When a company’s entire net worth is tied to a wildly fluctuating asset, it gets difficult to analyze the stock. Do you analyze the stock, or the asset?

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What if the asset is wiped out? Does the company have another source of revenue? Marathon Digital Holdings (MARA) mines cryptocurrencies, primarily Bitcoins. When Bitcoin (BTC) prices rose rapidly in 2021, Marathon stock surged as well.

It hit $76 in November 2021. Since then, Bitcoin prices have crashed, and Marathon has followed suit. The stock closed at $11.39 on May 13, down around 85%. We’re bullish on Marathon despite the huge fall.

Marathon wasn’t always a Bitcoin miner. From its inception in 2010 until 2021, the company was a patent holder. It was called Marathon Patent Group, and held patents in the encryption space. Last year, the company changed its name, replaced its CEO, and got into the Bitcoin mining business.

Marathon’s business model functions this way: Miners need technology and computing power to mine Bitcoins. Marathon provides it. Its technology helps miners mine Bitcoin faster.

The speed of mining Bitcoin is called hash rate. The better the tech, the faster the hash rate. The more the miners, the more Bitcoins they can mine. Marathon deploys miners and provides them with tech to mine Bitcoin. Marathon then sells the mined Bitcoin to make a profit.

Q1 Numbers

The company reported its earnings for Q1 2022. Revenue increased 465% to $51.7 million from the same quarter in 2021. However, it decreased by $8.6 million, or 14%, from Q4 2021.

Marathon’s Bitcoin production increased 556% to 1,259 Bitcoin for the quarter, compared to 192 Bitcoin in Q1 2021. It also increased 15% from Q4 2021. The fact that revenue decreased $8.6 million, even though production was up 15%, shows how bad the numbers have been hit with falling price of the flagship cryptocurrency.

The company said that the revenue decline compared to Q4 2021 was the result of a fall of around 25% in average revenue per Bitcoin mined. Marathon had a cash balance of $110.8 million at the end of Q1.

The total number of miners deployed by the company at the end of the quarter was 36,830. This number is going to increase exponentially in 2022.

Fred Thiel, Marathon chairman and CEO, said, “We believe 2022 will be transformational for Marathon as we are in the process of deploying nearly 200,000 miners and transitioning our operations to be 100% carbon neutral.”

Year-to-date, Marathon has produced 1,558 Bitcoin, an increase of 340% from Q1 2021. The company owns a total of 9,673 BTC, with a fair market value of $365.5 million.

The last time Marathon sold its Bitcoin was on October 21, 2022. Marathon has been “HODLING” on to BTC since then. In January 2021, it purchased Bitcoin for an average price of $31,168 per coin.

Wall Street’s Take

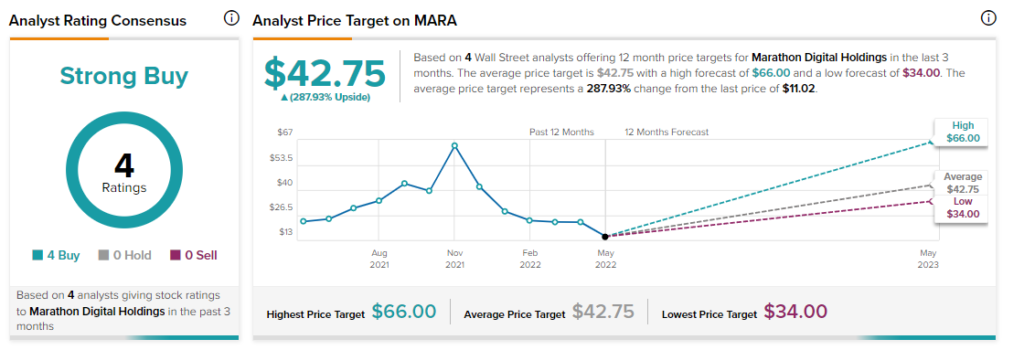

Marathon has a Strong Buy consensus rating on TipRanks, with four Buys assigned over the past three months.

The average Marathon price target is $42.75 which suggests 287.9% potential upside.

Bottom Line

The company’s Q1 earnings were fine. Yes, the company reported lower revenue on a sequential basis, but that is only due to Bitcoin prices falling.

Bitcoin has a tendency to make drastic moves. This is where the company’s HODL strategy comes into play. If Marathon continues to stick to its HODL strategy, the stock price will surge after Bitcoin prices bottom out and start to move up.

It is sitting on a decent-sized cash balance. The number of miners it is planning to deploy this year indicates that it expects Bitcoin prices to remain subdued for quite some time, and that it wants to press home the advantage it has. The cash it has should help it survive and mine Bitcoins.

If you look at Bitcoin prices historically, it has a tendency to hit peaks and immediately follow them by deep troughs. It is entirely possible that Bitcoin prices could go in for another round of correction. Marathon’s stock price falls in correlation to Bitcoin prices. We feel Marathon is an attractive investment at this point even if Bitcoin falls a little more.

However, Marathon has to guard against the dual-edged sword of rising energy prices and inflation. Both these factors will make it tough for Bitcoin to bridge the gap.

Thiel is also open to an acquisition. In an April interview with Bloomberg, he said, “If somebody offers us a huge premium over our market cap, I have to take it under consideration and that may be the right thing to do for the investors.”

Thiel says the logic behind someone buying Marathon is that an energy company can sell its electricity to itself at a lower cost. It can scale up by acquiring a big miner, and Marathon is one of the biggest miners out there.

If you are a Bitcoin believer, you should hold Marathon stock. The only questions left to answer are: Will Bitcoin prices move up? If it does, how long will that take? Will Marathon HODL until then?

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure