strong. The company beat on both top and bottom lines, with revenues growing 18.2% year over year to $3 billion, and an 11% increase in comparable store sales. Guidance for the full year remains optimistic, with expected comparable sales growth in the mid-to-high single-digits.

Still, potential margin pressures from higher sales costs and wage inflation raise concerns. While a second-half slowdown is anticipated by the company’s management team, it remains uncertain how Chipotle will sustain growth over the long term.

Is CMG Stock a Buy?

Wall Street’s consensus is that CMG stock is a Moderate Buy. This rating is based on 17 Buy and eight Hold recommendations made in the last three months. There are no Sell ratings on the shares. The average price target on CMG stock of $62.67 suggests upside potential of 8%.

Read more analyst ratings on CMG stock

Conclusion

Among McDonald’s, Starbucks, and Chipotle, the Golden Arches stands out as the best investment due to its resilient business model and strong dividend yield. Starbucks shows long-term potential but faces challenges and a leadership change. Chipotle, while performing well recently, is exposed to significant risks from high valuations and margin pressures.