Li Auto (LI) stock has faced a tough 2024 so far, down 50.69% over the past 12 months. This decline reflects challenges such as the less-than-expected launch of its first full Electric Vehicle (EV) and disappointing Q1 deliveries. However, despite these hurdles, I remain bullish on this Chinese New Energy Vehicle (NEV) maker. Recent developments offer a promising counterpoint to earlier struggles. Notably, Li Auto smashed its delivery records in July, showing a significant rebound from Q1 disappointments. This surge in deliveries, coupled with strong demand for its new L6 vehicle and a compelling underlying value proposition, bolsters my optimistic outlook for the company.

Li Auto Deliveries: It’s Not That Bad

Turning to recent performance, the impressive rebound in Li Auto’s delivery figures strongly supports my bullish outlook on the company. After a bumpy start to the year, marked by disappointing Q1 results and a drop in deliveries, the company hit a significant milestone in July. Li Auto achieved record-breaking deliveries with 51,000 vehicles shipped, reflecting a 49.41% increase from the previous year and a 6.75% rise from June.

This improvement is largely driven by the sustained demand for Li’s L6 model, its most affordable vehicle. “Li L6 sustained its robust sales performance with monthly deliveries continually exceeding 20,000, and has become a blockbuster model in the RMB200,000 to RMB300,000 price range,” said Li Xiang, Li Auto’s founder, chairman, and CEO. The success of the L6 showcases a growing consumer preference for hybrid vehicles with extended-range capabilities. By the end of July, Li Auto’s cumulative deliveries had reached 873,345, with 239,981 vehicles delivered in 2024—a notable 38.52% increase from the previous year.

Is Li Auto Sustaining Margins?

While these delivery numbers are encouraging, it’s crucial to consider the company’s financial metrics, especially its margins. In Q1, Li Auto reported a gross margin of 20.6%. This is relatively strong compared to industry peers, though it marks a decline from 23.5% in Q4 2023 and a slight improvement from 20.4% in Q1 2023.

The L6 model’s specific margins aren’t publicly detailed, but it’s likely they are lower than the company’s overall gross margin. Lower-priced vehicles often have slimmer profit margins, which could influence the company’s overall profitability if the L6 continues to drive significant sales

Forecasts Might Not Do Li Auto Justice

While Li Auto’s recent performance highlights a strong recovery in delivery numbers, earnings forecasts present a more cautious picture. Earnings forecasts—provided by analysts—serve as a critical barometer for evaluating a company’s financial health and future prospects. They offer a snapshot of expert expectations based on the latest data, market trends, and company performance. These projections help investors gauge whether a stock is likely to meet, exceed, or fall short of anticipated results, and can significantly influence market sentiment and stock valuations.

When it comes to Li Auto, analysts have been revising their projections downwards over the past 90 days. With no positive revisions and four negative ones, the consensus estimate for Li Auto’s earnings per share (EPS) in 2024 stands at $1.15, representing a 27.91% decline from the previous year. The Q1 EPS of $0.17, down 71.18% sequentially, has contributed to this cautious outlook.

However, despite these downgrades, the recent uptick in deliveries and the success of the L6 could signal that Li Auto has the potential to exceed expectations. This optimism is bolstered by the fact that Li Auto is set to release its Q2 report on August 19, with analysts forecasting an EPS of $0.19. Given that the company delivered 80,400 vehicles in Q1, 108,581 in Q2, and has already delivered 51,000 in the first month of Q3, there is substantial room for Li Auto to potentially outperform these forecasts. This suggests that, despite current pessimism, Li Auto’s improving performance metrics and strong demand for its vehicles might drive better-than-expected results, supporting a more optimistic view of the company’s future.

Is Li Auto Stock Cheap?

Despite the optimistic turnaround in delivery numbers and the potential for improved earnings, Li Auto stock currently trades at 12.7x trailing twelve-month (TTM) earnings and 17.3x forward earnings. On the surface, these valuations don’t seem exorbitant. However, the downward trend in earnings for the near term is less appealing and could suggest underlying issues.

Looking ahead, there is a forecasted EPS growth of 56.89% in 2025 and 30.36% in 2026, which appears promising. Nonetheless, the long-term outlook reveals a potential complication. The number of analysts providing forecasts for the stock diminishes significantly, from 15 to just one by 2027. Moreover, this sole analyst’s projection suggests a troubling 40.36% decline in earnings compared to the 2026 consensus, resulting in a somewhat distorted price-to-earnings-to-growth (PEG) ratio of 2.14.

These figures might not immediately signal an attractive value proposition. However, as I highlighted earlier, the current earnings forecasts might not fully capture Li Auto’s potential, particularly given the recent positive trends and demand for its L6 model. The skewed PEG ratio, influenced heavily by the uncertain 2027 forecast, may not accurately reflect the company’s underlying value and future prospects. This discrepancy suggests that, despite the less-than-ideal valuation metrics, there could be more to Li Auto’s story than these numbers alone convey.

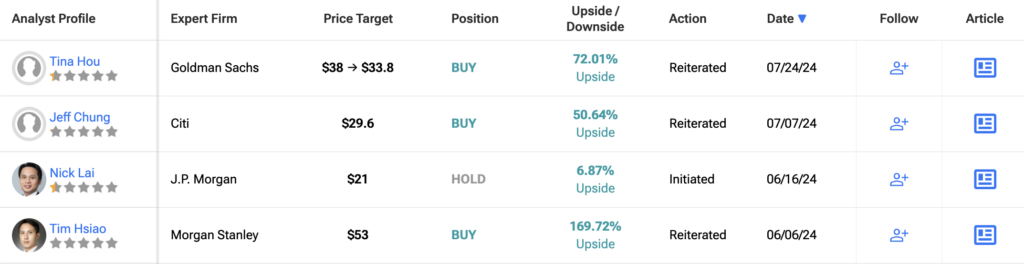

Is Li Auto Stock a Buy, According to Analysts?

On TipRanks, LI comes in as a Strong Buy based on nine Buys, two Holds, and zero Sell ratings assigned by analysts in the past three months. The average Li Auto stock price target is $33.85, implying a 70.91% upside potential.

The Bottom Line On Li Auto Stock

Li Auto stock is down in the doldrums, and I appreciate that the above metrics don’t necessarily point to undervalued conditions. However, looking beyond what I believe are slightly distorted metrics, there are plenty of supportive trends and tailwinds, including improving deliveries and NEV penetration in China. I’d also suggest that the current forecasts look a little unfavorable, and we could see outperformance in the coming quarters.