John Paulson, the billionaire who at the height of the 2007 credit bubble made his fortune from betting against subprime mortgages has hit the jackpot again. As a major investor in Horizon Therapeutics, Paulson is in line for a $500 million payday, given the biotech is to be acquired by Amgen in a $27.8 billion deal.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

To bring Horizon under the fold, Amgen will pay $116.50 per share in cash. This is 267% higher price than the average of $31 per share paid by Paulson, who has been a Horizon investor since 2017 and holds around 6.1 million HZNP shares.

If you’ve made it your investing strategy to follow Paulson’s moves, you stand to gain handsomely too. If you haven’t, here’s a chance to assess some of Paulson’s other two big holdings.

We’ve dug up the details on the pair and have also run the tickers through the TipRanks database to get a feel for Street sentiment toward these names. So, let’s see what they make of Paulson’s holdings and find out why he has made the pair his top stocks right now.

Bausch Health Companies (BHC)

The first big Paulson holding we’ll look at is Canadian global pharma company Bausch Health. The multinational healthcare player sells generic and branded drugs, with eye health, gastrointestinal diseases and dermatology being some of its main focal points.

Amongst its bestselling products you can find Arestin (minocycline HCl), an antibiotic utilized in procedures associated with periodontitis, insomnia medication Ativan (lorazepam), chest pain treatment Cardizem and depression therapy Wellbutrin XL (bupropion hydrochloride).

Despite boasting a long list of commercially available products, BHC stock has had a torrid time of it this year having touched down at 25-year lows. The shares have shed 72% in 2022, with the slide kicking off in May following a very disappointing Q2 report.

The latest financial statement, for Q3, was not much to shout about, either. Revenue declined by 2.8% year-over-year to $2.05 billion while EPS of $0.76 fell short of the $0.78 consensus estimate. For the outlook, the company lowered its guided revenue range for the full year from $8.05 – $8.22 billion to between $8.0 – $8.17 billion. Consensus had that figure at $8.11 billion.

The company has also been going through a restructuring phase, having announced the spin-off of its eyecare business Bausch + Lomb. An IPO took place earlier this year, but the separation has yet to be consummated.

In any case, Paulson seems to be a big fan. BHC stock makes up 13.33% of his portfolio, showing ownership of more than 26.4 million shares, currently worth over $203 million.

Stifel analyst Annabel Samimy also remains in Bausch’s corner and she thinks the BHC story has better days ahead.

“Under new management, Bausch Health has been executing on the divestment of non-core assets with a priority to debt pay down and to reinvest internally in growth franchises,” the analyst explained. “Specifically, the company is focused on stabilizing its core franchises through sales infrastructure and new launches. We think as BHC demonstrates its success in stabilizing and transforming, the market will again grant the company appropriate value for its franchises, which, in our view, has been overwhelmed with negative sentiment,” Samimy opined.

Accordingly, Samimy rates the shares a Buy while her $14 price target suggests they are undervalued to the tune of ~82%. (To watch Samimy’s track record, click here)

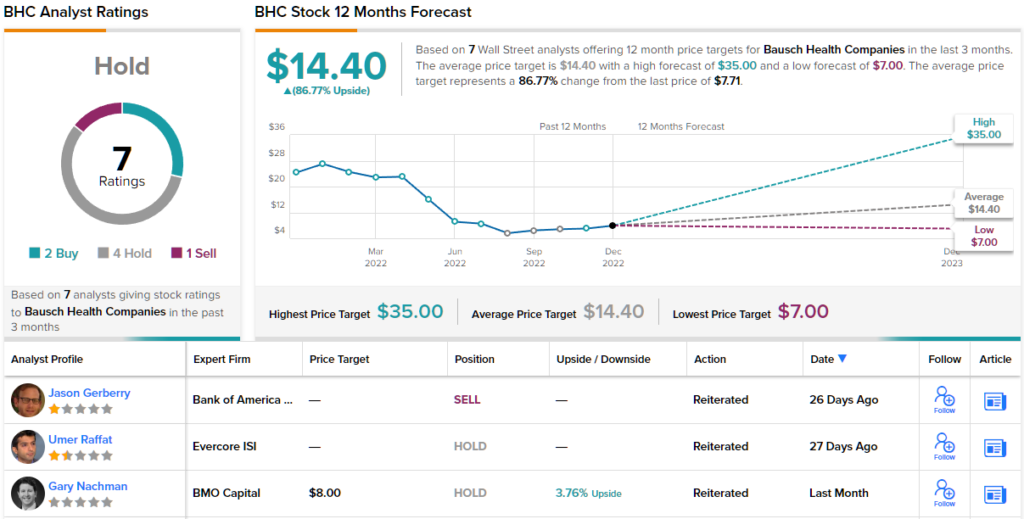

According to TipRanks, the consensus on Wall Street is that BHC stock is a “hold” for investors. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $7.71, could zoom ahead to $14.40 within a year, delivering ~87% profits to new investors. (See BHC stock forecast on TipRanks)

BrightSphere Investment Group (BSIG)

The next stock taking up plenty of room in Paulson’s portfolio is BrightSphere Investment Group, a global asset management holding company with basically one subsidiary under its arm – Acadian Asset Management. As of the end of September, the company boasted around $83 billion of assets under management. Via Arcadian, BrightSphere gives institutional investors access to a wide selection of cutting-edge quantitative and solutions-based strategies with the firm invested in public equity, fixed income, and the alternative investment market.

The company has struggled in 2022, with the revenue haul declining throughout the year. In the recent Q3 report, revenue declined sequentially and also fell by 26% from the same period a year ago to $86.8 million, while the company delivered EPS of $0.30, also exhibiting a quarter-over-quarter drop. It should be noted, however, that both results beat Street expectations.

The drop in performance does not appear to bother Paulson, however. BSIG shares make up almost 10% of his holdings, amounting to 8.95 million shares. At the current price, these are worth nearly $176 million.

And if we’re on the subject of takeovers, then RBC analyst Kenneth Lee thinks BrightSphere’s recent actions might indicate some acquisitive action could be in the cards here too.

“With BSIG having paused share repurchases through 3Q now (second consecutive quarter of no repurchases), despite management’s stated goal to continue deploying excess capital to support organic growth and share repurchases, we continue to wonder whether management is engaged in strategic discussions (which could restrict BSIG from repurchasing stock),” the 5-star analyst said.

“We note management remains open to any potential value-enhancing transaction. In terms of potential acquisition consideration for BSIG, we think a valuation within the range of $25- $30 per share is plausible (9.5x on a more normalized ENI per share, plus potential acquisition premium,” Lee added.

All told, Lee rates BSIG shares an Outperform (i.e., Buy) backed by a $23 price target, suggesting the stock is set to climb ~17% higher over the coming months. (To watch Lee’s track record, click here)

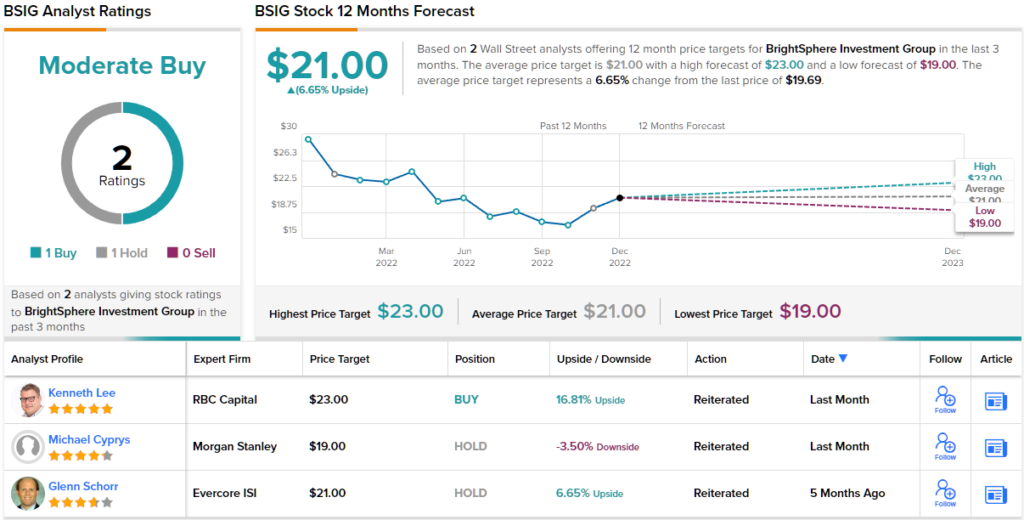

Only one other analyst has thrown the hat in with a BSIG review, and they remain on the sidelines, providing this stock with a Moderate Buy consensus rating. (See BSIG stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.