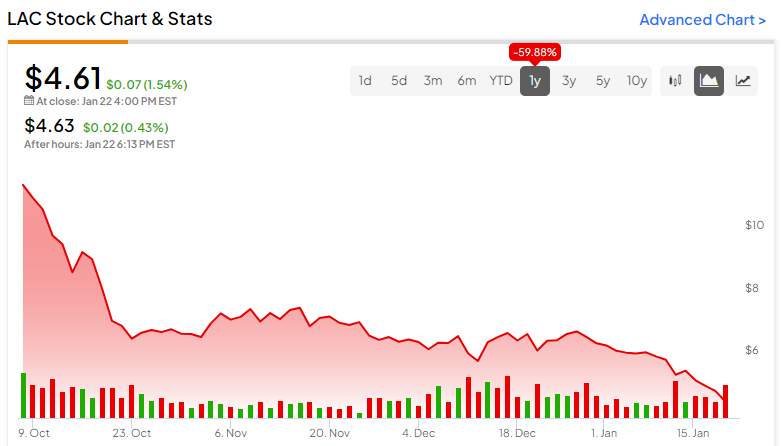

As global EV sales continue their ascent, the American market has demonstrated some aversion to our electrified future. Still, stateside adoption is slowly but steadily growing, and Lithium Americas (NYSE:LAC) (TSE:LAC) finds itself in a unique position to profit from the expanding North American EV battery supply chain. Despite its one-year loss of 60%, I am bullish on the stock.

In 2022, the price of battery-grade lithium carbonate, which is measured in Chinese Yuan, reached its all-time high at around ¥600,000 per metric ton, or $84,420. It has since come down to Earth and is currently trading around its lowest levels since August 2021. However, demand is forecast to double by the end of the decade to over 2 million tons per year by 2030 as EV adoption increases alongside the Biden administration’s subsidies and tax incentives.

Lithium Americas is a pure-play lithium mining and production company. Founded in 2007, the Vancouver-based company has a market cap of around $743 million. Because of the company’s premier project, it’s poised to play a central role in addressing the looming supply gap based on elevated EV battery demand.

Growing Adoption and a Looming Supply Gap

One of the most well-documented reasons for slow EV adoption is vehicle range. To address this, battery makers are increasing the amount of lithium in EV batteries to improve range and vehicle power, with average battery pack sizes growing from 50 kWh in 2018 to an expected 68 kWh by 2030. This factors into a forecast increase in annual global EV sales from 14.5 million vehicles in 2023 to an estimated 45.3 million by 2030.

According to Grand View Research, the compound annual growth rate (CAGR) for the U.S. EV market is forecast to be 15.2% between 2023 and 2030. Globally, the EV market surpassed $452.4 billion in 2022, grew to $646.72 billion in 2023, and is expected to reach $1.669 trillion by 2030.

Adoption in the U.S. will be a considerable driver of this growth and the subsequent lithium supply gap. The Biden administration and the private sector have committed more than $25 billion to expand public EV charging stations, with at least 40 U.S.-based EV charger factories being announced or opened in the U.S.

Additionally, Americans are eligible for up to $7,500 off the retail price of new EVs that qualify under the Inflation Reduction Act’s 30D New Clean Vehicle Tax Credit and $4,000 off the price of used EVs eligible under the 25E Used Clean Vehicle Credit, which is expected to continue increasing EV adoption.

As legacy automakers like Ford Motor (NYSE:F) and General Motors (NYSE:GM) continue to refocus on EVs in an effort to steal market share from industry-dominator Tesla (NASDAQ:TSLA), ancillary companies like Lithium Americas are poised to continue supporting the transition to our electrified vehicle future.

In fact, GM has an agreement in place with Lithium Americas for 10 years of exclusive rights to all Phase 1 production, with an optional extension of five years, at its Thacker Pass project. The global lithium supply is expected to grow substantially by 2030; however, there will be an expected shortfall of 2.3 million to 2.45 million tons per year by 2030. For Lithium Americas, that gap couldn’t be more welcome.

Thacker Pass, the Golden Ticket

Located in Humboldt County in Northern Nevada, Thacker Pass is an integral resource for the establishment of an EV battery supply chain in North America that’s capable of meeting demand. In January 2021, the U.S. Department of the Interior’s Bureau of Land Management granted a Record of Decision for Thacker Pass to Lithium Americas, which owns 100% of the project.

Construction of the mine began in early March 2023, and it’s estimated that Thacker Pass has a production capacity of 40,000 tons per annum (tpa) of battery-grade lithium carbonate for Phase 1 and 80,000 tpa for Phase 2, making it the largest known measured and indicated lithium resource in the U.S. The life expectancy for the mine is at least 40 years.

The project at Thacker Pass — the only fully-permitted lithium mining operation in the U.S. — is being overseen by Lithium Nevada, LLC, a wholly-owned subsidiary of Lithium Americas, whose largest shareholder is General Motors. According to the company’s website, Thacker Pass has an after-tax net present value of $5.7 billion.

The company has already established its mineral beneficiation infrastructure as well as its processing plant. Between the two, an 11-step process follows extraction and results in battery-grade lithium carbonate. The result of this is a $6,743 operating cost for every ton of lithium carbonate produced at Thacker Pass. At the time of writing, the spot price of lithium carbonate is ¥95,500 per ton, or $13,436.85, indicating a 50.18% margin for Lithium Americas.

Not Profitable, Yet

Lithium Americas currently isn’t generating revenue. However, that’s largely attributable to the Thacker Pass project being in its infancy. Whereas behemoths Albemarle (NYSE:ALB) and Sociedad Quimica y Minera de Chile (NYSE:SQM) have been in the industry since 1994 and 1968, respectively, Lithium Americas has just 17 years in lithium operations and just received full approval for the Thacker Pass project last year.

Nonetheless, from Q4 2022 to Q3 2023, the company managed to increase its total assets from $27,838 to $363,491 while lowering its long-term liabilities by 39%.

Unprofitable companies don’t pay dividends, and LAC is trading well below its 200-day simple moving average of $10.27. However, the stock is well into oversold territory according to its Relative Strength Indicator RSI reading of ~25, which could indicate a near-term price reversal and a desirable entry point for buy-and-hold investors.

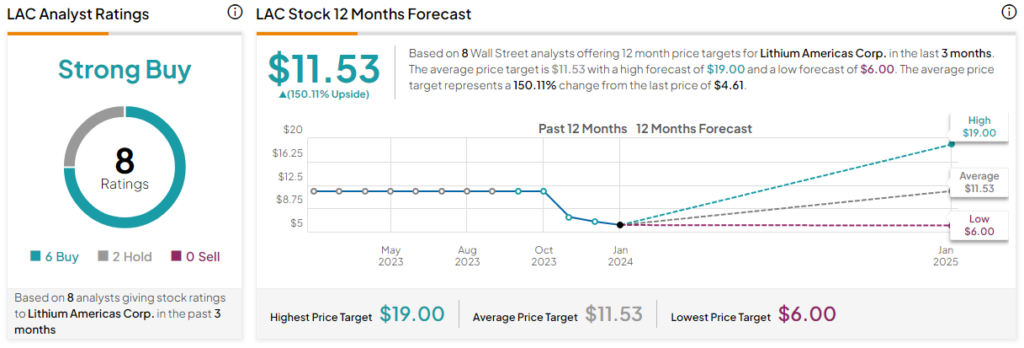

Is LAC a Buy, According to Analysts?

Lithium Americas doesn’t announce Q4-2023 and full-year earnings until March 22, but analysts are bullish on the stock, giving it a Strong Buy consensus rating. The average LAC stock price target is $11.50 based on eight Wall Street analysts, with a low-end price target of $6 and a high-end target of $19.

Currently trading at $4.61, even analysts’ low-end price target represents 30% upside potential.

The Takeaway

The outlook for the global EV market is robust and will contribute to a sizable lithium supply gap by 2030. Because of its Thacker Pass project and partnership with General Motors, Lithium Americas is uniquely positioned to address that shortage as part of the North American EV battery supply chain. The company currently isn’t profitable but has been able to lower its total debt and total expenses while increasing its free cash flow. All of these are contributing factors to Wall Street’s bullish price targets on the stock.