JD.com (JD), and China-based businesses in general, were formerly considered uninvestable by many. That sentiment is changing quickly, however following the China’s central bank unloading of its monetary-policy bazooka. I believe that JD.com should benefit in the coming quarters. All in all, I am bullish on JD stock because JD.com is an income grower and is reasonably valued.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

JD.com is an e-commerce company based in China. It’s not as big as Alibaba (BABA), but JD.com is still a large company with a market capitalization of around $62 billion.

Until recently, during the past year JD’s stock chart has looked like a scary rollercoaster. Yet, the stock is perking up now, and there’s an identifiable reason for this. All things considered, you might agree with my view that JD.com shares offer a good entry point for exposure a potentially-recovering Chinese economy.

Massive China Stimulus and JD.com

China’s post-pandemic economic recovery has been uneven, and cyclical businesses like Alibaba and JD.com have had to navigate a challenging backdrop for several years. On the other hand, China’s government is now responding with a massive wave of monetary stimulus. This supports my bullish outlook, because a boost to China’s business activity generally should provide a tailwind for JD.com’s top and bottom lines.

Last week was eye-opening, as China’s technology stocks experienced their best week since 2008. Prior to that, according to DataTrek’s Nicholas Colas, many global investors regarded Chinese stocks as “almost uninvestable.” Now, however, the People’s Bank of China (PBOC) is unleashing an RMB800 billion ($114 billion) lending pool earmarked for China’s capital markets. This “surprise announcement of aggressive fiscal and monetary policy action,” Colas observes, is “spurring a reappraisal” of the view that China’s businesses are uninvestable.

Billionaire David Tepper even went so far as to say that it’s now time to buy “everything” in China. I’m a little more discriminate, but JD.com will undoubtedly benefit from what PBOC governor Pan Gongsheng claims will be at least 800 billion yuan ($113 billion) worth of liquidity support from China’s government to the nation’s businesses. This funding could spur economic activity generally while also facilitating company share buybacks. Only time will tell how much all of this will impact specifically JD.com, but it’s easy to envision a surge in e-commerce sales and income for this famous China-based business.

JD.com’s Impressive Income Growth

Investors may ask why JD stock is a standout opportunity amongst all the leading Chinese stocks. To begin, I would point to JD.com’s solid financial profile. The company has a respectable balance sheet with $28.8 billion in cash and minimal debt. This supports my JD bull thesis about JD stock because I prefer to invest in financially stable businesses.

Another sign of financial stability is JD.com’s income growth. In the second quarter of 2024, JD.com grew its diluted net income per American Depositary Share (ADS) by a whopping 97.3% year over year to RMB8.19 ($1.13). If you prefer to use adjusted (non-GAAP) measures, then JD.com’s diluted net income per ADS increased by 73.7% to RMB9.36 ($1.29) which is still quite impressive.

Furthermore, in spite of China’s recently challenging macroeconomic conditions, JD.com has topped earnings per share (EPS) estimates for more than 15 consecutive quarters. Just imagine how much better the company might do now that China’s government is providing big-time financial support to the nation’s economy.

JD.com Looks Reasonably Valued

JD stock perked up due to the China stimulus news, but I believe there’s more upside potential. The company’s price-to-earnings (P/E) ratio is very reasonable, and this will likely appeal to many value-conscious investors looking to dive into U.S.-listed Chinese stocks.

We can calculate JD.com’s trailing 12-month adjusted (non-GAAP) P/E ratio as $39.90 (the recent share price) divided by ($0.95 + $0.75 + $0.81 + $1.33), or 10.39x. This compares favorably to the sector median P/E ratio of 15.28x, as well as to JD.com’s five-year average P/E ratio of 34.98x. Therefore, I believe value seekers should definitely consider adding JD.com stock to their watch lists.

Is JD Stock a Buy, According to Analysts?

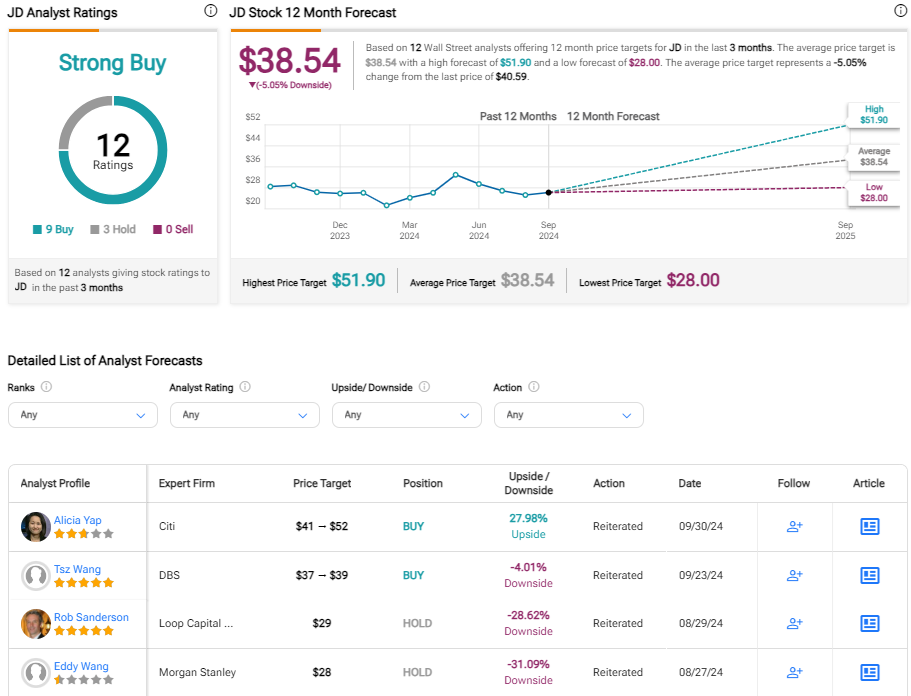

On TipRanks, JD comes in as a Strong Buy based on nine Buys and three Hold ratings assigned by Wall Street analysts in the past three months. There are no current Sell ratings. The average JD.com stock price target is $38.54, not far from the latest trade price.

Conclusion: Should Investors Consider JD Stock?

JD.com looks reasonably valued despite the recent share price surge. It helps that the company’s profitability has been increasing. JD.com is also a cyclical e-commerce business that’s poised to benefit from the Chinese government’s recently announced stimulus measures.

Analysts rate JD.com shares as a Strong Buy, on average, and this enhances my confidence. While investing in JD stock is not without risks, I take a favorable long-term view of JD.com right now.