Global payments technology company Visa (NYSE: V) is riding on the recovery in the travel & hospitality sector, as well as cross-border payment volumes. The increasing shift to digital payments has been a boon for the credit card company.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nonetheless, like all other technology giants, Visa, too, has been a victim of circumstances this year. Inflation, interest rate hikes, recession fears, and geopolitical headwinds have led to a decline of 11% in Visa shares so far this year.

Does this dip present a good buying opportunity for investors? To answer this question, we must dig deeper into the company’s fundamentals to understand the business and its prospects better.

Visa’s Power

Visa’s revenues have been consistently increasing over the years, and its solid position in the digital payments domain and strong core business is expected to support sustained top-line growth in the years to come.

Notably, cash transactions in the second quarter of Fiscal 2022 were 16 million less in volume compared to last year’s Q2. On the other hand, transaction volume with debit and credit cards was 7.9 billion more year-over-year. This speaks of the prospects of Visa in the digital payments space.

The consistent flow of new partnership deals, renewed contracts with existing partners, consistent customer additions, and strategic acquisitions continue to boost the company’s performance.

In Fiscal 2022, Visa reported $7.2 billion in revenues, which was 25% more than the prior-year quarter. Moreover, for the current quarter, management expects net revenues to be hovering around the “upper end of the mid-teens range in constant dollars.”

Visa’s continued investments in technology to fortify its leading position in the payments market are noteworthy. With growing digitization, stronger security for online transactions has become the need of the hour. With this in mind, Visa is focusing on strengthening its information security and protecting consumer and merchant information.

A compelling liquidity position combined with a healthy free cash flow is another reason for optimism. Despite a long-term debt much higher than its cash and cash equivalents ($17.5 billion in long-term debt against $12.3 billion of CCE as of March 31, 2022), Visa’s commercial paper program provides a cushion of ample liquidity for general corporate purposes.

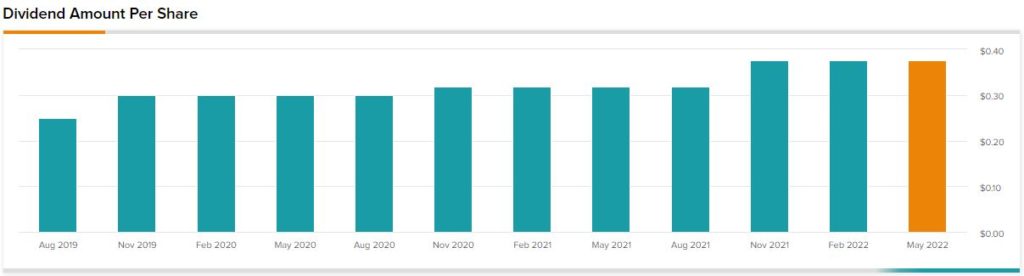

Moreover, Visa has consistently paid dividends four times a year. The dividend amount has increased over the years. Currently, the dividend is $0.38 per share. Also, in December 2021, the company’s board of directors authorized a new share buyback program worth $12 billion.

Another point to ponder is that, despite being a great candidate to become a lender and open a new revenue stream of interest income, Visa does not lend and is not likely to lend in order to protect its 50% plus margins. This is because, unlike a lender, Visa does not need to allocate capital to buffer the business from loan losses in the event of recessions and economic downturns.

Again, taking the current scenario and economic outlook into consideration, Visa is not too sensitive to interest rate hikes by the Federal Reserve or its multinational counterparts, as it is not a lender. This is because the company’s revenues come from client services, cross-border transactions, licensing fees, and other non-interest fees. That’s why the risks associated with interest payments are by cardholders.

Wall Street’s Take

Wall Street analysts seem to have mixed opinions on Visa’s prospects. Late in April, Evercore ISI analyst David Togut reiterated a Buy rating on the stock and raised the price target on Visa to $310 from $304.

Then, after a few days, Piper Sandler analyst Christopher Donat downgraded Visa to Hold from Buy and slashed the price target to $239 from $283, citing macroeconomic headwinds from Europe. Donat is worried about Europe witnessing a recession in 2023, which he believes can cut into payment transactions from the region.

However, the consensus is bullish on Visa stock, with a Strong Buy rating based on 14 Buys and two Holds. The average Visa price target is $269.53, which indicates upside potential of 40.3% from current price levels.

Parting Thoughts

There can be no perfect company that has zero downsides to its prospects. It is important to carefully weigh the pros and cons of the company and look for upsides that are sustainable, which will help it overcome the troughs of the market. In this regard, Visa seems to be in a strong position, as its core business is likely to help the company pull through recessions, inflation, or any harsh economic event.

Also, with the stock trading around the lowest levels in over a year, around 27 times its forward Fiscal 2022 earnings, the valuation seems to be at an attractively discounted level for a company that has consistently shown double-digit growth over the years.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure