We all want a crystal ball, something that will let us peer a few months into the future and know how the markets are going to shake out. Of course, that won’t happen – but it won’t stop investors from looking for clues.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In this pursuit, experts know that the key is in the data. Madison Faller, a global investment strategist at J.P. Morgan, has gone looking for the repeating patterns, and has found at least one that appears informative for investors today.

“100 trading days in, and the S&P 500 is up more than 10%. That’s well above the historical average for any full year. While past performance is no indication of future results, gains this strong also tend to signal more strength for the rest of the year. Since 1950, whenever the S&P 500 has gained at least 10% in the first 100 trading days, stocks have closed out the full year with an average return of about 25%. Seem familiar? This time last year, the S&P 500 was up over 8% and later closed the year with a gain of almost exactly 25%,” Faller opined.

Some of Faller’s colleagues among JPMorgan’s stock analysts have embraced the idea of strong gains this year and have tagged two stocks with the potential for up to 210% upside.

In fact, it’s not only JPMorgan who favors these names. Using the TipRanks database, we found that both are also rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look.

Kyverna Therapeutics (KYTX)

Autoimmune diseases present a challenge to the biotech industry. They are usually both chronic and progressive, causing increasingly serious and/or uncomfortable difficulties for patients over time – but they are also notoriously difficult to treat, and frequently resistant to the therapeutic agents tried against them. Kyverna, the first stock we’ll look at here, is a biopharmaceutical company with an autoimmune focus, working on new chimeric antigen receptor T cell (CAR-T) therapies designed to ‘restart’ the immune system and initiate a treatment-free remission.

CAR T-cell drug therapies have already been proven successful in the treatment of hematological cancers, and Kyverna believes that the action of these agents can be used to advantage against autoimmune diseases.

Kyverna’s flagship drug candidate is KYV-101, a CAR-T therapy that has demonstrated robust efficacy and well tolerated safety profiles across various autoimmune diseases. Currently, KYV-101 is progressing through multiple clinical trials, including phase 1/2 trials for lupus nephritis (LN) and systemic sclerosis (SSc), and phase 2 trials for myasthenia gravis (MG) and multiple sclerosis (MS). As of May 14, the company has treated a total of 30 patients across all four targeted diseases, including 8 with myasthenia gravis, 7 with lupus nephritis, and 4 with multiple sclerosis.

To fund the expensive run of these clinical studies, Kyverna conducted its IPO in February of this year, becoming the fifth drug startup to go public in 2024, and raised $366.9 million in gross proceeds. In its 1Q24 report, Kyverna disclosed having $369.8 million in available cash and other liquid assets.

For JPMorgan analyst Brian Cheng, the solid progress of the company’s clinical program is the key point. The analyst is upbeat about the potential of Kyverna’s approach, and looks forward to seeing the upcoming data releases from the clinical trials.

“We believe Kyverna, armed with compelling clinical evidence to-date, is at the forefront of deploying CAR-T cell therapies across multiple autoimmune indications. The evidence to-date is compelling and consistent with the results seen from academic research… We anticipate early insights from a handful of pts – potentially from the Ph 1/2 KYSA-1 (US) and Ph 1/2 KYSA-3 (Germany) trials. We believe this will be an important milestone for the co. as the data continues to mature beyond the initial set of named patient cases.”

Cheng goes on to rate Kyverna stock as Overweight (i.e. Buy) along with a $39 price target, indicating his confidence in a ~210% upside potential for the next 12 months. (To watch Cheng’s track record, click here)

Overall, Kyverna’s Strong Buy consensus rating is based on 4 recent positive analyst reviews, making it unanimous, and the stock’s $42.75 average price target is even more bullish than the JPMorgan view, suggesting a 241% one-year gain from the current trading price of $12.53. (See KYTX stock forecast)

Structure Therapeutics (GPCR)

JPMorgan’s second pick is Structure Therapeutics, a clinical-stage global biopharmaceutical company dedicated to discovering and developing new orally dosed therapeutic agents for chronic metabolic and pulmonary diseases. The company derives its name from its structure-based drug discovery platform, which has enabled the creation of a robust pipeline of drug candidates.

Two of these drug candidates are at the human clinical trial stage, GSBR-1290 and ANPA-0073. Each is a small-molecule compound, created especially to overcome the natural limits on biologics and peptide therapies. Structure’s pipeline is focused on the GPCR family of drug targets, hence the company’s stock ticker.

The leading drug candidate in Structure’s pipeline is GSBR-1290. This is a selective GLP-1R agonist targets obesity and has completed a Phase 2a study. The company expects to release topline this month. The data release will cover full 12-week efficacy data for 40 patients, as well as safety and tolerability data for all 64 patients. The company is making preparations for later stage clinical trials, and states that it is on track to initiate a global Phase 2b obesity study of GSBR-1290 during 4Q24. An additional Phase 2 study, in T2DM, is planned for the second half of this year.

Structure’s second leading drug candidate, ANPA-0073, is an oral small molecule apelin receptor (APJR). This drug candidate has completed a Phase 1 single-ascending and multiple-ascending dose study, and is considered to be Phase 2 ready, against potential selective or muscle-sparing weight loss. The company is also evaluating ANPA-0073 idiopathic pulmonary fibrosis (IPF). The completed Phase 1 study showed that ANPA-0073 was generally well-tolerated, and patients in the study did not report any serious adverse events.

Analyst Hardik Parikh, covering the stock for JPMorgan, notes that there is a large opportunity in the obesity treatment realm, and that even grabbing a small slice of that pie would be a solid achievement.

“We think the opportunity for oral GLP-1s is underappreciated and think this market could generate $30bn in sales by 2035. GPCR’s lead asset, 1290, is a pure-play option for this opportunity, and even a small share would support a substantial upside to the stock, by our estimates). We expect next-generation oral GLP-1s to gain meaningful share over time, and here GPCR has some advantages over several of other companies looking to enter the market (ex-LLY/Novo). These include 1) a small molecule formulation and 2) a slight time-to-market advantage, and we think 1290/Structure could be an attractive partnership opportunity for larger biopharma companies looking to participate in the T2D/Obesity market,” Parikh opined.

These comments support Parikh’s Overweight (i.e. Buy) rating on GPCR, and he gives the stock a price target of $65, implying a one year upside potential of 90%. (To watch Parikh’s track record, click here)

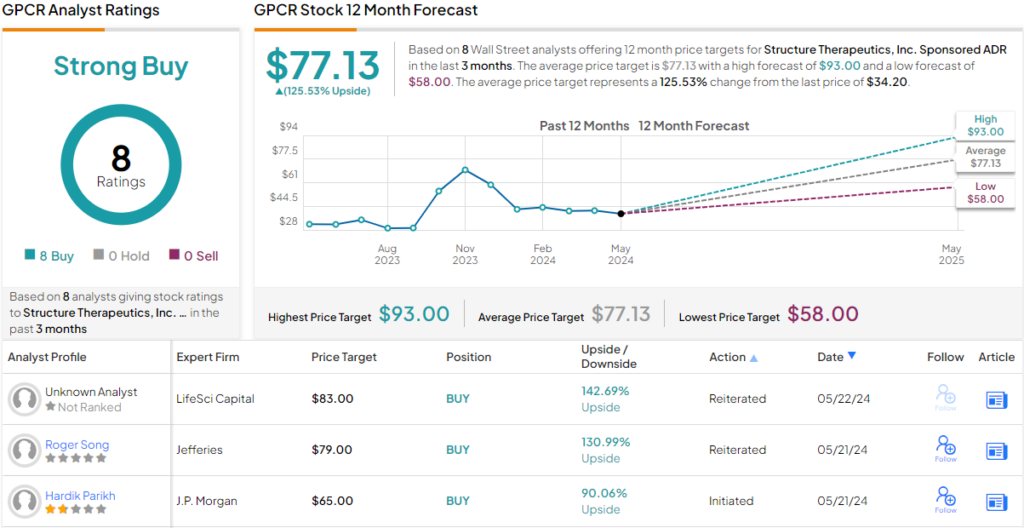

The broader market view is even more bullish. There are 8 analyst recommendations on file for GPCR, and they are all positive – for a unanimous Strong Buy consensus. The shares are priced at $34.20 and the $77.13 average target price suggests a ~125% gain in the year ahead. (See GPCR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.